If the COVID-19 pandemic changed how people consume content, it also transformed how media and broadcast firms delivered content to their customers across the world with the rapid adoption of cloud-based software solutions.

Bengaluru-based startup Amagi, which was one of the early movers in this space, has been one of the biggest beneficiaries of this transformation. The startup enables content owners to launch, distribute and monetise live linear channels on free-ad-supported television and video services platforms through a suite of solutions.

A key breakthrough for the media-tech SaaS (Software-as-a-service) startup was this year’s Olympics, where it partnered with media conglomerate NBCUniversal to provide an Ultra HD feed for broadcast in the United States for the first time, with everything being controlled on the cloud.

“It took us 18 months of hard work and effort to pull this together but I believe it was a big technology demonstrator for the whole world that a cloud- and-software-based approach of doing things can actually be demonstrated at the most extreme scale,” Amagi cofounder Baskar Subramanian said in an interaction with Moneycontrol’s Vikas SN.

In September, Amagi raised $100 million from investors such as Accel, Avataar Ventures, Norwest Venture Partners and existing investor Premji Invest to double down on its cloud-based solutions for broadcast and streaming TV firms. The investment also provided a handsome exit to early investors such as Emerald Media and Mayfield India.

This investment also came on the back of strong customer growth and, consequently, revenue growth through the pandemic. Amagi reported a 136 percent increase in its revenues, with a 44 percent increase in customers for the financial year ended March 31, 2021. On a quarterly basis, it saw a 18 percent sequential revenue growth for the quarter ending June 2021, while the customer base grew 19 percent on a quarterly basis. The United States accounts for nearly 74 percent of the startup’s revenues.

Subramanian said that India is still a challenging market due to low advertising dollars as compared to other regions, although online viewing has increased dramatically in the country in recent years. That said, things are changing with more advertisers looking at digital video as a strategy. "I think we are about 18 months away from a fundamental change in the market in the country," he said.

He also talked about the various changes in viewership trends through the pandemic, the firm’s growing global footprint, and what’s in store in its future roadmap. Edited excerpts.

Tell us a little bit about your journey

Amagi as a company has been in existence for more than 10 years. However, there was a big pivot about five to six years back, when we started working on creating a cloud-based media technology suite to enable broadcasters, content creators, owners and sports producers to transition all their content on the cloud as well as deliver and monetise it.

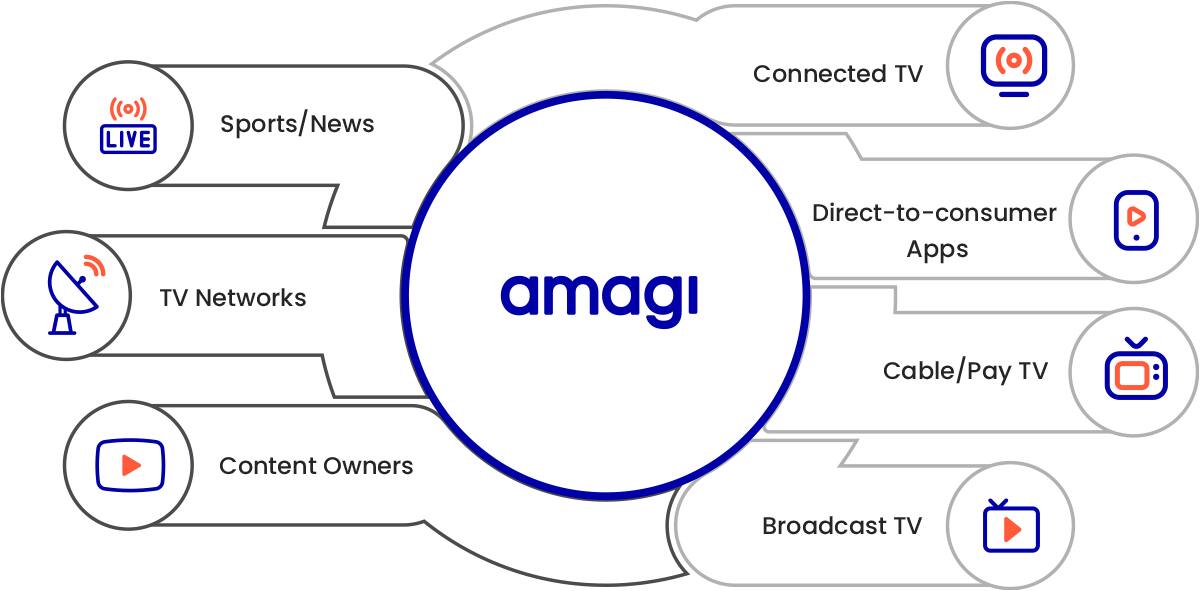

What’s evolved worldwide is a two sided market — one side is content creators like TV channels and the other side is content distributors like cable operators and streaming platforms. We’re connecting the dots between both of them.

