Private life insurer ICICI Prudential Life Insurance is looking to grow its protection business as a part of the journey to doubling its FY19 value of new business (VNB) by FY23.

"Innovative products, distribution reach and superior customer service has enabled the company to seamlessly execute its 4P strategy of Premium growth, Protection business growth, Persistency improvement and Productivity enhancement. We remain on track to double the FY19 absolute Value of New Business (VNB) by FY23," said NS Kannan, MD & CEO, ICICI Prudential Life Insurance in the insurer's annual report.

VNB is the present value of expected future earnings from new policies written during a specified period and it reflects the additional value to shareholders expected to be generated through the activity of writing new policies during a specified period.

In FY19, ICICI Prudential Life Insurance's VNB stood at Rs 1,328 crore. At the end of FY21, it rose to Rs 1,621 crore.

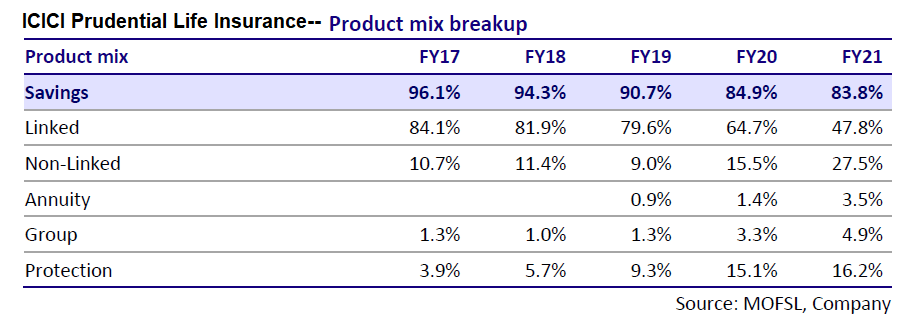

He said that the total premium income in FY21 was Rs 35,733 crore of which Rs 13,032 crore was new business premium. Here, the protection business mix for the year stood at 16.2 percent as against 15.1 percent in the previous year.

Kannan added that leveraging the multi-decade opportunity in the massively under-penetrated protection segment is one of the factors that will determine the long-term sustainable growth in VNB.

There has been a steady decrease in unit-linked insurance plans (Ulips) in the product mix for the insurer. In FY18, it was 81.9 percent and now it is down to 47.8 percent.

Motilal Oswal Institutional Equities said in a report that the recent strategy changes made by ICICI Prudential Life Insurance to its product mix, with a higher focus towards non-linked segments like protection, backed by strengthened distribution, are driving healthy premium growth.

"ICICI Prudential Life's product mix has changed over the years from being Ulip heavy (82% of APE in FY18) towards a more balanced product mix," the report said.

Protection business refers to term insurance plans. These products typically offer financial protection to a policyholder's family in case he/she dies during the policy tenure.

Assets see steady growth

ICICI Prudential Life Insurance also completed 20 years of operations in December 2020.

Kannan said in the annual report that the insurer had closed its first year in financial year 2000-01 with Assets Under Management (AUM) of approximately Rs 124 crore. The insurer touched AUM of Rs 1 lakh crore in FY15.

As on March 31, 2021, the insurer had an AUM of Rs 2.14 lakh crore. The company also raised subordinated debt of Rs 1,200 crore in FY21.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.