The war for market share in the cement industry is heating up and the leader UltraTech Cement has signalled that it will use all its might to protect its share with its latest acquisition plan.

The Kumar Mangalam Birla led-UltraTech said on November 30 that it will acquire the cement business of Kesoram Industries on a share swap basis. With this move, the company will in one stroke achieve two goals—gaining a stronger footing in southern and western India and widening the gap with its closest competitor, the Adani Group’s Ambuja Cements and ACC. It also helps that there are natural synergies.

The deal

While the companies did not disclose the deal size, a person in the know told Moneycontrol that it will be at an enterprise value of a little over Rs 7,600 crore, which includes the debt on Kesoram Industries’ book of around Rs 1,700 crore.

Birla, the chairman of the AV Birla Group which owns UltraTech Cement, is also a promoter-shareholder of Kesoram Industries, which is owned by his aunt Manjushree Khaitan.

The deal got a thumbs up from many brokerages. Shares of both UltraTech and Kesoram, which have been rising the last few sessions on speculation of a deal, hit their respective 52-week high on December 1.

“The companies want to enhance capacity and market position and it is not easy to build greenfield capacity due to environmental concerns and there is also a challenge accessing limestone mines. Hence, as a strategy, bigger players believe that the inorganic way is the faster and better way to augment capacity expansion,” Suman Chowdhury, chief economist and head, research, Acuité Ratings and Research, told Moneycontrol.

Analysts expect that the big boys of the cement industry will continue to take over smaller companies and consolidate to protect and gain market share on expectations of robust demand driven by increased spending on infrastructure projects in the country.

While the merger with UltraTech will benefit the operations of Kesoram’s cement units with economies of scale kicking in due to synergies in procurement, logistics and fixed costs, there may be some challenges in the near term, too.

“Given operational inefficiency of KSI’s (Kesoram) plants and the regional mix, which would tilt toward the surplus market of South India, acquisition may have a slightly negative impact on blended margin in the medium term,” Elara Capital said in a note.

Challenger vs leader

Billionaire Gautam Adani’s big-bang entry into cement with the $10.6- billion acquisition of India’s second-biggest cement business (Ambuja Cement and ACC) from Holcim Group of Switzerland last year marked the arrival of an aggressive challenger in the cement industry.

UltraTech soon announced a mega investment plan to scale up capacity and made it clear that it will match the aggression to protect its market leadership.

With its latest move, UltraTech will add Kesoram’s total capacity of 10.75 million tonnes per annum (mtpa) to take its total capacity to 149.14 mtpa on completion of the deal. This will take the company closer to achieving its stated goal of 200 mtpa cement capacity in India.

Brokerages said that the acquisition will help UltraTech strengthen its presence in the underpenetrated southern region. While the company enjoys 22-25 percent market share across India, its operations in southern India have been a drag with a market share close to a little over 10 percent.

“The said acquisition would solidify its presence in the highly fragmented, fast-growing western and southern markets such as Telangana, where currently it is not present. UltraTech has also recently announced an acquisition of 0.54mt cement GU (general use) of Burnpur Cement at Patratu, Jharkhand. Post completion of phase II/III expansion and announced acquisitions, we anticipate the company’s pan-India capacity market share to improve by 350-400 bps (basis points) going ahead,” Emkay Global said in a report.

Big boys to buy more

In the emerging industry landscape, the heightened ambitions of the major players may lead to price wars even as new capacities are added, and that may squeeze margins in the coming years.

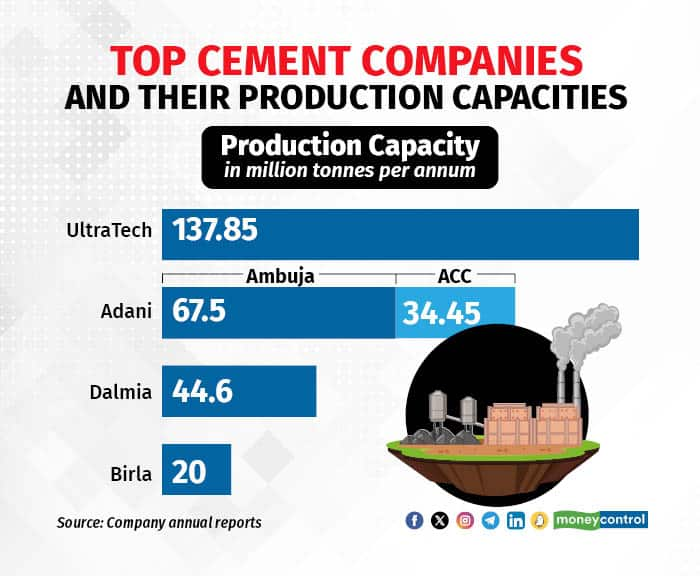

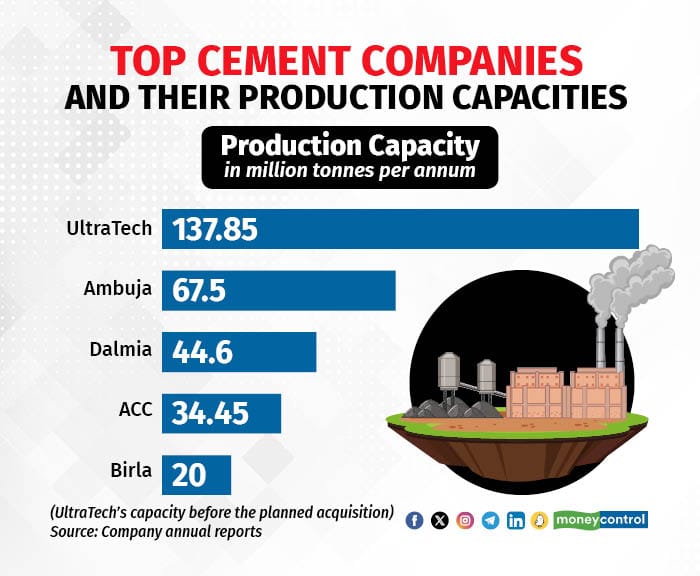

Current production capacities of top cement makers

Current production capacities of top cement makers

Commenting on the deal, Morgan Stanley said, “This is incrementally positive for the industry as it reduces the risk of excess organic supply medium term. It is also positive for UTCEM (UltraTech) given its increased footprint in the south and should help drive economies of scale and thus potential operating synergies.”

Even if demand remains strong, smaller players may face the heat.

“The businesses in the sector may concentrate on growing their market share as the need for cement rises. Companies may use competitive tactics, such as compromising profit margins in favour of higher sales volume, in an effort to grow their share of the market. Companies may place a high priority on establishing a sizeable market presence in order to reinforce their position in the sector,” said Ashutosh Murarka, cement analyst, Choice Equity Broking.

Media reports suggest that the Sajjan Jindal-led JSW Cement may be in early talks with German cement company Heidelberg Materials to purchase its cement business in India, which produce 13.4 million tonnes annually. JSW Cement, Adani Group and ArcelorMittal Group are also believed to be in the race to bag Vadraj Cement, an ABG Shipyard company that is undergoing the Insolvency and Bankruptcy Code (IBC) process.

In August, Ambuja Cements announced the acquisition of Sanghi Industries and market watchers don’t expect this to be the last of the acquisitions from the Adani Group.

Safe to say, the cement industry is ‘under construction’ with these concrete shifts in dynamics with increased mergers and acquisitions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.