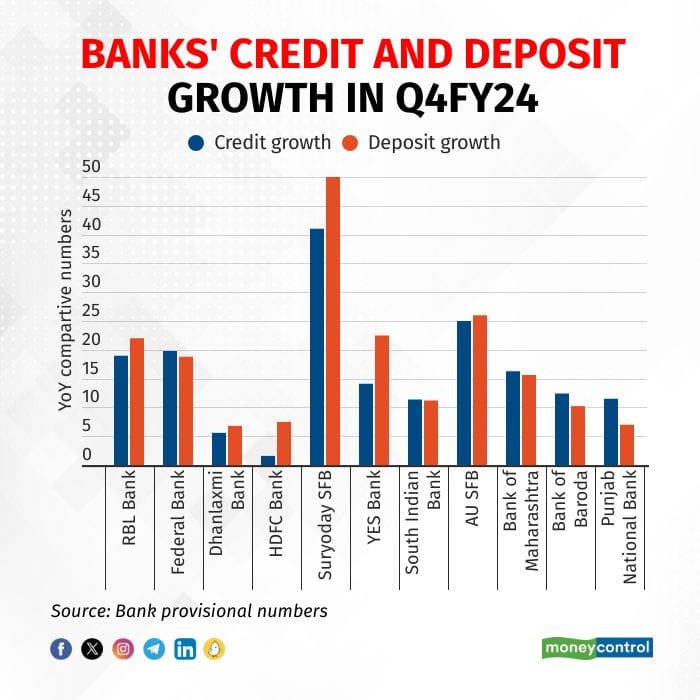

Some of the Indian banks which have reported their provisional earnings for the January-March quarter of the financial year 2023-24 posted robust deposit growth compared to slow credit growth, a Moneycontrol analysis of at least 11 banks showed.

RBL Bank reported a deposit growth of 22 percent compared to credit growth of 19 percent on a year-on-year (YoY) basis. YES Bank reported a deposit growth of 22.5 percent compared to a deposit growth of 14.1 percent. HDFC Bank’s sequential numbers showed a deposit growth of 7.5 percent compared to the credit growth of 1.6 percent.

Also read: Seeing some rate transmission going through banks, says RBI DG

Public sector banks fared well in terms of credit growth compared to deposit growth. Bank of Baroda reported a credit growth of 12.41 percent compared to a deposit growth of 10.24 percent. Punjab National Bank’s credit and deposit growth numbers stood at 11.5 percent versus 7 percent on a YoY basis.

Robust deposit growth

Provisional numbers in the last quarter of FY24 showed banks reporting robust deposit growth.

Brokerage house Jefferies in December 2023 said that the uptick in bank deposit growth to 13 percent YoY, the highest in 6 years, has lowered the gap with credit growth. Over the past one year, one of the positive trends has been the 300 basis points (bps) improvement in deposit growth to 13 percent YoY, Jefferies said in a note. This was a result of improved GDP growth and a shift to financial savings against gold and land.

However, the majority of the banks’ current account and savings account (CASA) ratio saw a decline on a YoY basis. For example, the Bank of Maharashtra’s CASA ratio stood at 52.73 percent compared to 53.38 percent last year. AU Small Finance Bank’s CASA ratio stood at 33 percent compared to 38 percent last year. On the other hand, YES Bank’s CASA ratio grew marginally to 30.9 percent compared to 30.8 percent.

Competition for loans

Earlier Moneycontrol reported that the intense competition in the banking industry is playing out in the mortgage market, with lenders offering cheaper home loans in a bid to attract customers.

In the case of HDFC Bank, the country's largest private sector bank, the lower rates on home loans depend on the customer's credit profile. Similarly, India’s largest lender, State Bank of India (SBI) is offering existing customers with a good track record on previous repayments lower interest rates on new home loans. And private sector lender IDFC First Bank is providing additional top-ups on existing loans with lower interest rates.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.