Total loans restructured by Indian banks under two rounds of resolution schemes announced by the Reserve Bank of India (RBI) in the wake of the Covid-19 pandemic crossed Rs 1.5 lakh crore at the end of September 2021, according to a Moneycontrol data analysis.

Loan restructuring refers to offering relaxed conditions to stressed borrowers to repay the loans. This could include extending the repayment period, offering a repayment holiday or reduction in interest rate.

In August 2020, the Reserve Bank of India (RBI) had allowed lenders to open a window to implement a resolution plan in respect of eligible corporate exposures without change in ownership, and personal loans. In May 2021, considering the deadly impact of the second wave of Covid-19, the RBI again allowed lenders a limited window to implement resolution plans for individuals and small businesses.

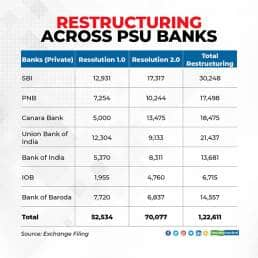

Overall, private banks restructured over Rs 60,000 crore of advances with the bulk of the restructuring coming from the second framework. Public sector banks restructured over Rs 1 lakh crore of loans, again with major restructuring happening under the second framework.

Non-performing assets (NPAs) in the retail and micro, small and medium enterprises (MSME) loan books of public sector banks rose 7.28 per cent in June 2021 from about 6 percent in June 2020, the analysis showed.

The jump in NPAs is largely due to the second wave of the pandemic and lack of schemes like a moratorium on repayments, said Vishal Balabhadruni, BFSI analyst at CapitalVia Global Research.

Major stress in the second restructuring framework across banks was seen in the retail portfolio, whereas in the first framework, corporates had availed the facility, experts said.

Outlook on the restructured pool

Among large banks, HDFC Bank expects that the overall impact on NPAs will not be large. Chief Credit Officer Jimmy Tata in an analyst call after the second-quarter result said, “We continue to monitor restructuring portfolios and have heightened monitoring at all times. We are evaluating on several criteria, including customer behaviour, we don’t think the impact will be more than 10-20 bps (basis points) on NPAs in any given point of time.”

Similarly, ICICI Bank restructured personal loans worth Rs 3,029 crore out of Rs 4,158 crore in second resolution framework. In an earnings call, ICICI Bank’s chief financial officer (CFO) Rakesh Jha said some of the restructuring will be seen in Q3 as well due to implementation timelines. Jha said, “But in the overall context it is not going to be any material number, I would say. It will be definitely be less than Rs 10 billion (Rs 1,000 crore).”

Bandhan Bank too saw heavy restructuring in the second window of around Rs 7,698 crore compared to about Rs 625 crore under first framework. CFO Sunil Samdani in a recent interaction with Moneycontrol said, “Customers are coming and paying instalments where they are not required to pay for six months. As economic conditions, mobility and ground-level activities improve, people are coming back and paying.”

Almost two-thirds of customers from the restructured pool paid us back in the second quarter, Samdani said.

The third largest public sector bank, Canara Bank expects less than 1 percent of its total restructured pool to slip into NPA territory. The bank’s managing director and CEO L.V. Prabhakar told Moneycontrol that as on September 30, in 52 percent of second restructured portfolio the bank had seen people paying instalments in advance. People have availed of the facility only as a safety measure, he added.

Asset quality outlook

Ratings agency ICRA in a recent note on October 20 had said that it expects gross fresh slippages to remain elevated at 2.8-3.2 percent during the second quarter but moderate to 2.0-2.4 percent during the second half of FY22 as the impact of the second wave wanes.

Anil Gupta, vice-president, financial sector ratings, ICRA Ratings, said, “Considering that 30-40% of the loan book was under moratorium during Q1FY20 across most banks, the loan restructuring at 2.0% of advances after the second wave is a positive surprise and much lower than our earlier estimates.”

“Despite the positive headline numbers, we continue to be watchful of the asset quality, given the elevated levels of the overdue loan book and for the performance of the restructured loan book,” Gupta added.

Amit Gupta, vice-president-fund manager, portfolio management services at ICICI Securities, said banks’ restructuring in Q2 was 30-100bps higher than Q1 where a large chunk came from personal loans, which is expected to recover going forward.

Gupta of ICICI Securities added that both the frameworks can’t be compared as in framework 1.0 restructuring resulted in 20 percent slippages out of which nearly 60 percent got converted into NPAs.

Analyst expect that going forward things will improve given the recovery trends, and the improvement in corporate earnings and jobs scenario

“By March 2022, we expect stressed assets in this segment to reach up to 11 percent from up from 9 percent in March 2020,” CapitalVia’s Balabhadruni said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.