Anubhav Sahu

Moneycontrol Research

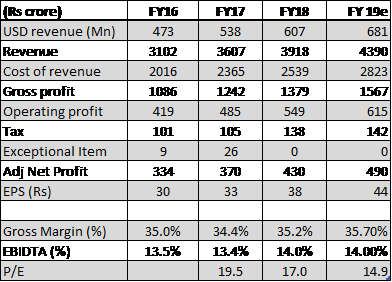

Mid-sized IT company Cyient ended FY18 on a positive note. The management met earnings expectations in Q4, announced new initiatives for growth/tie-ups and guided for another year of double-digit growth. If the momentum sustains, a further re-rating cannot be ruled out.

Q4 FY18: Strong sequential improvement

In Q4 FY18, Cyient reported dollar revenue of $165 million, a sequential growth of 8.3% (17% YoY) led by double-digit growth in both services and design-led manufacturing (DLM) businesses.

Geographically, Europe, West Asia and Africa (EMEA) region (31% YoY) led the growth in revenue. In terms of industry verticals, communications, transportation and semiconductor continued with their growth momentum.

EBITDA margin at 14.1% witnessed a 79 bps YoY improvement on the back of operational efficiencies for the services business and scale benefits in the DLM business. Net profit, excluding one-offs, was up 16.2% YoY.

New collaborations and initiatives

In Q1 FY19, the company formed a joint-venture (JV) with Israel’s Bluebird Aero Systems to support unmanned aerial vehicle (UAV) manufacturing and maintenance services in the Indian market. This entity will manufacture, integrate and test UAV systems in Hyderabad under a defence industrial licence with an initial production capacity of 100 systems per year. Estimated capex for this venture is $200 million.

The company has launched a New Business Accelerator (NBA) programme with a focus on developing new products and services. Here, more than dozen opportunities have been identified in areas of Internet of Things (IoT), healthcare, aerospace and defence and semiconductor. Initial budget for this is to the tune of $700 million.

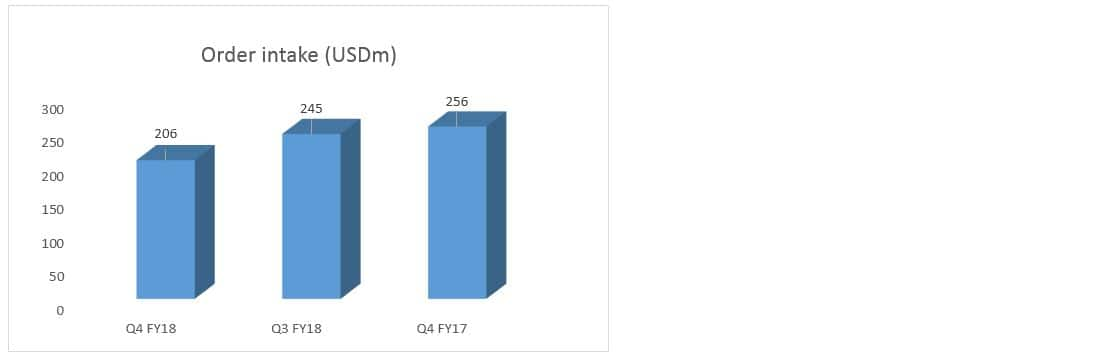

Order inflow improves for DLM

Total order intake at $730 million in FY18 was tad lower than that of the previous year ($751 million) on account of lower DLM order intake ($64 million versus $110 million in FY17). Sequentially, order intake for DLM improved in Q4 ($19 million versus $4 million in Q3 FY18).

Overall, the management appeared positive on the order pipeline and potential for new order intake in the near-term.

Management guides at double-digit growth

Cyient’s FY18 performance was broadly in-line with its guidance of double-digit growth and margin expansion of over 50 bps. For FY19, the management again guided to double-digit growth for services, 20% YoY growth for legacy DLM (excluding B&F Design acquisition) and tax rate benefit of over 200 bps (US tax rate reform and higher growth from SEZ). Growth in the DLM business, however, could dip in Q1 FY19 after a strong Q4 FY18.

Operational efficiency is expected to aid 100 bps improvement in margin, but this could be offset by investment expenses.

The free cash flow to EBITDA metric had declined to 26% in Q4 FY18 from 67% last year due to higher working capital expenses. However, the company remains confident of higher free cash flow conversion in FY19. In the case of DLM, the company expects to post positive free cash flow in FY19.

Overall, we remain positive on Cyient’s leadership position in engineering services and expect the stock (14.9 times FY19e earnings) to re-rate as it executes its guidance.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.