In a major boost to the new income-tax regime, the Finance Minister Nirmala Sitharaman on February 1 proposed to make the new income-tax regime as the default system.

A major shift in the way income tax has been provisioned at the salary-payment stage and the return-filing stage has been proposed under the Union Budget 2023-24. The Government has proposed to make the new income tax regime as the default tax regime.

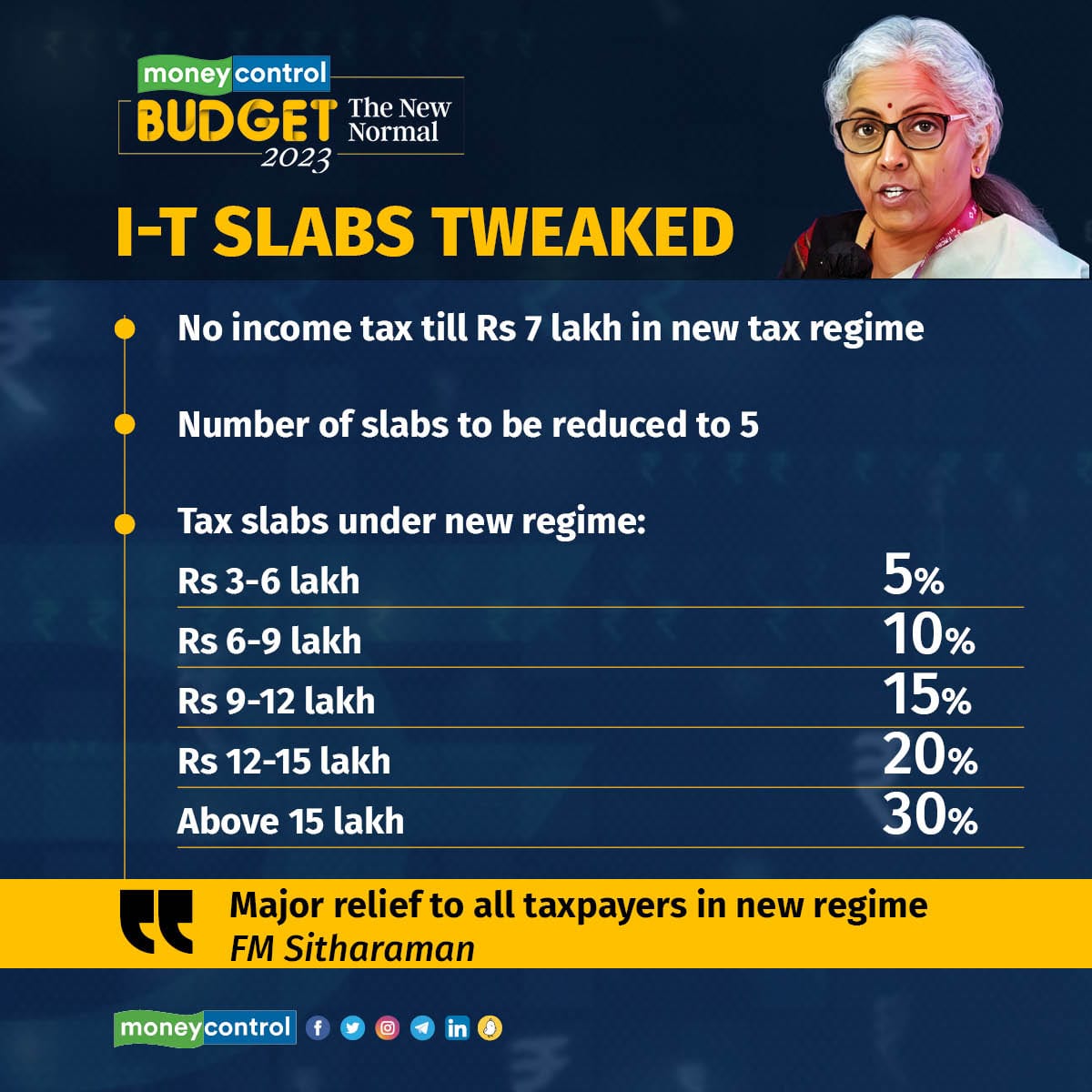

The new tax regime – first introduced in Union Budget 2020 – would now have five slabs instead of six slabs, with the lowest tax rate being 5% and the highest tax rate being reduced to 39% from 42.74%.

Catch all live updates on Budget 2023 here

So far, the existing tax regime, with higher tax rates and 78-plus tax deductions was the default tax regime considered unless an individual opted for the new tax regime via a special form to be filled before the due date of filing income tax return.

While there has been no break-up offered by Central Board of Direct Taxes on how many individuals have opted for the new tax regime, chartered accountants state that those who have home loans, especially joint home loans and high deductions to be claimed under Section 80 C and 80 D would be better off with the existing tax regime.

Sitharaman has, however, offered citizens the option to avail the old tax regime.

Currently, self-employed can make the shift from the new tax regime to the existing tax regime once during the lifetime, but salaried individual could switch between the two regimes each year.

The new tax regime – first introduced in Union Budget 2020 – would now have five slabs instead of six slabs, with the lowest tax rate being 5% and the highest tax rate being reduced to 39% from 42.74%.

So far, the existing tax regime, with higher tax rates and 78-plus tax deductions was the default tax regime considered unless an individual opted for the new tax regime via a special form to be filled before the due date of filing income tax return.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.