Even as several analysts have been expecting that blue-chip stocks would outperform midcap and smallcap stocks, the latter continue to maintain their leading position and show no signs of relinquishing the lead, suggesting that midcap and smallcap stocks are still performing well in comparison to their larger, more established counterparts in the market.

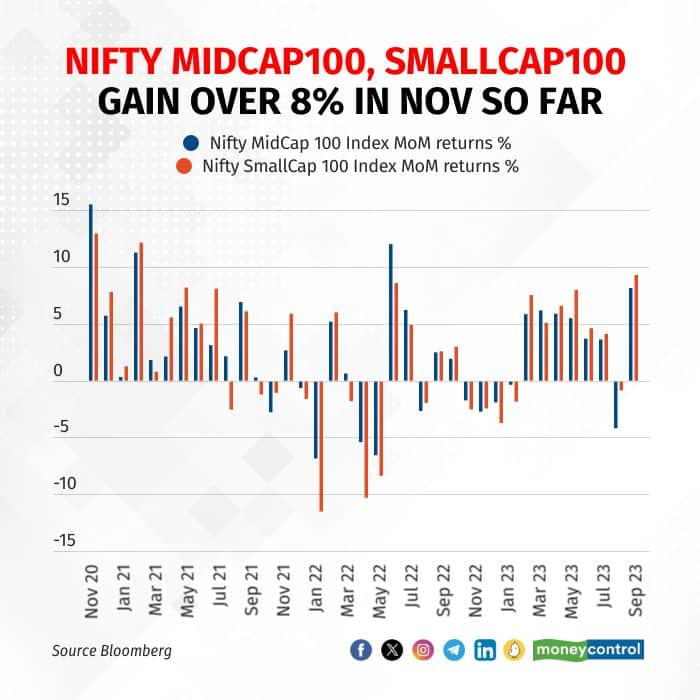

In November, the Nifty Midcap 100 Index saw a notable increase of 8.2 percent, marking its most significant surge since July 2022. Similarly, the Nifty Smallcap 100 Index recorded an impressive gain of 9.2 percent, its highest since February 2021. These performances surpassed the gains of the Sensex and Nifty 50, which advanced by 3.3 percent and 3.8 percent, respectively.

Shrey Jain, founder of SAS Online, credited November's surge to better-than-expected earnings and foresees sustained strong earnings ahead. Additionally, the drop in crude oil prices and easing US bond yields were considered key positives for the broader recovery, according to analysts.

In October, midcap, smallcap, and blue-chip stocks faced pressure due to anticipation of prolonged higher interest rates and impending near-term elections. However, analysts' worries about increased US yields, escalating oil prices, and the outcome of the state elections have eased.

Read: Daily Voice | FII inflow set to rise post election uncertainty, says Shreyas Devalkar of Axis MF

Poll outcome

The US 10-year yields have declined by 60 basis points from their recent peak. Despite ongoing turmoil in West Asia, oil prices have remained stable. Feedback and opinion polls indicate that the performance of the Bharatiya Janata Party (BJP) in the current state elections may surpass initial expectations, with a potential win in Rajasthan and an increased vote share in other states.

Jefferies anticipates a market upswing if the results of elections in five states, to be announced on December 3, favour the BJP. The brokerage remains confident about the capex cycle, particularly in housing, power, and various industrial sectors.

Q2 earnings

Midcap and smallcap companies posted robust earnings in the September quarter. Net profit of 62 companies in the Nifty Midcap 100, excluding banking, finance, insurance, and oil & gas firms, surged 153 percent year-on-year, the most in 20 quarters. Sequentially, there was a 4 percent rise.

Revenue grew by 8 percent year-on-year and 5 percent quarter-on-quarter. Operating profit soared by 45 percent year-on-year, the most substantial increase since the June 2021 quarter.

For the Nifty Smallcap 100 Index, the aggregate net profit of 58 companies, excluding BFSI and oil & gas, surged 46 percent, the most in nine quarters, and rose 27 percent sequentially. Revenue increased 6.5 percent quarter-on-quarter and 3 percent year-on-year.

Operating profit jumped 28 percent year-on-year, the most in five quarters, and 14.2 percent sequentially. The net profit margin stood at 7.1 percent, the highest in five quarters, while operating profit margins were at 15.5 percent, the most in seven quarters.

Read: Investors strike it rich as first sovereign gold bonds come up for maturity

According to Jain, consumer-facing businesses like lifestyle, restaurants, automobiles, and building products have seen the most significant earnings upgrades. The industrial recovery is also positively impacting the outlook for many engineering companies. However, sectors such as chemicals, pharmaceuticals, and information technology have experienced earnings downgrades.

Analysts suggested that currently, the growth potential for midcap stocks seems more promising than for large-cap stocks. Consequently, investors consistently inject funds into high-quality midcap stocks during market corrections.

"We expect midcap’s outperformance over the broader market to continue in the near to medium term, given the better earnings growth prospects. However, some of the midcap stocks rallied beyond their fair valuation, which may narrow the outperformance gap," said Kripashankar Maurya, assistant vice president of Choice Broking.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.