After weeks of delays and additional queries, the Competition Commission of India (CCI) has approved the $4.7 billion acquisition of payment gateway BillDesk by Naspers' PayU, the competition watchdog said in a tweet on September 5.

While the detailed order by CCI is awaited, the approval was long pending for India’s second largest internet deal after Walmart’s acquisition of Flipkart in 2018. According to multiple sources, CCI had also reached out to competitors of PayU and BillDesk to seek their advice on the deal.

Both the players compete with the likes of Razorpay, Pine Labs, Paytm, Infibeam Avenues, MSwipe etc.

The deal is still awaiting a final regulatory nod from the Reserve Bank of India (RBI).

Anirban Mukherjee, CEO of PayU India said about the development, "We are delighted to announce that the CCI has unconditionally approved the proposed transaction involving the acquisition of IndiaIdeas.com Limited (“BillDesk”) by PayU India. The proposed transaction involved novel assessment by the CCI of dynamic digital markets. Closing of the proposed transaction remains subject to the satisfaction of remaining conditions precedent, which we will continue to work through."

Commission approves acquisition of 100% of the equity share capital of https://t.co/X3WJSGTZO8 (BillDesk) by PayU Payments pic.twitter.com/nOz35P53KM— CCI (@CCI_India) September 5, 2022

Founded in 2000 by MN Srinivasu, Ajay Kaushal and Karthik Ganapathy, BillDesk focuses on making, accepting and collecting payments. Besides facilitating over 170 payment methods as a payment aggregator, it provides biller network solutions through the Bharat Bill Payment System (BBPS) and enables the collection of recurring payments.

The deal was announced a year ago by Prosus on August 31, 2021 and marks PayU’s fourth Indian acquisition, after Citrus Pay in 2016, Wibmo in 2019 and PaySense in 2020.

"Prosus is committed to the India growth story with confirmed investments of $12 billion to date across various companies such as Swiggy, Urban Company, Meesho, Pharmeasy and BYJU’s. Prosus firmly believes that this acquisition of BillDesk will have significant pro-competitive benefits for the Indian economy and will strengthen the Indian digital payments market, which is fully regulated by the RBI," Mukherjee added.

While BillDesk has a stronghold in government and Banking, Financial Services and Insurance (BFSI) segments, PayU is the go-to payment gateway for an array of internet companies.

BillDesk has a near monopoly in payment processing for government agencies - also lucrative because this is a steady source of income and forever growing, compared to e-commerce, travel or other industries which have seasonal peaks and troughs.

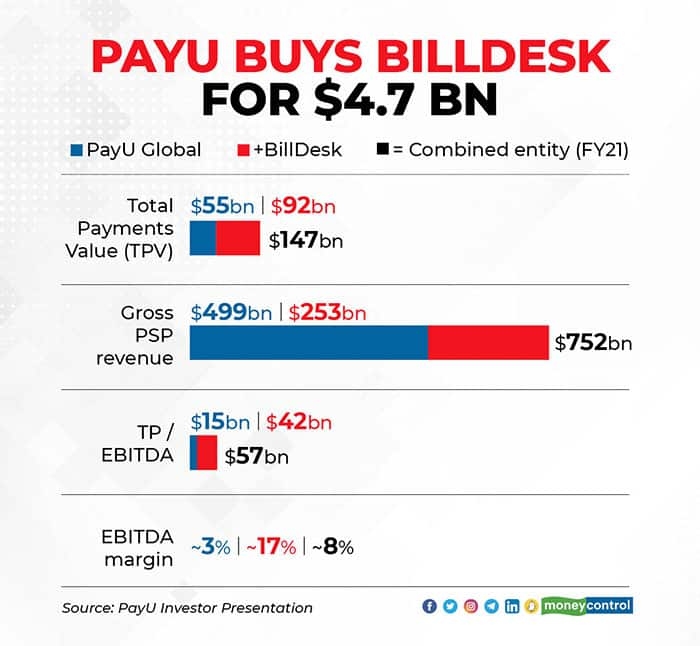

According to PayU, the two entities combined are expected to process Total Payment Values (TPV) of $147 billion as per numbers for the financial year 2020-21. Gross revenues of both entities as per FY21 numbers stood at $752 billion.

"The combined business will be uniquely positioned in India and will be among the top 10 online payments player globally. Together, PayU and Billdesk expect to create a financial ecosystem handling four billion transactions annually, along with high quality teams and a culture of innovation and collaboration," said Mukherjee.

In 2021, competitors Razorpay and Infibeam Avenues clocked in TPVs of $60 billion and $48 billion, respectively. Razorpay's TPV includes other transactions on its platform besides the payment gateway.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.