Infosys, which is scheduled to report its earnings report card for September quarter on October 13, will likely posts strong set of numbers thanks to strong momentum and ramp up of past deals.

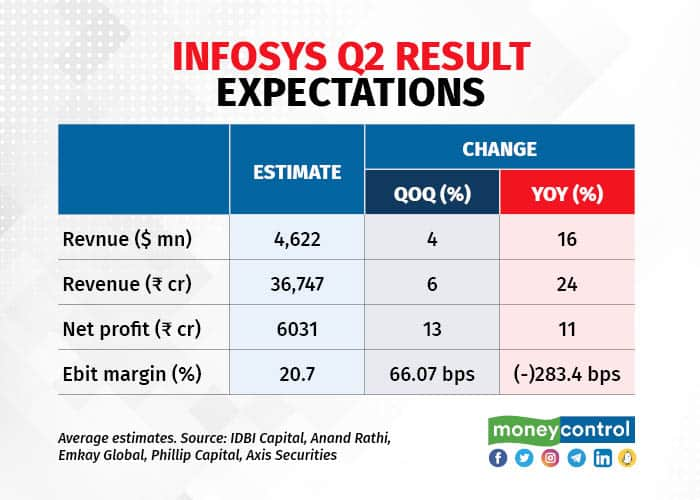

A poll of analysts projected that the second largest information technology (IT) company of the country will report revenue growth of 24 percent year on year at Rs 36,747 crore. Net profit is likely to grow 11 percent to Rs 6031 crore, according to the poll. Sequentially, growth will be in mid-single digits.

“We expect revenue to grow at 5.9 percent quarter on quarter (QoQ) aided by strong deal wins,” said analysts at Axis Securities in a note. “Margins likely to expand aided by higher offshoring and favourable currency mix.”

Like all IT companies, there are concerns over Infosys’ demand growth given western nations – which form most of the customer base for the company – are under recessionary pressure. This is likely to result in lower technology spend from clients.

However, analyst don’t believe we will see the impact in September quarter’s numbers for Infosys. Indications from TCS’ numbers also suggest the same, which managed to deliver decent growth in revenue.

Enkay Global said it expects 3 percent QoQ USD revenue growth in Q2FY23 after factoring in 150 bps cross-currency headwinds. Phillip Capital, meanwhile, said it expect strong CC revenue growth of 5.3 percent (3.8 percent QoQ in USD) on strong momentum and ramp up of past deals.

Analysts expect Infosys to see an uptick in margins, thanks to positive currency impact. Infosys bills most of its clients in dollars, which have grown stronger over the quarter compared to the rupee. This means more revenue in rupee terms for the company.

IDBI Capital said it expects EBIT margin to expand by 155 bps QoQ to 21.6 percent, mainly led by better utilisation, price hike and reduced subcontractor cost.

Phillip Capital sees margins expanding by 30 bps QoQ due to absence of salary hikes, USD/INR depreciation and operational efficiencies offset by likely lower utilisation, senior management salary hikes and travel expenses. On average, brokerages are expecting a rise of 66 bps in margins.

Analysts expect Infosys to retain 14-16 percent constant currency revenue growth and 21-23 percent EBIT margin guidance. The Bengaluru-based firm will also consider a share buyback during the board meeting.

Among the key things that analysts will be watching for are:

1) FY23 guidance

2) Large-deal intake

3) Any delay/deferral/cancellation of projects due to macro uncertainties and high inflation

4) Update on client conversations–impact of high energy prices, inflation and potential economic slowdown/recession

5) Management commentary on: (i) steps taken to manage supply-side challenges and available levers to defend margins, (ii) demand environment in BFSI, manufacturing, retail, and communications, (iii) pricing environment, (iv) deals pipeline, pace of decision making, and deal closure momentum

6) Attrition level and trends.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.