Finance Minister Nirmala Sitharaman on February 1 maintained the status quo on the capital gains structure, opting not to introduce any changes. However, the interim Budget for 2024 did not bring any relief on the front of debt taxation.

Taxation experts were hoping that the government would rationalise and streamline the capital gains structure, which is different for different assets (equity, debt, real estate, and so on) across time periods.

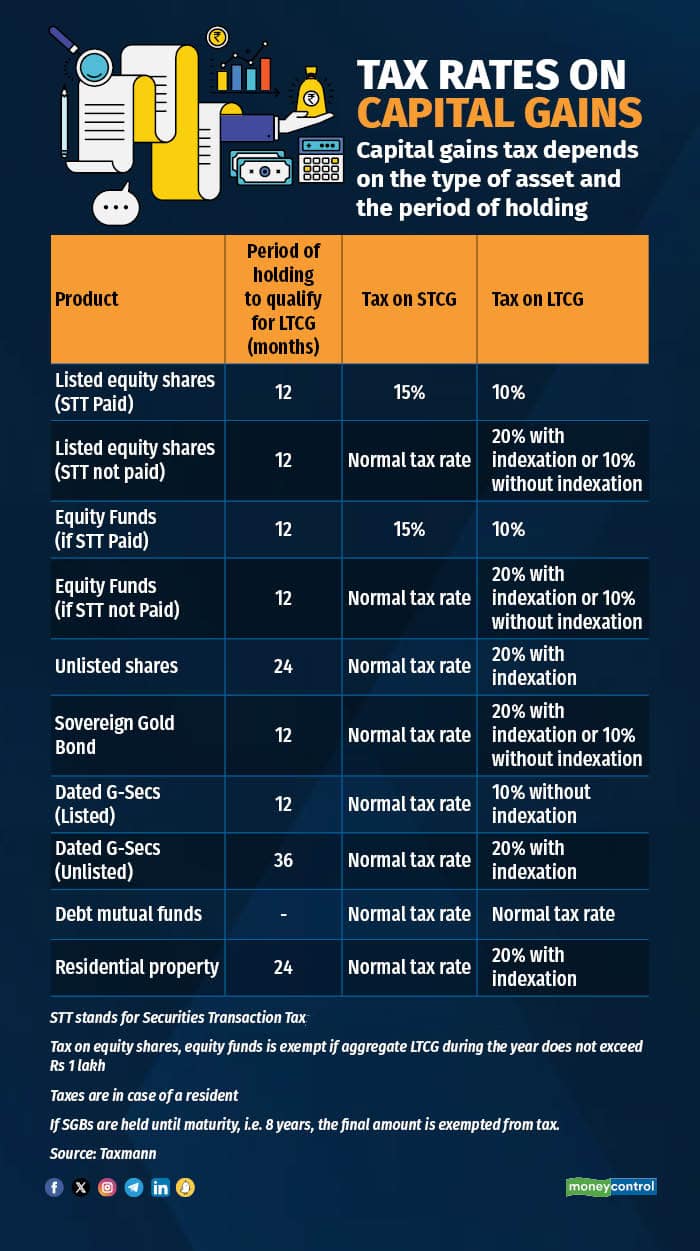

Different assets have different capital gains tax rates and periods that determine whether your gains are short-term or long-term.

Also read | Budget 2024: Thrust on spiritual travel to enhance Leave Travel Allowance usageFurther, asset management companies (AMCs) in India were hoping that the government would roll back the debt taxation changes, which were brought in last financial year.

Currently, if you sell listed securities such as equity shares and units of equity-oriented mutual funds (where equity exposure is above 65 percent of the assets) before a year, then you will be charged short-term capital gains (STCG) tax at 15 percent. This concessional tax rate applies if the Securities Transaction Tax (STT) is paid at the time of the transfer of such securities.

The sale of listed equity shares or units of equity-oriented funds after a year is when the long-term capital gains (LTCG) tax kicks in. It attracts a tax of 10 percent on gains in excess of Rs 1 lakh in a year.

Also read | FM Sitharaman leaves income tax rates, slabs unchangedWhere STT is not paid on listed equity shares, STCG is taxed at the normal tax rate, and LTCG is taxed at 20 percent with indexation or 10 percent without indexation benefits.

For unlisted shares, the STCG period is 24 months, while for listed shares, it is 12 months. Further, STCG on unlisted shares is taxed at your income-tax bracket rates, while LTCG (after 24 months) is taxed at 20 percent with indexation benefits.

In case of equity mutual funds where STT is not paid, STCG is taxed at the normal tax rate, while LTCG tax is 20 percent with indexation.

When it comes to debt funds, according to the amendments to the Finance Bill on March 24, 2023, gains from funds with less than 35 percent of their assets in equities do not offer LTCG and indexation benefits. Irrespective of when you sell these units, they are added to your income and taxed at your income-tax rates.

Also read | FM waives off disputed direct tax demand of Rs 10,000-25,000Earlier, gains from investments in debt funds — if units were held for more than three years — were subject to the LTCG tax rate of 20 percent, after indexation.

But if you sell listed debt securities on the stock exchanges, the threshold to determine the capital gains tax is 12 months. If you sell this security before 12 months, you have to pay STCG tax; else you pay LTCG tax.

Also read | Budget 2024: No announcement on TCS on international credit card spendsDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.