The Deposit Insurance and Credit Guarantee Corporation (DICGC) said on August 1 that it will refund eligible depositors of 17 cooperative banks, including eight from Maharashtra, in October. Moneycontrol explains what’s at stake in the offer.

How much money will depositors receive?

DICGC, a subsidiary of the Reserve Bank of India, provides insurance cover of up to Rs 5 lakh on bank deposits. The DICGC said eligible depositors should support their claims through valid document/s of identity and a written consent to receive the amounts lying in their deposit accounts subject to a maximum of Rs 5 lakh, along with details of alternative bank accounts in which the amount should be credited.

Why do the depositors require to be refunded?

RBI clamped restrictions, including on withdrawals, by depositors of these 17 banks in July because of the institutions’ deteriorating finances.

Which banks’ deposits are covered by DIGCC?

Deposits at all commercial banks, including branches of foreign banks functioning in India, local area banks and regional rural banks are insured by DICGC. The body has also previously paid back amounts to the depositors of various cooperative banks.

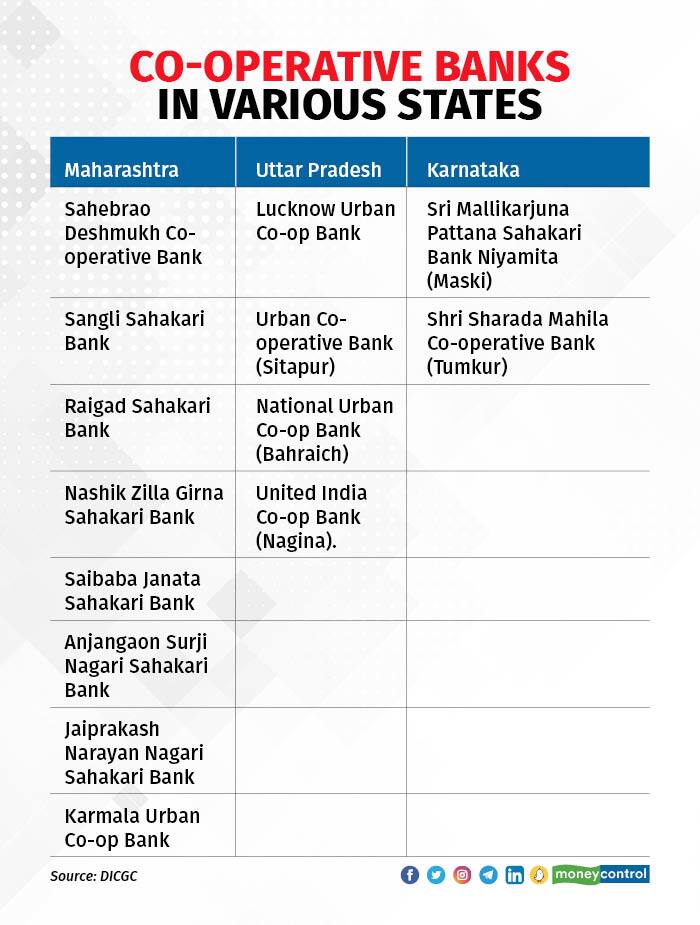

Out of the 17 cooperative banks shortlisted this time, eight are in Maharashtra, four in Uttar Pradesh, two in Karnataka, and one each in New Delhi, Andhra Pradesh and West Bengal.

Other banks include Ramgarhia Cooperative Bank in New Delhi; Suri Friends Union Coop Bank in Birbhum, Suri, West Bengal; and Durga Cooperative Urban Bank in Vijayawada, Andhra Pradesh.

“DICGC has not quantified the exact amount that will be assigned to each bank. They have just said that they will give a maximum amount of Rs 5 lakh to each deposit account. Now, they will do an audit and then decide,” added Vijay Mungale, an activist for depositors.

What do depositors say?

The offer by DICGC will bring no respite to the depositors, according to members of the Bank Depositors Protection and Welfare Society (BDPWS) and other activists.

“They are cheating the people as they are not refunding the whole amount. They are not going to save the banks. They are finishing the institutions and cheating the customers,” said Vishwas Utagi, secretary of the BDPWS.

According to depositors, many customers who had more than Rs 5 lakh in their accounts will lose out.

“There is no point in insuring small amounts. Moreover, many times, the documentation process involved like KYC (Know Your Customer) and others make the process complicated,” added Mungale.

“DICGC collects premium from each bank on entire deposit of 12 paise per Rs 100. However instead of protection of 100 percent of deposits, only up to Rs 5 lakh is refunded. The question is what happens to the depositors’ money beyond Rs 5 lakh,” said Utagi.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.