Nazara Technologies is in discussions with domestic and international investors to raise funds to build a war chest for potential acquisitions to scale up all of its verticals, founder Nitish Mittersain told Moneycontrol.

On September 4, Nazara Technologies, the diversified gaming and sports media company, announced that its board has approved raising funds of up to Rs 100 crore from Zerodha co-founder Nikhil Kamath's two firms - Kamath Associates and NKSquared. Mittersain said this is the first investment by these firms, although they had previously bought some equity shares from the public markets.

The transaction will increase the combined stake of both firms to 2.72 percent from 0.67 percent, as per a stock market filing. They are buying these shares at a price of Rs 714 per share, a 6 percent discount to the company's closing price of Rs 759 per share on September 1. The share price jumped 10 percent to Rs 835 at the market close on September 4.

Mittersain said this investment is part of the company's plans to raise capital of up to Rs 750 crore, for which it received board approval in July 2023 and is valid for a year. The firm had previously said it intends to raise this capital through qualified institutional placements, preferential allotment, or a combination of both.

This will be the second fundraise for one of the country’s oldest gaming companies after it went public in February 2021.

Nazara Technologies had earlier raised Rs 315 crore from a clutch of institutional investors including Singapore sovereign wealth fund GIC-managed investment firm Gamnat Pte and Ahmedabad-based Plutus Wealth Management in October 2021. Of this, Rs 119.1 crore has been utilised until June 30, 2023, as per a stock market filing.

"Nazara is already well-capitalised today. It's not that we are raising capital out of desperation or urgency. It's something we want to do because we think the timing is good and therefore, what is equally important is the quality of the investor" Mittersain said.

"I have been very fortunate over the years to get some really good investors in the company, like Sandeep Singal (WestBridge Capital co-founder and MD) and (late) Rakesh Jhunjhunwala (ace investor) " he said.

Tech entrepreneurs such as Nikhil Kamath bring in a "lot of forward looking thought process and experience" which will be helpful, Mittersain added.

The company plans to use the capital raised to invest in its funding requirements and growth objectives, including making strategic acquisitions and investments to strengthen its existing verticals.

Plan to acquire popular gaming IPs

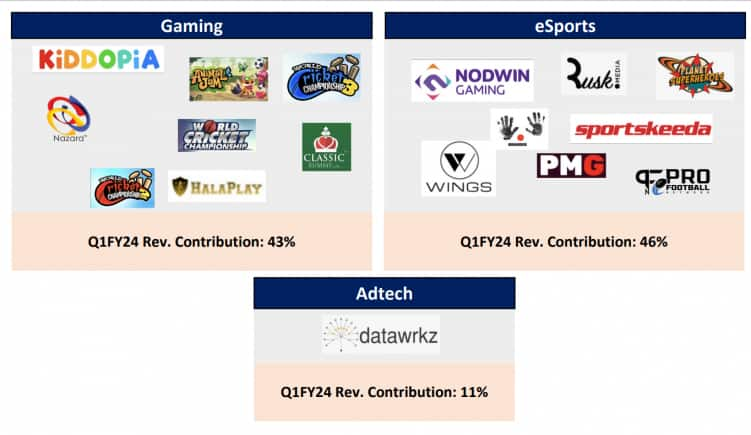

Nazara currently operates in three key sectors - gaming (World Cricket Championship, Kiddopia, Animal Jam, Classic Rummy etc), esports (Nodwin Gaming, Sportskeeda) and advertising (Datawrkz).

Nazara currently operates in three key sectors - gaming, esports, and advertising

Nazara currently operates in three key sectors - gaming, esports, and advertising

A big push is towards growing its portfolio of gaming IPs (intellectual properties) through acquisitions.

“We are very keen to build it on a larger scale, acquire more popular IPs, build it globally as well as go deeper into India with it. You should see a lot more activity there” Mittersain said.

Apart from gaming studios, the firm also plans to shop for gaming-focused adtech companies, programmatic adtech firms, and media buying or media planning agencies to expand its presence in developed markets, Mittersain said in an interview to Moneycontrol in July 2023.

"We are not looking at launching a new vertical but instead, focusing on going deeper into each of our segments, making the business healthier and stronger with better cash flows and doing M&A that makes our verticals bigger" he said.

The country’s first publicly listed gaming company is also actively looking at game publishing tie-ups such as their recent partnership with Israel-based Snax Games, Mittersain said.

Nazara Technologies has acquired exclusive rights to publish game titles from Snax Games in the Indian subcontinent and the Middle East region on a revenue-sharing basis for five years.

The company is also investing up to $500,000 in Snax Games across one or two tranches in the form of a Simple Agreement for Future Equity (SAFE), with a right to buy equity shares at a future date.

“We felt that by taking a small minority stake (in Snax Games), we would be able to create an Israel-India connect, bring in more technology, and learn more from that market. It would be a good way to start a relationship” Mittersain said.