What we do is enable our customers to take all of their content, carry out all the processing they want to do on the cloud as a software platform, and eventually distribute it to all of these platforms worldwide, and monetise it through targeted traffic.

Media tech SaaS is a new category that we have broken into and we are scaling very nicely, doubling revenues pretty much year on year.

How has the past year been for Amagi?

We are in the business of connected television, where the television is connected to an IP connection. Obviously, in an Asian context, that also means mobile television on which you’re watching video content. The largest market for us is the United States, which accounts for 74 percent of all our revenues. This is followed by Europe, and then Asia.

This is largely driven by the biggest transformational change that has happened in the business, especially in the United States, where people have started moving into what’s called FAST (Free, Ad supported Streaming Television) platforms.

While the format has been there for the last three-four years, I think the last year has been a dramatic year, where people started consuming content through these FAST platforms like Roku, Samsung’s TV Plus, ViacomCBS’s Pluto TV among others.

This led to a lot of new content distributors coming on to the horizon in the United States and increased consumption from users. But more importantly, the bigger thing that happened was that advertising started moving from traditional television to connected TV over the past 18 months. This is especially crucial since these platforms are free and ad-supported.

Television is starting to shift its ad dollars, a $70 billion industry in the US, into connected television, since viewership and user patterns are changing.

We grew 136 percent over the last year and just in the last quarter, we grew by about 18 percent. We have also doubled in pretty much everything, in terms of revenues, profitability, and employee base. We were at 250 plus channels but right now, we’re at over 550 plus channels already.

The second big trend is that sports and news are moving completely to an IP connected platform. Previously, all premium sports were largely on offline cable platforms, which is one of the biggest bread-and-butter (businesses) for cable operators and DTH operators to make money. Today, a shift is starting to happen where sports and news is moving to the cloud and all media operations in the backend are changing. That’s where Amagi gets to play a larger game as we move forward.

You also played a key role in the Olympics coverage this time. Can you elaborate on that?

Live content has been a big investment strategy for us over the last two years and live sports is front and centre for us from an investment standpoint. NBC, which owns the Olympics rights for all of the United States, is a big customer of ours.

Baskar Subramanian, Co-founder & CEO - Amagi

Baskar Subramanian, Co-founder & CEO - Amagi

We partnered to bring Ultra HD, which is like a high-quality 4K resolution, for broadcast in the United States for the first time. Everything was done on the cloud without a single piece of hardware. It took us 18 months of hard work and effort to pull this together but I believe it was a big technology demonstrator for the whole world that a cloud- and software-based approach of doing things can actually be demonstrated at the most extreme scale. We also did Paralympics for Eurosport in India.

Considering your vantage point, how have viewership trends changed, especially through the pandemic?

There was a bump when COVID-19 started in terms of overall transformation to IP connected viewing behavior. This happened due to two counts — one, obviously people were at home, which meant there was a lot more consumption happening in terms of the number of hours. Another important thing, at least in the US context, was that a lot of people transitioned to free television since the cable bundle is very expensive in that country. It also matched with a lot of new streaming platform launches such as Disney+ and NBC’s Peacock.

Interestingly, since the COVID-19 outbreak, we have seen that consumption has remained the same in terms of the number of people to the number of hours that they consume. While we don’t expect another bump in viewership, what we’re going to see is a bump in the number of consumers starting to adopt these platforms.

You raised around $100 million in funding from Accel and Norwest in September. What sort of returns did the investors get and where will the money go?

Mayfield India got a 14x return on their investments while Emerald Media got about 3x returns. These investors were at the sunset of their funds and we were also looking for investors who can take the company to the next level, since we have transformed into a SaaS company.

