Beer industry profitability hinges on varying excise policies levied by states on the sale of liquor and Kotak Equities sees a lot of room for the industry bottomline to grow.

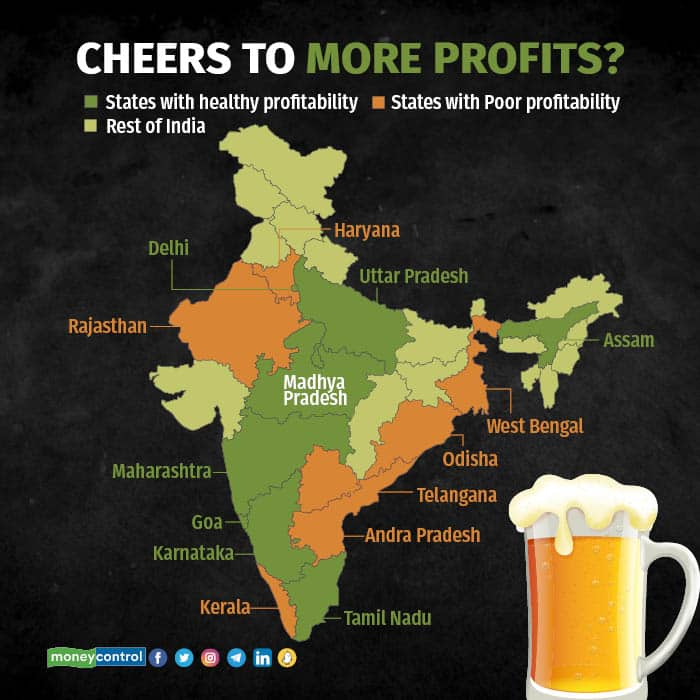

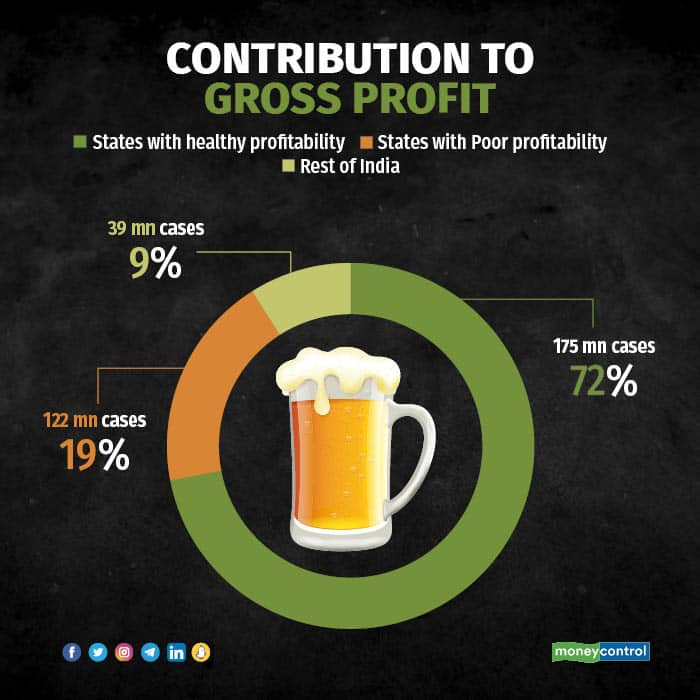

Karnataka, Maharashtra, Uttar Pradesh, Tamil Nadu, Delhi and Goa account for 70 percent of the beer industry's gross profit pool, while Telangana, Andhra Pradesh and Rajasthan are high on volumes but poor on profitability, according to the domestic broking firm.

"The question is whether states that are characterised by subdued profitability will let the industry make better margins/RoIs (returns on investment) in future, i.e. allow pricing flexibility," it said in a recent report.

Also Read: Carlsberg warns price hikes may hit beer sales in 2023

The beer industry volumes and consumer spends in Andhra and Telangana saw 10-11 percent and 5-6 percent annual growth rate in the past two decades, but the industry EBITDA pool has barely grown.

"Companies continue to operate in these states with the hope that profitability will improve eventually," the Kotak Institutional Equities report said.

Beer is taxed on volumes in India, rather than on alcohol content. This makes beer costlier than spirits. KIE sees premiumisation of beer as one avenue to increase profits. "But, price laddering from popular to premium augurs well for spirits," it noted.

Stock preference

The firm has 'add' ratings on both United Spirits and United Breweries but it prefers the first one. The company is a play on premiumisation in spirits, has cost levers, offers superior return ratios with similar revenue growth profile, said the KIE report. It has a target of Rs 925 on the stock.

Also Read: United Spirits Q3 report card hurt by provisions, high input costs hurt Q3 report card

For United Breweries, CEO transition and competitive intensity are some key risks. They have a target of Rs 1,625 apiece.

That said, both the companies face headwinds such as discretionary slowdown, continued inflationary pressure and delayed price hikes from states, but that gives an opportunity to accumulate, KIE said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.