Eighty-six percent of India Inc’s finance leaders expect consumer demand to rise in the next six months, led by increased government spending on public welfare measures and infrastructure, a Moneycontrol sentiment survey of chief financial officers (CFOs) from leading Indian companies.

Almost 75 percent of CFOs plan to boost investments in FY25, driven by a positive demand outlook, according to the survey in which respondents answered questions ranging from demand forecasts to risks. The remaining CFOs adopted a cautious "wait and watch" approach, monitoring domestic and global economic cues before making investment decisions.

Nearly 82% of respondents expect an increase in private capital expenditure in the latter half of FY25. "We are eyeing more capital expenditure and a rise in consumption across urban and rural areas. This can be achieved with lower inflation, targeted benefits transfers, and continued infrastructure development that enhances accessibility and affordability," noted respondents.

In March, Morgan Stanley raised its FY25 India GDP growth estimate to 6.8%, citing ongoing capital expenditure and narrowing rural-urban consumption gaps. S&P Global Ratings and QuantEco also project 6.8% economic growth but note that high interest rates and reduced fiscal stimulus may temper demand. Fitch Ratings, however, expects a faster 7% growth on improved consumer spending and higher investments.

Outlining potential risks, almost 73% of CFOs said that while they expect the government to focus on infrastructure and social sectors, policy inconsistency, inflation, high interest rates and political instability remain the top concerns for India Inc’s CFOs.

"Inflation remains a concern for businesses. While CPI inflation has eased slightly, it remains above the RBI's target range, with food inflation seeing marginal relief," the report noted.

Interest rates also feature among the top five concerns for Indian businesses, with 80% of CFOs expressing satisfaction with the Reserve Bank of India's performance over the past five years.

The survey revealed optimism about financial performance of companies, with over 78% of CFOs expecting revenue and profitability to improve in FY25. Meanwhile, 16% predicted stability, and 2% expected moderate growth with potential profitability challenges.

CFOs said the economy is set to grow if labour, land, and agriculture reforms continue, although there remains a small risk of government instability.

The survey drew respondents from a diverse range of industries, with services contributing 26%, manufacturing 22%, auto & auto parts 10% and infrastructure 8%. Other sectors represented included telecom, FMCG, space, consumer goods, and engineering goods, providing a comprehensive view across various economic segments.

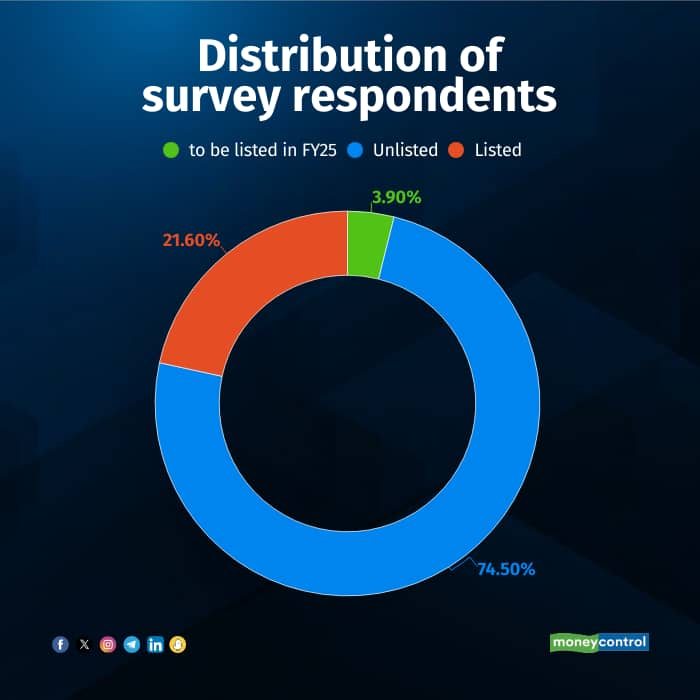

The survey predominantly included small-cap companies (39%), followed by mid-cap (22%) and large-cap (16%) sectors. Notably, 74.5% were unlisted companies, 21.6% were listed, and 3.9% are planning to list during this fiscal year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.