Investors warming up to the gaming sector

The investment in Nazara Technologies comes at a time when India’s gaming sector is showing signs of maturity in terms of user behaviour and their gaming habits.

Mittersain said that domestic investors are warming up to the nascent gaming sector since they are recognizing how the digital economy is changing the entire landscape.

"When everybody is walking around, they can see people on their phones playing games. Now you can tangibly see that this is going to be a large opportunity 5-10 years down the line" he said.

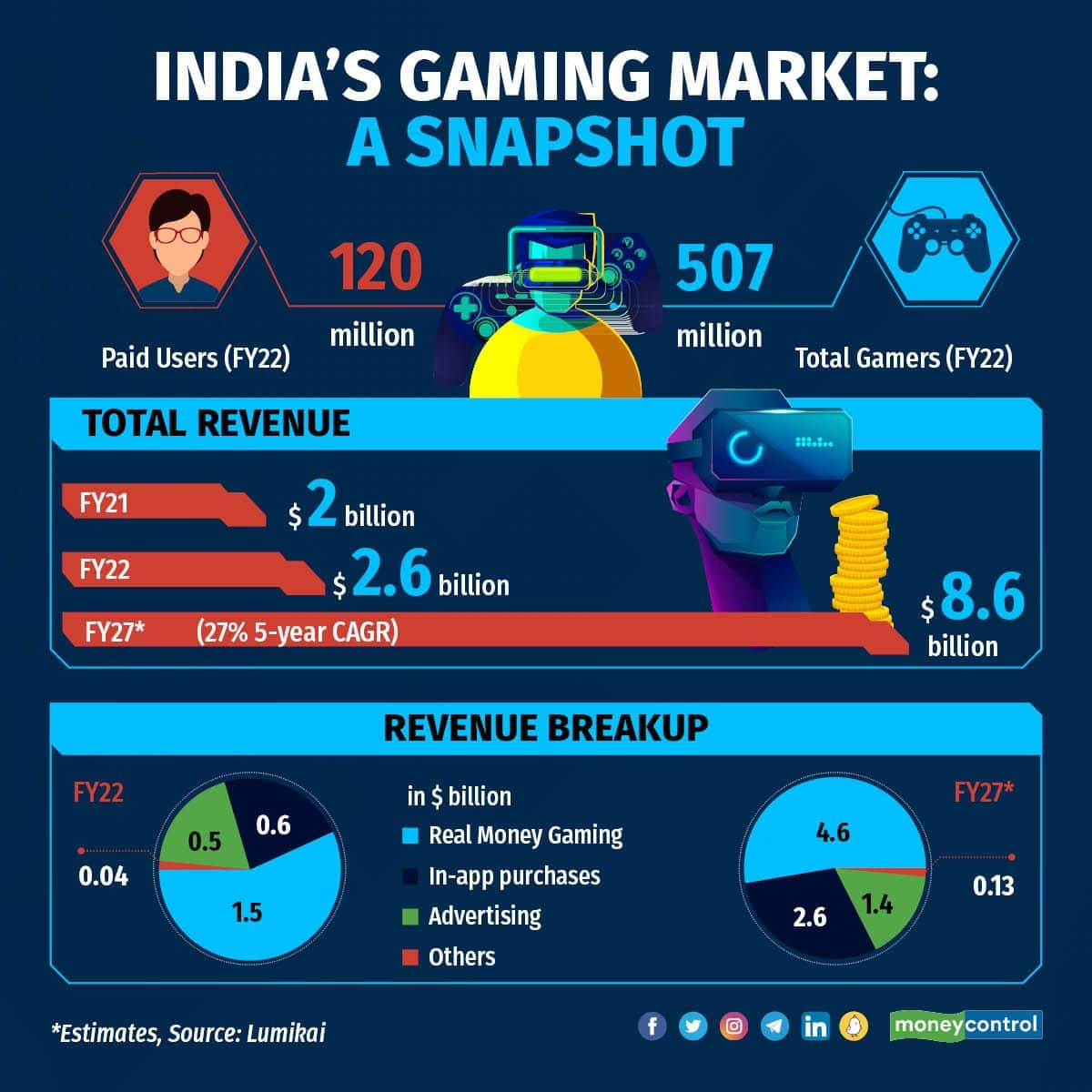

India's overall online gaming industry revenues reached $2.6 billion in FY22 and is expected to expand at a compound annual growth rate of 27 percent to $8.6 billion in FY27, according to a report by Lumikai, a gaming and interactive media-focused venture fund.

A snapshot of India's gaming market

A snapshot of India's gaming market

Moneycontrol has previously reported that India’s rising potential as a global video gaming hub is also drawing interest from international gaming giants and game-focused funds.

Japanese mobile entertainment company Mixi launched a $50 million corporate venture capital fund dedicated to the Indian market last month.

Meanwhile, South Korean gaming giant Krafton has pledged to invest $150 million in Indian gaming and interactive entertainment startups over the next two to three years, bringing the company's total investment corpus in the country to about $290 million.

