Madhuchanda Dey

Moneycontrol Research

Highlights:

- Decent quarterly performance by Federal Bank

- Slippages likely to decline in the coming quarter

- Business growth strong, core fees impressive

- Stock valuation attractive following underperformance in the past year

-------------------------------------------------

Federal Bank was in the doldrums amid the worst corporate non-performing loan (NPL) cycle in India like many of its peers. While the intensity of the NPL cycle was abating, floods in its key market of Kerala raised fears of incremental asset quality pains. The stock has been a big underperformer in the past. With most of the lingering issues largely addressed now, the future looks promising and valuation reasonable for a rewarding long term journey.

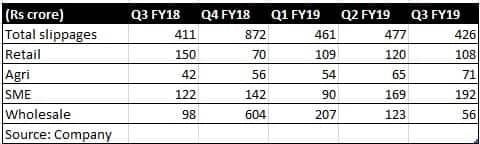

Slippages driven by SME but the outlook is comforting

In the quarter-ended December 2018, overall gross slippage stood at Rs 426 crore. The bank has up-fronted slippage from the Kerala market and doesn’t expect much on this count in the future. Slippage in the quarter under review was dominated by SME and the management expects the Reserve Bank's restructuring dispensation on MSME loans to help. IL&FS exposure to the tune of Rs 245 crore is in operating projects with assured cash flow.

The bank is guiding at an annual slippage of Rs 1,550 crore. Given that the slippage in the first nine months of FY19 was to the tune of Rs 1,364 crore, the bank expects the last quarter slippage to fall drastically.

The bank has seen stabilisation in its credit cost (68 basis points in the quarter), an improvement in provision coverage (amount of provision held against non-performing assets) and a reduction in overall stressed book (NPL, restructured assets as well as security receipts) to 1.96% of assets (compared to 4.37% three years back).

Strong growth with reduced risk

Business growth continues to remain strong, with advances growing at a healthy 25% (for past several quarters) and deposits also catching up with a growth of 23%.

Advances growth has been supported by corporate as well as retail. The bank has been steadily improving its incremental market share in deposits as well as advances, thereby pointing to market share gains.

Given the opportunity presented by the comatose state of public sector banks and challenges for many NBFCs, the bank is targeting 20-25% credit growth going forward.

Federal Bank is consciously improving the quality of its book with 72% of the outstanding wholesale credit rated 'A' and above. In the quarter gone by, there has also been a reduction in the ratio of risk weighed assets to total advances, which corroborates this trend.

Strong traction in fee income

Non-interest income grew 51% driven by core fees (that rose a respectable 45%) and strong treasury gains.

Source: Company

Non-interest income is clearly an area of focus. To improve the share of core fees, the bank has acquired stake in Equirus Capital - a boutique investment firm. The bank has brought on board a strategic investor -- True North -- in its non-banking subsidiary FedFina, which should help scale up the business.

Margin trajectory improving

Federal Bank has been gradually improving its interest margin. The quarter under review saw a two basis points sequential improvement in interest margin to 3.17% and expects to end the year with an interest margin of 3.2%.

The bank has seen steep a repricing of assets (especially corporate assets) and has witnessed close to 19 bps sequential improvement in yield on advances. It is also taking initiatives to counter the falling yields by foraying into relatively high margin businesses like unsecured retail credit and commercial vehicle financing.

Cost of funds, nevertheless, has firmed up too. Deposits growth is back on track driven by low cost (CASA), non-resident deposits as well as term deposits. The share of low-cost deposits has been stagnating around 33% and would require focus, especially since the bank has not been adding branches which could have been a potent source.

Quarter at a glance

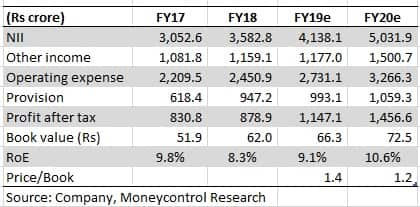

Federal Bank’s quarterly net profit grew 28% to Rs 333 crore. Growth in net interest income (difference between interest income and expenses), at 13%, lagged credit growth as net interest margin declined year-on-year. On a sequential basis, margin showed an improvement.

Non-interest income performance was strong. While pre-provision profit rose by close to 26%, reported profit growth was better as provision was well contained despite an increase in coverage on better asset quality performance.

Outlook – underperformance and valuation deserve attention

The bank looks set to achieve return on assets of 1% by FY19-end. Directionally, the bank appears to be making the right moves. We take note of the underperformance in the stock in the past one year – down 19% compared to a 5% rise in the Nifty.

We do see a lot of comfort in the current valuation at 1.2 times FY20 estimated book and recommend buying the stock in the current volatile market.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.