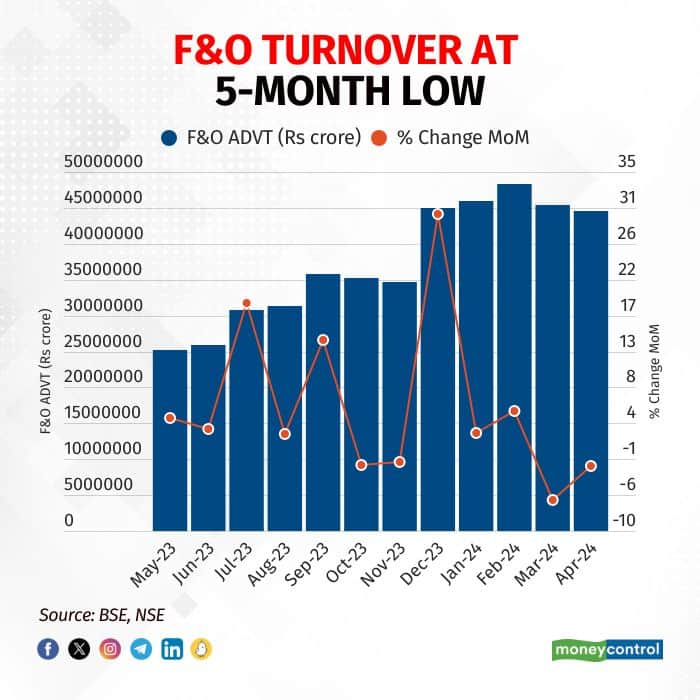

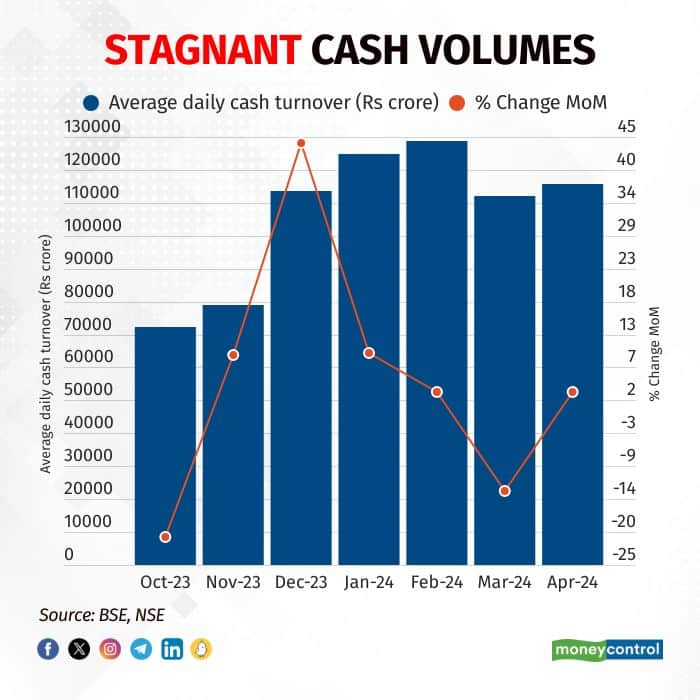

The average daily turnover of futures and options (F&O) on both BSE and NSE hit a five-month low in April with the market mostly range-bound and lacking buying momentum at higher levels. Cash volumes in local equity markets on both exchanges stayed stagnant.

The combined F&O average daily turnover for both BSE and NSE exchanges hit a five-month low of Rs 360 lakh crore in April, down 3.5 percent from a month ago. This was the second straight month when the turnover declined.

Meanwhile, the combined average daily trading volume in the cash segment of both exchanges in April rose just 3 percent to Rs 1.15 lakh crore from Rs 1.12 lakh crore in the previous month, which was the lowest in five months

Analysts said low expected volatility and cheap option prices are causing fewer trades in the Futures & Options (F&O) market. From October 2023 to January 2024, Nifty was going up, but from March to April, Nifty has consolidated with upward bias. This stability is reducing scope for making money in F&O trading. Normally, before elections, prices swing more, but this time, people expect the current government alliance to win easily. Hence, the rise in implied volatility seen in previous elections may not be seen to a similar extent this time. Some rise in volatility, however, may still be expected till June 04.

According to Kranthi Bathini, Director of Equity Strategy at WealthMills Securities, during April VIX hit a five-year low of 10. With the market mostly range-bound and showing some exhaustion at higher levels, there's a lack of buying momentum on the long side. Traders are staying on the sidelines, neither buying nor shorting aggressively. Also, regulatory warnings about F&O trading are making people cautious, leading to lower trading volumes. With upcoming events like election results and earnings reports, many are holding onto cash.

In April, global markets plummeted due to geopolitical tensions like the Israel-Iran conflict and rising oil and commodity prices. Negative sentiment prevailed as the US Fed signaled borrowing costs to remain high for an extended period.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.