We are using the money to double down on our R&D and expand our operations in the United States. We are quadrupling the number of people in the United States, and also doubling overall our employee base, including our India operations.

Tell us about the different businesses that you have.

We have two flagship business units inside the company: Cloudport and Thunderstorm. Cloudport is all about media content, be it managing it, or processing it and distributing it to our customers, either as linear, live-like or on-demand content.

Thunderstorm is all about delivering content in terms of analytics and monetisation, and everything related to making money out of the content through advertising. We have a targeted advertising infrastructure, with billions of impressions per month that we’re actually addressing today, for our customers.

After the United States, which are your biggest markets?

EMEA (Europe, the Middle East and Africa) is our second largest market, with about 21 percent of all our revenues coming from this region. Asia is smaller, but growing.

This split essentially reflects the maturity of technology adoption and infrastructural availability. The United States had the best internet infrastructure and the cloud infrastructure to start with, therefore adoption by consumers happened slightly early. We are now seeing this transformation happening in Europe.

I think Asia is just about starting on the horizon. Maybe four or five years behind the US in terms of adoption, but clearly, that’s starting to happen as well.

Do you see India as a potential market?

India is an interesting market because online viewing has increased dramatically. I think all of us are consuming a lot more content. The challenge is not with the viewership as much as advertising dollars.

In India, the cost per 1,000 impressions is anywhere from $2 to $3. So, it’s very low compared to the US, which is anywhere close to $30. However, the technology cost is the same while the cloud cost is more expensive. Those are some of the things we are struggling with in India.

However, we are seeing things changing in the ecosystem with advertisers looking at digital video as a strategy. With Samsung, we have launched a bunch of channels to monetise in India. I think we are about 18 months away from a fundamental change in the market in the country.

India is starting to become important and ready for these sorts of capabilities. You will see a lot of transformations in the future where everyone will start to move to the cloud. It’s a question of years and infrastructure availability.

(Earlier this month, Amagi signed a deal with Xiaomi to manage and monetise its linear TV and video-on-demand offerings for mobile and connected TV consumers across multiple countries, including India. The content will be part of Xiaomi’s direct-to-consumer app.)

Apart from sports and news, are there any genres that are picking up for Amagi?

I think it’s been an explosion of genres. If you come to the entertainment genre itself, there are so many sub-genres that have emerged. For instance, there is Dog TV, which is a television channel made specially for dogs. We also do reality shows and content for the LGBTQ community. Cooking has its own range of sub-genres like Vegan cooking and country-specific cooking, like Vietnamese cooking, among others.

What is in your roadmap for the future?

Three big areas we are looking at are live sports and news, expanding our ad monetisation capabilities, and using data and video-led machine learning models and artificial intelligence technologies to build business cases.

We are looking to build end-to-end capabilities for live sports and news, which will be a big investment for us. We are also trying to increase the number of ad monetisation models. I think we are in a very primitive phase of ad monetisation in the video context of how consumers watch — there will be a lot more ad formats and interactivity.

We have been toying with machine learning on video for the past three to four years, but I think it’s now come to primetime, where it has become business-case driven. The maturity of machine learning models and technology have also come to a point where we can start leveraging them to build business benefits and business cases.

Do you see your revenue mix changing in the future?

The revenue mix has changed over the last few years for us. For example, ad-driven technology revenues used to be 20 percent of our business and the remaining 80 percent came from media management and delivery of content. Over the last two years, ad monetisation grew 10x, contributing to about 33 percent of our revenues. We feel this mix will become constant as we move forward.

Interestingly, we continue to see a rapid pace of growth in the US market. So, while the growth rate in the US will continue, its contribution will come down and the mix is going to change towards a broader base.

What will be the key focus areas going forward?

The key focus will be on building the whole portfolio of products and driving growth. We are transforming into more of a media-tech platform with a lot more third-party companies coming and integrating into our systems.

We will do some M&As in terms of specific technology elements that we can actually integrate into our systems.

Are you looking at any specific areas for M&As?

There are small pockets that we are looking at. We don’t have anything specific zeroed in today. We are talking to our customers and figuring out where the gaps are that Amagi can fill. It’s really a build versus buy decision. We are either going to go build it ourselves or buy something that can integrate into our platform.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.