Farm loan waivers - the dreaded phrase for banks of any size - are back hounding the lenders this poll year. No wonder, these are time-tested tools politicians have been using to lure farmer votes.

India's small and marginal farmers live at the mercy of banks, both big and small ones. Every year, be it for agriculture activities or for meeting the consumption needs of their families, farmers borrow from commercial banks and microlenders. And most of them remain sunk in debt till the end of their lives.

Soon after Telangana Chief Minister Revanth Reddy recently vowed to waive off farm loans up to Rs 2 lakh, farmers in states like Punjab too raised their demand for waivers. The chorus got louder along the course to the elections.

Not the first time

In fact, loan waiver announcements are nothing new in Indian politics. It's a proven tool to mobilise impoverished voters to achieve political gains.

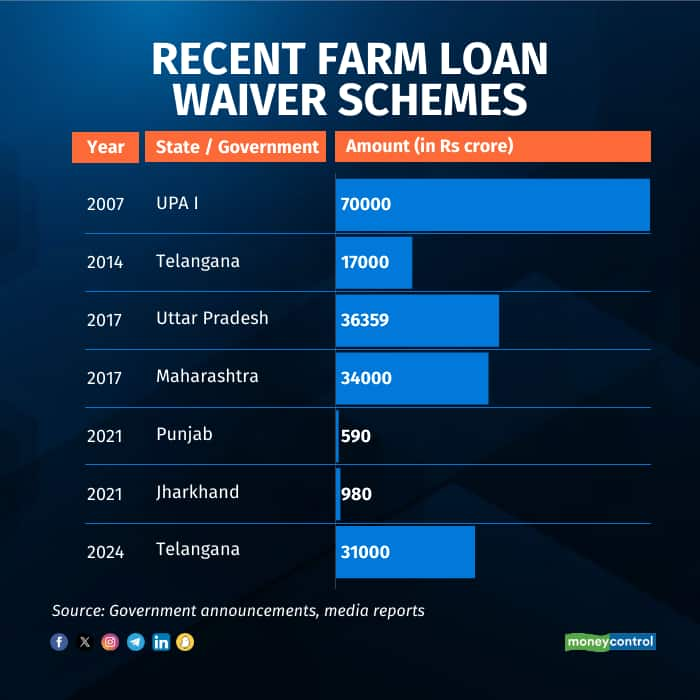

Following the big Rs 70,000-crore farm loan waiver sponsored by then UPA government in 2007, there has been at least six state-level loan waiver announcements. These include Rs 36,000-crore Uttar Pradesh farm loan waiver and Rs 34000 crores Maharashtra waiver in 2017. Such moves fetch brownie points in politics, but they dent economics, for sure. Loan waiver spawns dreams for ambitious leaders, but they are no less than a nightmare for banks.

Bad loans may spike

In the period that follows farm loan waivers, agriculture portfolios may feel the heat. It is a classic example of bad politics trumping good economics. Such loan waiver promises severely impact the credit culture of a large geography, encouraging even the honest, regularly paying borrowers hope for a waiver of their liability by the government. Besides mounting liabilities on the government's books, there is an inevitable impact on the credit culture both for the borrower as well as for the bank.

As Moneycontrol reported on June 25, banking industry experts have already warned that the Telangana government's announcement could lead to asset quality issues and hit the credit culture of a wider section in other states who may make similar demands. In the years that followed mega farm loan waivers in some states, some of the biggest state lenders had seen a massive spike in their gross non-performing assets (GNPAs).

For instance, State Bank of India’s GNPA ratio spiked from 5 percent in 2016-17 to almost 14 percent in September 2019. Bank of India's agricultural NPA touched 17 percent and IDBI Bank’s GNPA reached 15 percent over the same period. Also, as an RBI internal working group report to review agricultural credit pointed out, the NPA level had increased for all states that had announced farm loan waiver schemes in 2017-18 and 2018-19.

What about farmers?

On the farmer's side, the waiver comes as an immediate breather when it happens, but does it help them in the long run? Not really. In a recent interview to Financial Express, Nabard Deputy Managing Director Goverdhan S Rawat warned about the impact of loan waivers - the ultimate burden- on farmers. Citing a study on ‘Farm Loan Waivers in India: Assessing Motives, Challenges and Impact on Farmers in Selected States’ conducted by Bharat Krishak Samaj in 2021, he pointed out the indirect effects of farm loan waiver on agricultural credit target and lower lending in the subsequent years.

Over the years, and more specifically since the Rs 70,000-crore mega loan waiver by the erstwhile UPA government in 2008, politicians have increasingly used it as an easy poll plank to lure voters. This has been used time and again in Maharashtra, Uttar Pradesh, Punjab and Karnataka. In the last decade, loan waivers of Rs 4.7 lakh crore were announced by different governments, according to an SBI research report. The actual amount will be even bigger if one includes the recent waiver announcements such as the one announced by Tamil Nadu.

A loan waiver simply means the government asking the banks to waive or write off the loans of a large number of borrowers in one go. The government then promises to compensate the lenders from its own coffers for the amount that gets waived off. Parties in fray for power promise loan waivers to garner votes in a trade-off with liability. Who would not want such freebies? Once voted to power, the parties use taxpayers' money to repay the banks, which eventually puts the fiscal position of the state under strain.

Read: Banking Central | Loan waiver neither good for borrowers, nor for banks, but a big bait in polls

Credit culture goes for a toss

They immediately take a toll on the credit discipline of a large section of borrowers. Once the waiver is announced, even the honest borrowers stop repayments to banks, causing a spike in overall bad loans.

The success of loan waivers in mobilising support have gone beyond the political landscape with some private lenders often coming up with such campaigns to woo depositors. In December, 2023, the RBI cautioned against such unauthorised campaigns, urging public to not fall prey to such false and misleading propaganda and report such incidents to law enforcement agencies. The RBI caution came after the central bank noticed certain misleading advertisements enticing borrowers by offering loan waivers.

Farm loan waiver don’t do any good for the small and marginal farmers in the long term. Ask this simple question: Why are farmers, largely in heartland India, killing themselves despite so many waivers every year? Empirical evidence shows that farm loan waivers have largely failed to cause any meaningful improvement in the lives of farmers on the field.

This is more because the benefit of the farm loan waivers do not often reach the bottom of the pyramid. The small, landless farmer is most often out of the formal banking ambit and, resorts to unorganised moneylenders for credit. Several studies also point to the fact that the rich farmers with large landholdings grab the benefits of loan waivers, while those with tiny plots of land and no political clout get no real benefit. This is why the schemes have failed to contain the menace of farmer suicides.

Banks too hesitate to lend in areas where loan waivers were announced because credit culture takes a big hit there. Moreover, since the lenders do not get their money from the governments on time, they drag their feet on further lending to farmers. Even if the banks get the money from the governments, who bears the ultimate burden? Of course, the common taxpayer. The cost of every farm loan waiver is borne by the taxpayer.

The farm loan waivers often throw up another challenge. Other categories of borrowers too begin to lobby with the governments, seeking similar waivers, further deepening the mess. This further vitiates the credit discipline.

(Part of this piece was earlier published on Moneycontrol)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.