Despite heightened market volatility, foreign institutional investor (FII) outflows, escalating tariff risks and persistent concerns over earnings, brokerages have turned increasingly optimistic on select large-cap names within the Nifty50 compared to the start of the year.

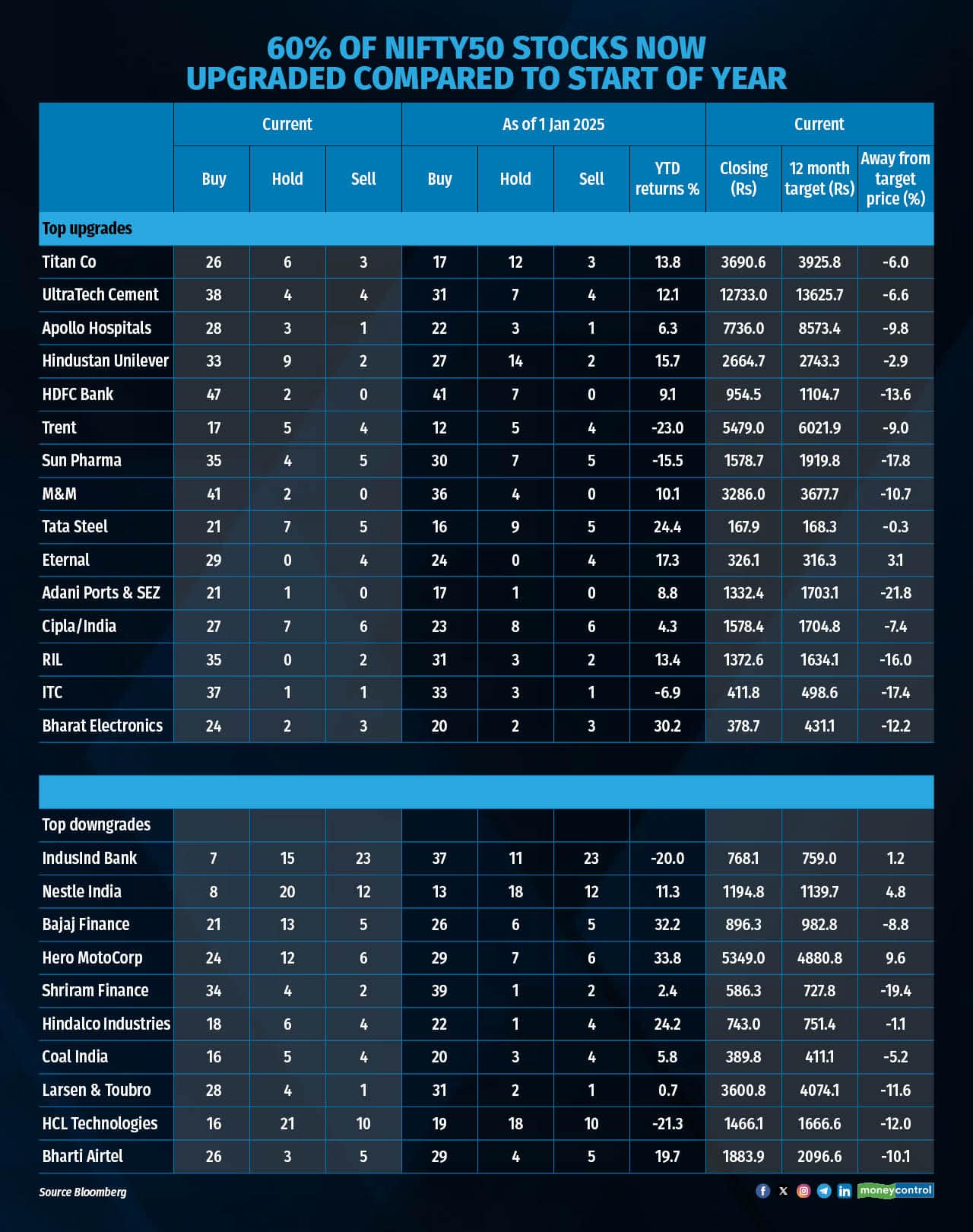

Currently, nearly 60 percent of index constituents have received rating upgrades and higher target prices versus January levels. Around 30 Nifty stocks have secured improved recommendations from research houses, while nearly 15 have faced downgrades, reflecting selective but growing confidence in corporate fundamentals and long-term prospects.

"Rating upgrades are primarily a function of better-than-expected earnings in the last quarter and improved growth outlook, which typically trigger upward revisions in estimates and target prices," said Sunny Agrawal of SBI Securities.

Among the biggest gainers, Titan Company has emerged as a standout. The stock now carries 26 buy calls, 6 hold and 3 sell, compared with 17 buy, 12 hold and 3 sell at the start of the year. Ultratech Cement ratings have climbed to 38 buy, 4 hold and 4 sell, up from 31 buy, 7 hold and 4 sell. HDFC Bank has also strengthened its analyst backing, with 47 buy calls and 2 hold, compared with 41 buy and 7 hold in January, while continuing to attract zero sell ratings.

Other Nifty majors drawing stronger endorsements include Hindustan Unilever, Apollo Hospitals, Eicher Motors, Tata Steel, Mahindra & Mahindra, Adani Ports & SEZ, Cipla, Reliance Industries, ITC, BEL and Tata Consultancy Services.

Deven Choksey of DRChoksey FinServ noted that while near-term challenges from global shocks and margin pressures persist, the wave of upgrades signals a clear shift toward companies with robust balance sheets, resilient demand and the ability to navigate macro headwinds.

Earnings momentum, subdued in the March and June quarters, is expected to improve in the second half, aided by consumption recovery, rural demand normalization and a favorable base. Nifty EPS is projected to rise from Rs 1,036 in FY25 to Rs 1,165 in FY26E (+12 percent) and Rs 1,335 in FY27E (+15 percent).

Analysts expect September quarter earnings to remain muted, with a possible uptick in December driven by festive demand. While markets are unlikely to deliver sharp gains from current levels, experts believe downside risks are also limited.

"Despite near-term softness, the two-year outlook remains constructive, with consumption-led growth and an expanding economy likely to drive further re-ratings," said market expert Ambrish Baliga.

On the flip side, several Nifty names have faced downgrades. IndusInd Bank currently holds 7 buy, 15 hold and 23 sell ratings, compared with 37 buy, 11 hold and 23 sell earlier this year. Nestle India has slipped to 8 buy, 20 hold and 12 sell, from 13 buy, 18 hold and 12 sell. Bajaj Finance now stands at 21 buy, 13 hold and 5 sell, against 26 buy, 6 hold and 5 sell previously. Other downgraded firms include Hero MotoCorp, Shriram Finance, Hindalco Industries and Coal India.

So far in 2025, markets have endured a volatile ride. The Sensex and Nifty have managed modest gains of around 3 percent and 4 percent, while the BSE MidCap and SmallCap indices have slipped 1.5 percent and 4 percent, respectively. Foreign investors have pulled out more than Rs 1.6 lakh crore from secondary markets, even as domestic institutional investors stepped in with purchases worth over Rs 5.2 lakh crore.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.