The market capitalisation of all listed companies on the BSE has gained over 41 percent over the past one year, since the last budget. Analysts have attributed this surge to a strong domestic economy amidst a global slowdown.

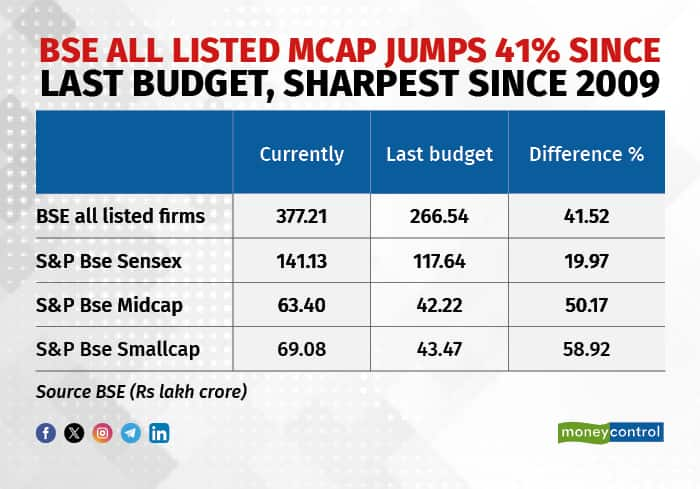

As of January 30, BSE-listed firms' market capitalisation soared to Rs 377.21 lakh crore from Rs 266.54 lakh crore in the last budget. This marks the sharpest absolute increase on record and the largest percentage jump since the July 2009 budget.

Sensex mcap increased 21.3 percent or Rs 25.11 lakh crore since last budget while BSE Midcap and BSE Smallcap jumped 51 percent and 58.5 percent or Rs 21.47 lakh crore and Rs 25.45 lakh crore respectively.

Indian markets witnessed a substantial rally in 2023, with Sensex and Nifty surging almost 20 percent each. This robust performance was driven by improved macroeconomic conditions and strong fund inflows from both domestic and foreign investors.

Also Read: Budget to budget: Realty and PSU stocks shine; here's how various sectoral indices fared

Notably, sectors sensitive to interest rate changes, like real estate and automobiles, posted impressive figures, showcasing the economy's resilience despite high interest rates.

Meanwhile in January 2024, markets saw correction due to higher valuations and weak December quarter earnings posted by some companies. The Sensex currently trades at 18.07 times its one-year forward earnings compared to its 10-year average forward PE of 18.11 times. Nifty one-year forward PE is at 18 times versus its 10-year average forward PE of 17.5 times.

All eyes are now on interim budget 2024. Analysts anticipate the government to announce measures focusing on boosting consumption, implementing manufacturing reform policies, allocating funds for infrastructure, and emphasising agriculture.

Also read: Budget 2024 | Fiscal deficit, nominal GDP, capex: Here's what top brokerages estimate

A potential slowdown in government capital expenditure is projected for 2024-25, with an expected allocation of around Rs 11 lakh crore. While this would set a new all-time high, it represents a modest 10.3 percent increase over the current year's budget estimate. On the other hand, the market may cheer government's aim to curb the fiscal deficit, targeting 4.5 percent of GDP by FY26.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.