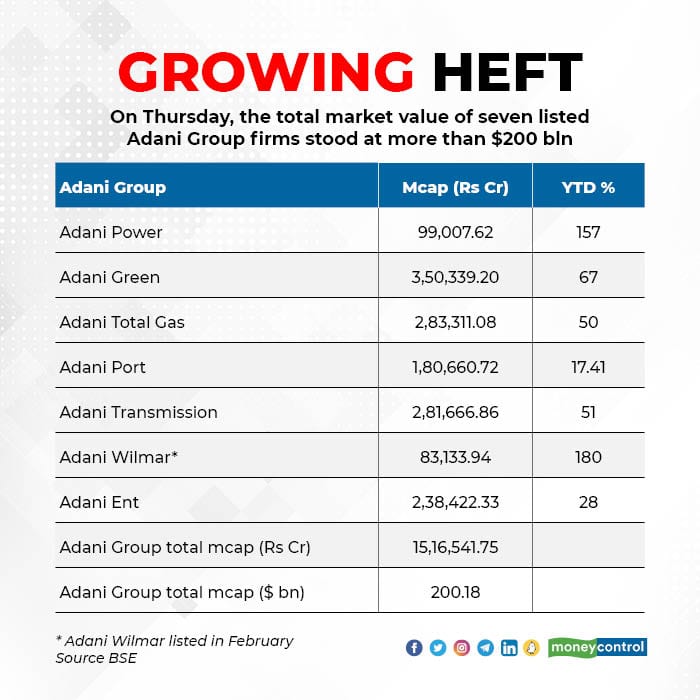

Adani Group The total market cap of the seven listed Adani Group companies stood at $201 billion, according to BSE data. Earlier, Tata Group and Mukesh Ambani led-Reliance Group had achieved this milestone. Tata Group's current market cap stands at $320 billion, while the RIL Group is valued at $237 billion at current market prices. Five firms in the Adani Group have a market cap of over Rs 1 trillion, while two — Adani Power Ltd and Adani Wilmar — have a market cap of Rs 98,000 crore and Rs 82,000 crore, respectively. Business improvement "The current businesses are at a growing stage and are far away from showing their full profit potential. So, future growth potential and improvement in profitability might be the reason for increasing investors’ interest,” said Santosh Meena, Head of Research, Swastika Investmart. "Investors are betting that it will be a major beneficiary of India's growth story," he said. The Adani Group has incubated various businesses like transmission, renewable energy, city gas distribution, etc., which have now become big businesses. Its current focus is on areas like airports, data centres, solar manufacturing, roads, defence and green businesses. Analysts say some of the current businesses have shown an improvement in fundamentals while others have made announcements about entering sunrise sectors. For instance, Adani Ports handled the highest ever cargo of 312.39 MMT (26 percent on-year growth) in FY22. Adani Total Gas announced its entry into electric mobility by launching its first EV charging station in Ahmedabad and has plans to expand its network by setting up 1,500 such charging stations across the country. Adani Enterprises announced a capital expenditure plan of Rs 55,000 crore for the next 5-6 years, out of which Rs 34,000 crore will be spent on the road construction segment. The rest of Rs 21,000 crore will be spent on the generation of green hydrogen, including downstream products, green electricity generation, manufacture of electrolysers and wind turbines. “We believe that the future growth prospects have already been priced in the CMP and the stock is fairly valued,” said Vinit Bolinjkar, Head of Research, Ventura Securities. Adani Power surged on expectations of better financials in the fourth quarter amid an increase in power demand as temperature soared across the country. Recently, Adani Power received dues with interest totalling Rs 3,000 crore from a state-run power distribution company in Rajasthan. Adani Wilmar Ltd fortunes improved since listing on the back of higher volumes in edible oil. With sunflower oil supply being disrupted due to the Russia-Ukraine war, consumers are shifting their consumption to alternatives such as soyabean, groundnut and mustard oil, analysts said. Adani Wilmar’s diversified product profile, its premium brand positioning and inventory stock should help it mitigate near‐term supply chain disruptions and increase market share, said Yes Securities report.

Adani Group The total market cap of the seven listed Adani Group companies stood at $201 billion, according to BSE data. Earlier, Tata Group and Mukesh Ambani led-Reliance Group had achieved this milestone. Tata Group's current market cap stands at $320 billion, while the RIL Group is valued at $237 billion at current market prices. Five firms in the Adani Group have a market cap of over Rs 1 trillion, while two — Adani Power Ltd and Adani Wilmar — have a market cap of Rs 98,000 crore and Rs 82,000 crore, respectively. Business improvement "The current businesses are at a growing stage and are far away from showing their full profit potential. So, future growth potential and improvement in profitability might be the reason for increasing investors’ interest,” said Santosh Meena, Head of Research, Swastika Investmart. "Investors are betting that it will be a major beneficiary of India's growth story," he said. The Adani Group has incubated various businesses like transmission, renewable energy, city gas distribution, etc., which have now become big businesses. Its current focus is on areas like airports, data centres, solar manufacturing, roads, defence and green businesses. Analysts say some of the current businesses have shown an improvement in fundamentals while others have made announcements about entering sunrise sectors. For instance, Adani Ports handled the highest ever cargo of 312.39 MMT (26 percent on-year growth) in FY22. Adani Total Gas announced its entry into electric mobility by launching its first EV charging station in Ahmedabad and has plans to expand its network by setting up 1,500 such charging stations across the country. Adani Enterprises announced a capital expenditure plan of Rs 55,000 crore for the next 5-6 years, out of which Rs 34,000 crore will be spent on the road construction segment. The rest of Rs 21,000 crore will be spent on the generation of green hydrogen, including downstream products, green electricity generation, manufacture of electrolysers and wind turbines. “We believe that the future growth prospects have already been priced in the CMP and the stock is fairly valued,” said Vinit Bolinjkar, Head of Research, Ventura Securities. Adani Power surged on expectations of better financials in the fourth quarter amid an increase in power demand as temperature soared across the country. Recently, Adani Power received dues with interest totalling Rs 3,000 crore from a state-run power distribution company in Rajasthan. Adani Wilmar Ltd fortunes improved since listing on the back of higher volumes in edible oil. With sunflower oil supply being disrupted due to the Russia-Ukraine war, consumers are shifting their consumption to alternatives such as soyabean, groundnut and mustard oil, analysts said. Adani Wilmar’s diversified product profile, its premium brand positioning and inventory stock should help it mitigate near‐term supply chain disruptions and increase market share, said Yes Securities report. Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.