One of India’s largest consumer staples firm Hindustan Unilever Ltd. is set to report its earnings for the fourth quarter of the previous fiscal year on April 24, 2025. Rising commodity prices, increased competition, and lagging urban demand are expected to result in the FMCG giant seeing tepid earnings for the quarter.

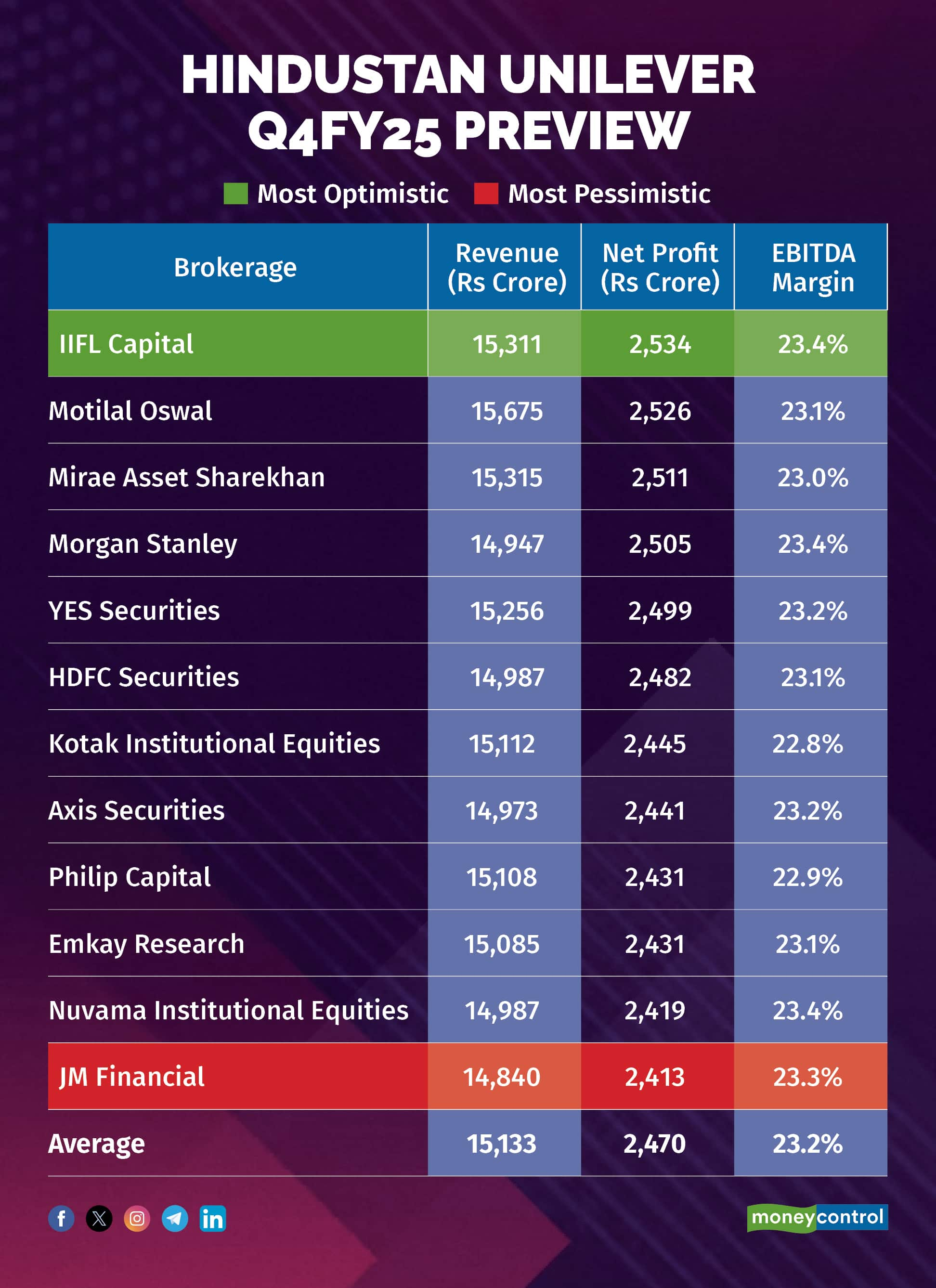

According to a Moneycontrol poll of twelve brokerages, Hindustan Unilever is likely to report revenue growth in low single-digits, higher by 3 percent on-year, at Rs 15,133 crore, as against Rs 14,693 crore in the March quarter of the previous year. Net profit is likely to come in at Rs 2,470 crore, up 3.1 percent from Rs 2,396 crore from the corresponding quarter last year.

Earnings estimates of analysts polled by Moneycontrol are in a narrow range, so any positive or negative surprises may elicit a sharp reaction in the stock. The most optimistic estimate sees HUL’s net profit jumping 5.8 percent on-year, but the most pessimistic projection suggests that net profit might remain flat, seeing a mere 70 basis points uptick.

What factors are impacting the earnings?Hindustan Unilever’s revenue is likely to remain flat on account of subdued performance across categories, as urban demand sees significant stress. "HUL’s growth has been impacted by multiple factors, including adverse mix dynamics, input cost inflation, and subdued seasonal demand, collectively moderating the overall growth trajectory," said Motilal Oswal.

Competition weighs: Amid the surge in competitive intensity, HUL has increased product discounting in the home care portfolio, which offset the price hike benefit the company has affected

in Q4 for Soap and Foods. This will have a further impact on margins and profitability.

Volumes: Brokerages believe that volume growth will be muted, which along with price cuts in

Detergents, will have an impact on the topline. Home care and hair care shall continue their good growth momentum in volumes while tea and soaps shall experience pressure due to

grammage cuts and price hikes, noted Nuvama Institutional Equities.

Margins: Hyperinflation in the raw materials (particularly tea and palm oil) will weigh on gross

margins. EBITDA margins are likely to be flat for the Mach quarter on a YoY basis due to lower ad spends and staff cost.

What to look out for in the quarterly show?The key focus will be on HUL's growth outlook and the consumer response to the new formulation of Lux and Lifebuoy. Further, experts will be watching closely for commentary on inflation and pricing outlook in both soaps and tea amid surging input costs. Additionally, demand recovery in urban consumption will be eyed.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.