Fundraising by banks through certificates of deposit (CD) in February rose to the highest in the current financial year due to tight liquidity in the banking system, experts said.

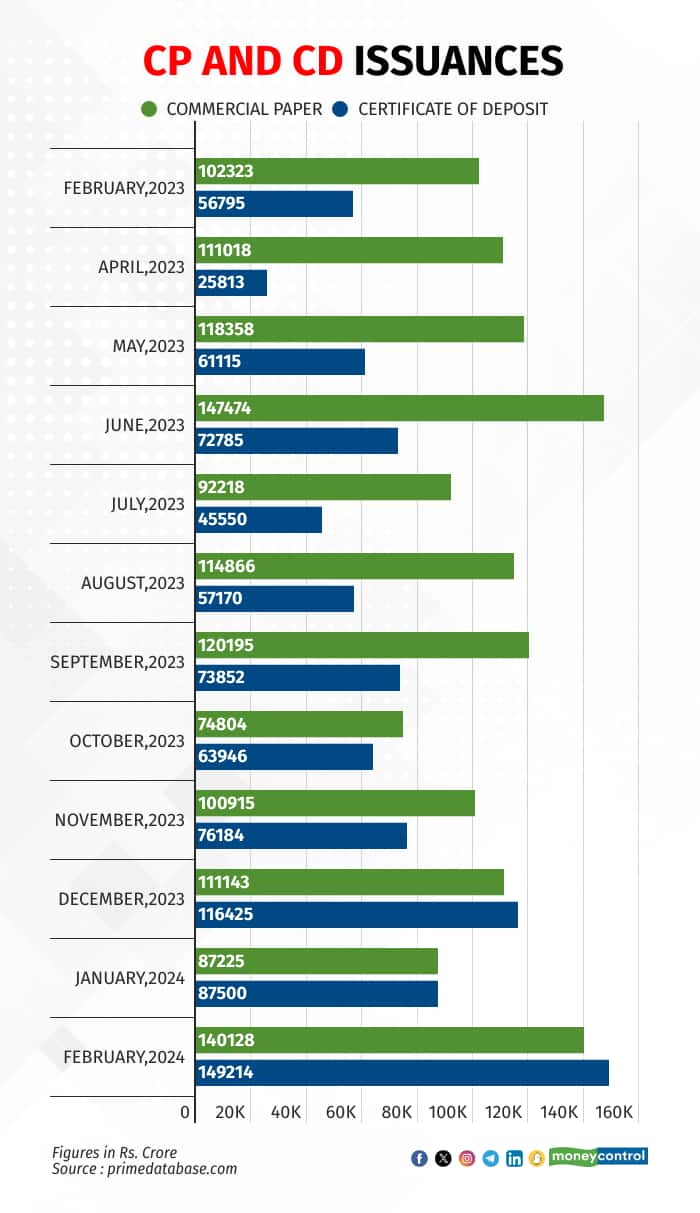

Banks raised Rs 1.49 lakh crore in February, a 162 percent jump over Rs 56,795 crore raised in February 2023, according to the data from Prime Database.

“Extreme deficit in banking system liquidity, which went up to Rs 2.5 lakh crore post GST outflows, is the major cause of the significant increase in CD issuances,” said Mataprasad Pandey, Vice President, Arete Capital Service.

Further, Anshul Chandak, Head of Treasury - RBL Bank, said in such times (deficit liquidity) CDs are cost-effective versus deposits from customers. Historically, CD and commercial paper issuances are higher during tight liquidity and subside during easy liquidity conditions.

In February, liquidity conditions in the banking sector remained tight with the deficit hovering at over Rs 1.50 lakh crore. This resulted in overnight and short-term rates going up by 5-10 basis points (Bps).

One basis point is one-hundredth of a percentage point.

Despite the rise in rates, banks raised funds through CDs for their working capital and funding needs.

However, liquidity conditions eased towards the end of February due to month-end government spending, which helped short-term rates to ease. Currently, the liquidity in the banking system is estimated to be a surplus of around Rs 13,377.23 crore.

Also read: Short-term rates fall 10-15 bps on easing liquidity conditions

The numbers

On a monthly basis, issuances of CDs rose by around 71 percent. In January, banks raised Rs 87,500 crore, data showed.

Around 60 percent of the total fundraising in February was done by the top five issuers – Bank of Baroda (Rs 24,155 crore), Punjab National Bank (Rs 18,650 crore), Union Bank of India (Rs 16,075 crore), Canara Bank (Rs 15,875 crore), and HDFC Bank (Rs 14,350 crore).

In the current financial year, issuances crossed Rs 1 lakh crore mark only in two months – December 2023 worth Rs 1.16 lakh crore and February worth Rs 1.49 lakh crore.

Commercial papers issuances

Issuances of commercial papers (CP) rose 37 percent to an eight-month high in February at Rs 1.40 lakh crore as against Rs 1.02 lakh crore raised through the route in the same month last year.

Pandey said traditionally CP issuances have always been higher during the last quarter as companies look to meet their borrowing targets for the fiscal.

Other experts said the need for working capital also pushes entities to raise more funds from the market.

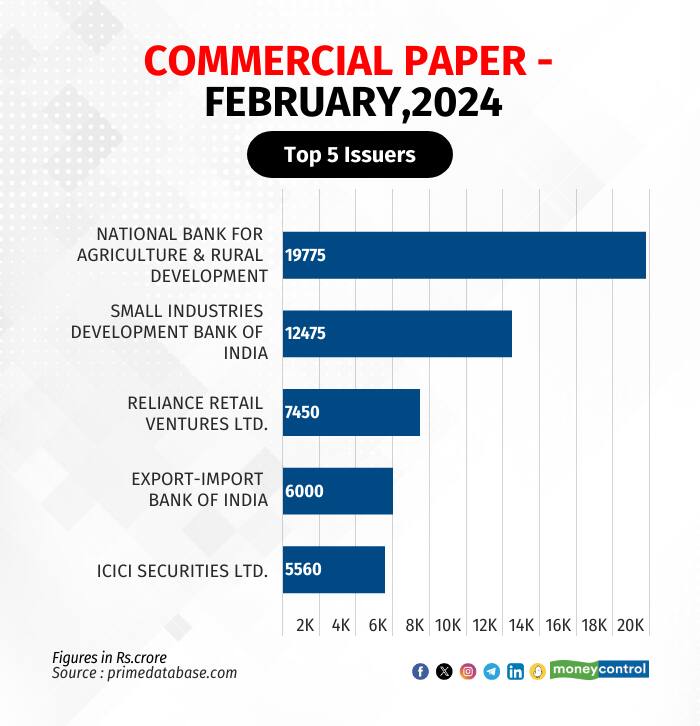

In February 2024, National Bank for Agriculture & Rural Development (NABARD), Small Industries Development Bank of India (SIDBI), Reliance Retail Ventures Ltd, Export-Import Bank of India (EXIM), and ICICI Securities Ltd, were the largest issuers.

These entities together raised Rs 51,260 crore.

Also read: Inflows Into Index-Eligible India Bonds Set to Hit $10 Billion

The way ahead

Money market experts are of the view that banks and corporates are likely to raise more funds in March due to quarter-end funding requirements and expectation of tight liquidity in the banking system.

Systemic liquidity is expected to get tight after the advance tax and GST outflows scheduled on March 15 and March 20, respectively.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.