Ruchi Agrawal

Moneycontrol Research

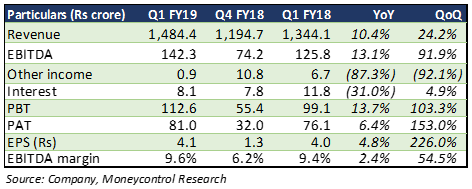

Godrej Agrovet (GAL) reported a healthy Q1 FY19, with mixed performance across segments. Revenue grew 10.4 percent year-on-year (YoY) on the back of strong palm oil performance and improved volume in the animal feed segment. However, weak performance in the dairy business remained a drag on performance. Hurdles with Astec Lifesciences’ export segment offset a portion of growth. Crop protection segment saw margin improvement, with consolidated earnings before interest, tax, depreciation and amortisation (EBITDA) margin up 40 basis points. Net profit rose 6.4 percent.

Animal feed segment

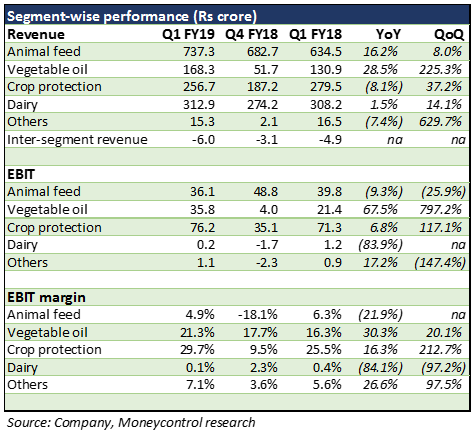

Driven by a 19 percent uptick in volumes, the animal feed segment saw a healthy 16.2 percent topline growth, with improved performance in cattle, broiler and layer feed segments. However, adverse pricing in the cattle feed segment due to lower milk prices led to noticeably lower realisations. With increase in the input cost for aqua feed, margin dipped 140 bps.

Crop protection

While revenue saw a substantial 8 percent YoY dip, an improvement in profitability in the domestic portfolio led to 420 bps margin improvement and a 6.8 percent uptick in earnings before interest and tax (EBIT). The quarter under review saw unexpected deferment of Astec Lifesciences’ exports which would spill into Q2. The management said crop protection is an important growth driver and commissioning of backward integration plants is on track.

Palm oil

Higher import duty helped improve domestic prices of palm oil, leading to improved realisation and a strong 28.5 percent topline growth. Margin improved 500 bps, leading to a noticeable 67.5 percent EBIT growth.

Dairy

The dairy segment remained a drag on overall profitability. While revenue improved 1.5 percent, weakness in milk prices had a significant impact on the segment profitability, taking the segment EBIT down 84 percent YoY. The management said margin was lower due to higher provisions for price impact, amid oversupply of milk and butter.

Outlook

With strategic plans and policy support, performance is expected to improve in the current fiscal. Import duty on palm oil has made the domestic palm oil business competitive. The company is now expending this segment, which would benefit it in the longer run. New product launches in crop protection segment are expected to drive growth by FY19-end. Animal feed performance has started to improve, however, aqua feed might remain an overhang. Despite instability in milk prices, performance of the dairy segment is expected to improve with strategic launches in value-added products.

After listing at Rs 460 per share on October 16, 2017, the stock has run-up around 31 percent. In the past one month, the stock corrected around 8 percent and is trading at a FY19e price-to-earnings multiple of 36 times and an enterprise value-to-EBITDA of 22 times. Although some hurdles in the operating environment have curbed growth currently, we expect these to stabilise and overall earnings to improve in FY19. We see GAL as a quality stock positioned to deliver healthy long term returns.Follow @Ruchiagrawal

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.