Madhuchanda Dey

Moneycontrol Research

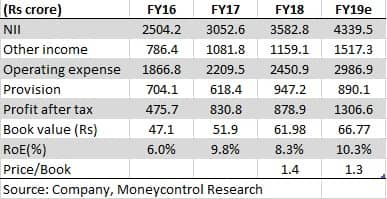

Federal Bank’s quarterly performance disappointed yet again as many loans had to be classified as non-performing assets in line with the revised RBI rules of February. Business growth was decent, but growth in core fees and deposits lacked sparkle compared to those at most other private sector banks. Federal is confident of a better performance in FY19 and sees strong growth momentum along with lower slippages and credit costs that should boost profitability. The repeated negative surprises, however, have turned most investors cautious about the stock. While we will monitor the progress of the guidance, we feel the bank is strategically well-positioned. The stock has underperformed in recent times and looks reasonably valued at 1.3X FY19e book. Any near-term weakness would be a good opportunity to accumulate for the long-term.

Rise in slippage

In the quarter gone by, the overall gross slippage rose to a record high of Rs 872 crore as the bank decided to recognise assets in the nfrastructure/power sector that were erstwhile standard restructured assets as NPA following the revised guidelines of RBI . Consequently the bulk of the slippage was from the corporate segment.

Out of the Rs 872 crore of total slippage, Rs 492 crore was on account of accelerated NPA recognition and belonged to four accounts and the remaining Rs 380 crore was normal addition to NPA. In terms of the nature of the slippage, Rs 487 crore has come from the standard restructured pool and Rs 385 crore from the Special Mention Accounts (SMA).

So is the problem largely addressed or is there more to come?

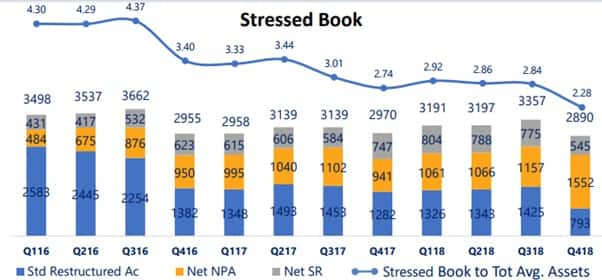

As per the disclosure, post the slippage from standard restructured accounts, the outstanding under that head stands reduced to Rs 792 crore (from Rs 1425 crore at the end of Q3 FY18). Of this Rs 375 crore is the sovereign airline account and unlikely to slip in the near term. There is one problematic road account of Rs 75 crore and the remaining Rs 342 crore are a clutch smaller exposure.

Source: Company

The total stressed exposure includeing net NPA, standard restructured assets and outstanding Security Receipts (SR, for assets sold to ARC) now stand at 2.28% (Rs 2890 crore) and the management has guided to slippage to the tune of Rs 1200 crore in FY19 (Rs 800 crore from agri, SME, retail and the remaining Rs 400 crore from corporate). This number will be closely tracked, going forward.

The bank has seen downgrades in its outstanding Security Receipts (mostly consists of assets facing resolution in NCLT) in the past as well as in the quarter under review and had to provide Rs 75 crore on account of the same. It is expecting provisions of Rs 75-Rs 80 crore on SR in FY19. The provision cover for the outstanding SR is 25%. This too will have to be closely scrutinised, going forward.

Nevertheless, the guidance on a much lower credit cost 65-70 bps in FY19, as against 123 bps in Q4FY18, suggests that the bank expects the pace of NPA formation to significantly decelerate.

The slippage had an impact on the reported financials although on the operational front, the bank still appears to have done a decent job.

Quarter at a glance

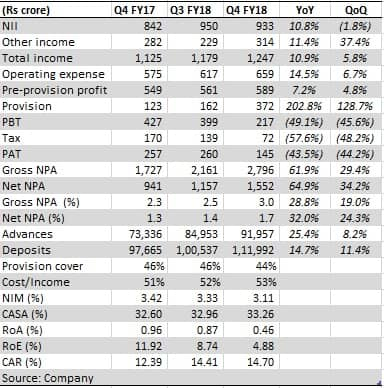

Federal Bank’s March quarter net profit fell 43.5% to Rs 145 crore due to accelerated NPA recognition. According to the management, profit would have been higher by Rs 119 crore without this impact.

Operationally, the net interest income (difference between interest income and expenses) grew 11% despite 25.4% growth in advances as interest margin declined partly impacted by Rs 31 crore interest reversal on account of recognising some assets as NPA. Non-interest income growth was supported by 12% surge in core fees while treasury gains declined 59%. Provision surged 203% and the provision cover stood at 44%.

Decent performance on the business front

In the year gone by, Federal Bank’s share in incremental credit and deposit of the system stood at 2.3% and 2% respectively.

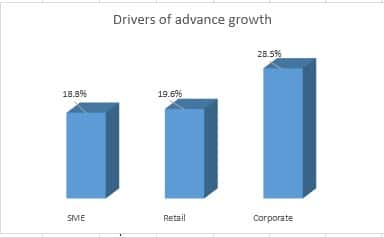

Business growth momentum remained strong with the advances book growing by 25.4% driven mainly by corporate. However, the bank still has a diversified asset book (41% wholesale, 38% retail and 21% SME) and it is consciously improving the quality of the book. Close to 76% of the outstanding corporate credit is now rated “A” and above. The improvement in the risk-weight assets to advance ratio bears testimony to the efforts.

The improvement in the quality of book will compress margin in the future and the bank needs to ramp up its share of low cost deposits to stay competitive in this environment where everyone is chasing high quality credit.

In the quarter gone by, while overall deposits grew by 14.7%, the low-cost (current & savings account) deposits rose by 17% leading to 66 basis points improvement in CASA share to 33.26%. While the bank aims to improve the overall share of low-cost deposits by 1% every year, this remains critical as the low cost deposit franchise of most peer group banks is much superior. The NRI deposits (38% of total deposits), continued to grow in line with the overall deposits of the bank.

The bank has guided to a slight improvement in interest margin at 3.25% in FY19 and is taking initiatives to counter the falling yields in corporate by foraying into relatively high margin businesses like unsecured retail credit and CV (commercial vehicle) financing.

High cost to income ratio is another area of focus as the bank has been relying on relationship manager- led distribution model in recent times. Operating expenses in the quarter saw the impact of enhanced payment on account of the upward revision in gratuity ceiling and wage revision. The management is targeting to bring the cost to income ratio down to 50% in FY19.

Non-interest income is another area of focus as that has been lagging the growth in assets so far. To focus on improving the share of core fees, the bank has recently acquired stake in Equirus Capital - a boutique investment firm and has recruited specialists for treasury sales & government business.

It is also looking to raise funds by selling stakes in subsidiaries that should help in shoring up the provision cover.

Directionally, the bank appears to have got it right, but execution remains critical. The bank is well capitalised that should help it embark on the growth journey once the asset quality issues/provision get sorted. The stock correction has rendered the valuation reasonable and we expect the near-term weakness to provide opportunity to buy into a decent dynamic private sector entity like Federal Bank for long-term.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.