Strong loan growth is likely to help Kotak Mahindra Bank clock double-digit rise in net interest income in the Q4 FY24, but higher cost of funds and shrinking margins may drag its net profit, said analysts.

The private sector lender will announce its Q4 results on May 4. The stock was recently in focus after the Reserve Bank of India barred the lender from issuing new credit cards, citing eficiencies and non-compliance. Additionally, the sudden resignation of senior leader KVS Manian also shocked investors over its faltering talent pool.

So far this year, Kotak Bank shares have crashed over 18 percent, underperforming four percent rise in the benchmark Nifty 50 index during the same period.

ALSO READ: Kotak Bank on a losing streak as analyst downgrades accelerate

Lower margins may eat Kotak's profit, but asset quality picture perfect

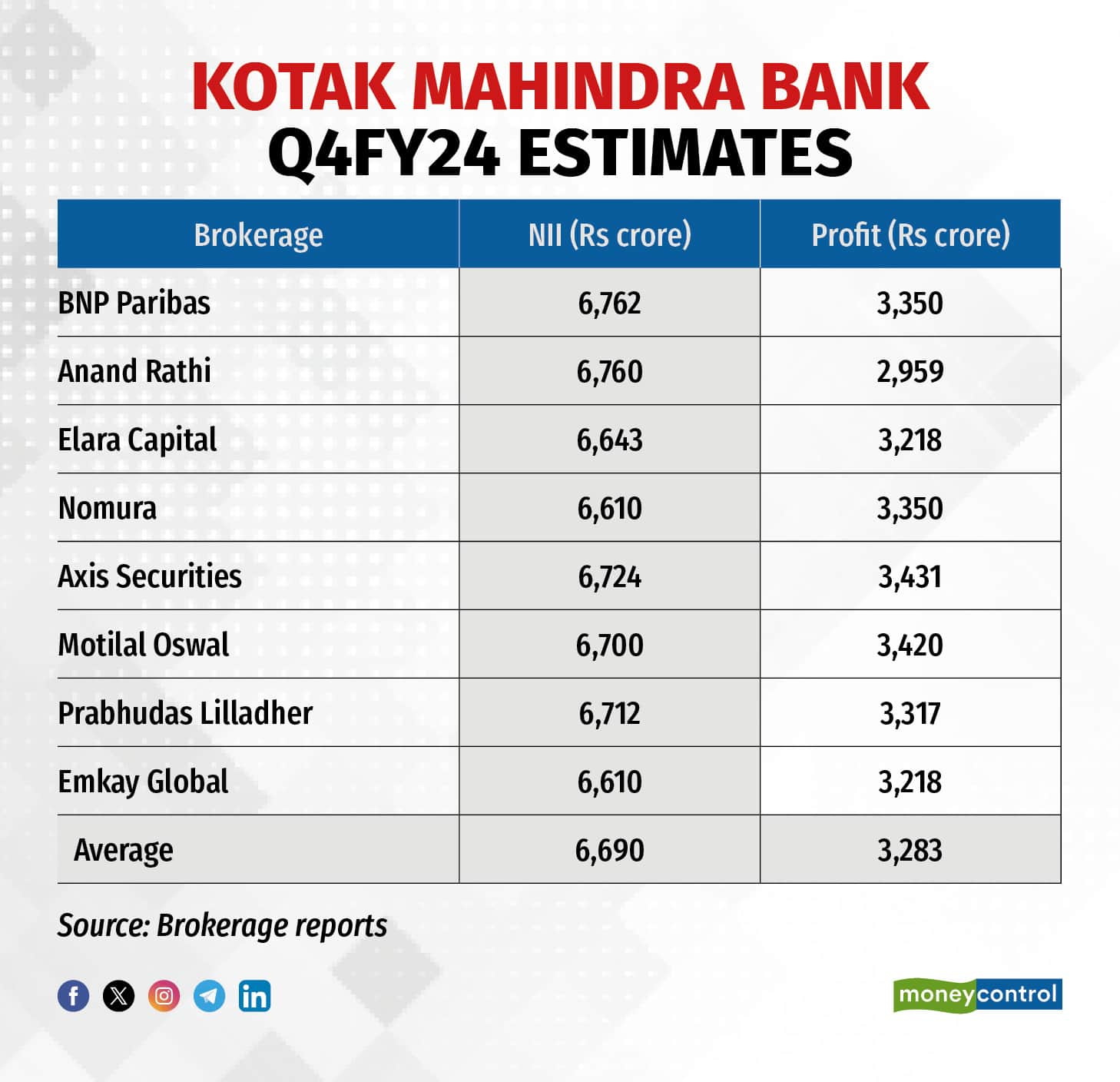

According to an average estimate of eight brokerages, Kotak Mahindra Bank's NII is expected to increase by 10 percent year-on-year (YoY) to Rs 6,690 crore in Q4FY24 from Rs 2,186 crore in Q4FY23 amid strong credit offtake.

However, the private sector lender's profit is pegged to decline by six percent YoY to Rs 3,283 crore in Q4FY24 from Rs 3,496 crore a year-ago.

Loans are modelled to grow by 16.6 percent YoY to Rs 3.72 lakh crore in Q4FY24, while deposits are seen to rise by 16.5 percent YoY to Rs 4.2 lakh crore, said analysts at Motilal Oswal.

ALSO READ: Are Kotak Mahindra Bank’s problems transitory?

The impact on profitability comes on the back of contracting margins as cost of funds rise across industry. Analysts at Prabhudas Lilladher forecasted Kotak Mahindra Bank's net interest margins (NIMs) to shrink by up to 28 basis points (bps) YoY to 5.21 percent in Q4FY24 from 5.34 percent in the year-ago period.

The lender's asset quality is seen to remain in control, added Motilal Oswal analysts. Gross non-performing assets (NPAs) may slip to 1.69 percent in Q4FY24 from 1.78 percent in Q4FY23, whereas net NPAs may decline to 0.33 percent in Q4FY24 from 0.37 percent in the year-ago period.

Following the release of Kotak's Q4 scorecard, some of the top factors to watch out would be the management's commentary on margins, growth trajectory on unsecured loan book, and observations on regulatory impact on digital banking business.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.