Diversified nature

Mittersain said Nazara Technologies also benefits from its diversified nature, which makes its operations less likely to be disrupted easily from major changes such as the government’s recent GST regime on real-money gaming segment, which has created havoc among several skill-based gaming companies.

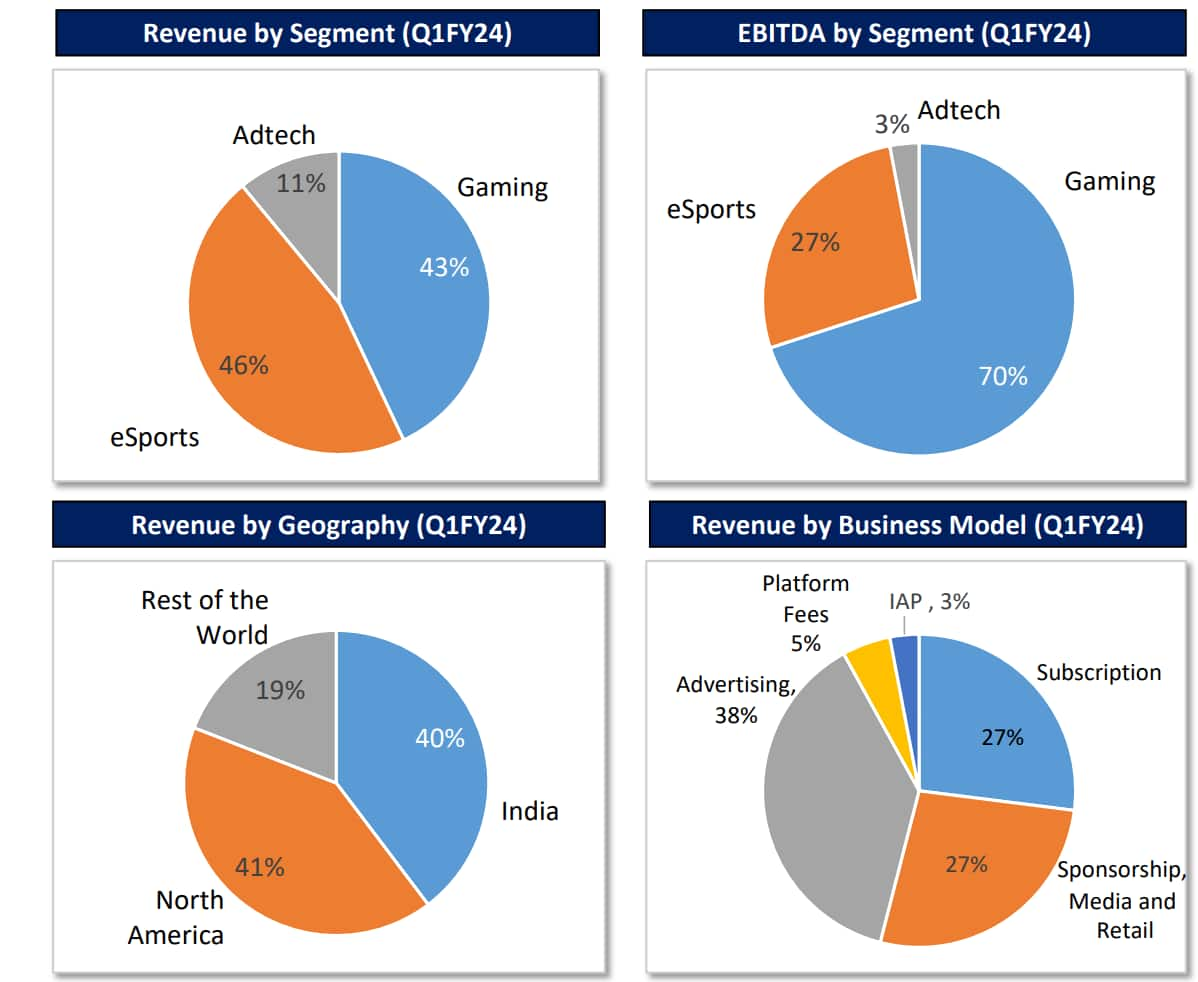

Nazara's Q1-FY24 revenue breakdown

Nazara's Q1-FY24 revenue breakdown

Nazara Technologies has been fairly insulated from the new tax rules, due to its limited exposure. The company's real-money business contributed only 4.7 percent of its Q1-FY24 revenue and 0.5 percent of the quarter’s EBITDA.

“We have always said that we are waiting for (regulatory and taxation) clarity. With better clarity now, if we get good opportunities, we will definitely acquire companies in that space” Mittersain said.

For the first quarter of FY24, Nazara saw its revenues grow 14 percent year-on-year (YoY) to Rs 254.4 crore, while net profit rose by 31 percent YoY to Rs 21 crore.

41 percent of the company's revenues come from North America, while 40 percent comes from India and the remaining 19 percent from the rest of the world.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.