Highlights:

- Strong chance for regime change in Argentina as incumbent loses primary

- New regime can potentially reverse reforms and renegotiate IMF bailout

- This can worsen economic conditions, facing recession & hyperinflation

- CDS pricing implies high probability of debt default in the next five years- Contagion risk intensifies due to sharp volatility in currency, stocks & bonds

Moneycontrol Research

Argentina’s financial markets slumped in a single day to the levels which can challenge the expectations of the most pessimist on the Street. While this happened in response to unexpected outcome of the primary election for the presidential candidate, implication of the same for this Lat-Am country’s economy and polity looks in sync with the pessimism in the market.

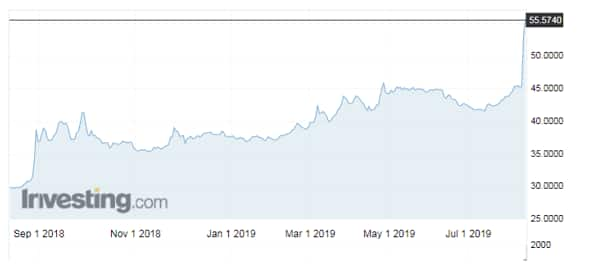

Chart: USD/Argentine Peso

Source: Investing.com

Argentina’s Black Swan moment led to 48 percent decline in its equity index – S&P Merval – on August 12. Note that it is the second-largest single-day drop for any stock market since 1950. Argentine currency – peso – tumbled 15 percent on that day and extended the decline the following day.

Very few equity indices have corrected so wildly in a single day before. Sri Lankan equity market had tumbled 62 percent in a single day in 1989 on account of a civil war.

Interestingly, the S&P Merval Index snapped similarly in 2002 as well when it was undergoing an economic depression. The financial market’s reaction underlines fragile investor psyche, given global slowdown and precarious condition of Argentina’s economy. There is now a strong expectation for a polity set-up which can reverse the reform process and may renegotiate the debt package from the IMF, which means financial markets may have to bear with similar risk events as was during the Greek government debt crisis.

The context

Argentina general elections are due in October 2019 which includes election for the President. In a precursor to that event, Primary elections (PASO stands for Simultaneous and mandatory open primaries) are held to root out marginal parties. This also serves as a run-up poll for the actual presidential election and gives a good estimate of what to expect in the actual election. Now, in the primary election held recently, incumbent President Mauricio Macri (32 percent vote), seen as a free market proponent, was defeated by a left-wing opponent Alberto Fernández (~48 percent vote).

In the actual election, if similar votes are garnered by Fernández, he would win straight way without needing even a second round as the votes would be higher than the threshold required (45 percent of vote).

Investors fear that if Fernández wins the presidential election, he would undo the progress Macri has made in pursuing reforms.

Precarious economy

Argentina is undergoing an economic recession, along with a hyperinflation phase. June reading for inflation was 55.8 percent, which is sequentially lower but still in a very uncomfortable range for the economic stability. In its March review of the economy, an OECD economic survey stipulated that high fiscal deficit, reliance on its foreign financing and high interest rates due to tight monetary policy has led to a build-up of significant vulnerabilities.

Last year, a record drought added to difficulties leading to capital outflows, adding to deterioration in market sentiment and sharp depreciation of the peso. To meet this challenge, the current establishment had been running a campaign of austerity for the nation and secured $56 billion bailout from the IMF in 2018.

As the need for a steep contraction in fiscal deficit and inflation remains, tight monetary policy and fiscal adjustment are the need of the hour, but this has its political challenges due to near-term hardships.

Chart: Argentina's inflation trajectory

What next?

There has been a gradual improvement in some of the economic metrics due to recent reforms and the OECD predicted an economic recovery in 2020. However, it had mentioned upcoming election in October as the key risk for the continuation of reforms. Investors are worried about the same now after the Primaries.

Table: Projections for Argentina

Source: OECD

According to media reports, Argentina is due for ~$16 billion debt payment in 2019 and about $19 billion in 2020. Argentina’s 5 Years CDS (credit default swap) has jumped more than 150 percent over the past one week wherein it implies about 80 percent probability of default in the next five years.

While the S&P Merval bounced back 10 percent on August 13, emerging worries on the reforms path suggest that it could be a dead cat bounce and capital outflows may intensify due to uncertainties. Hence, Investors should watch out for developments in Argentina as it adds to wall of worries for the global equity markets.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.