BUSINESS

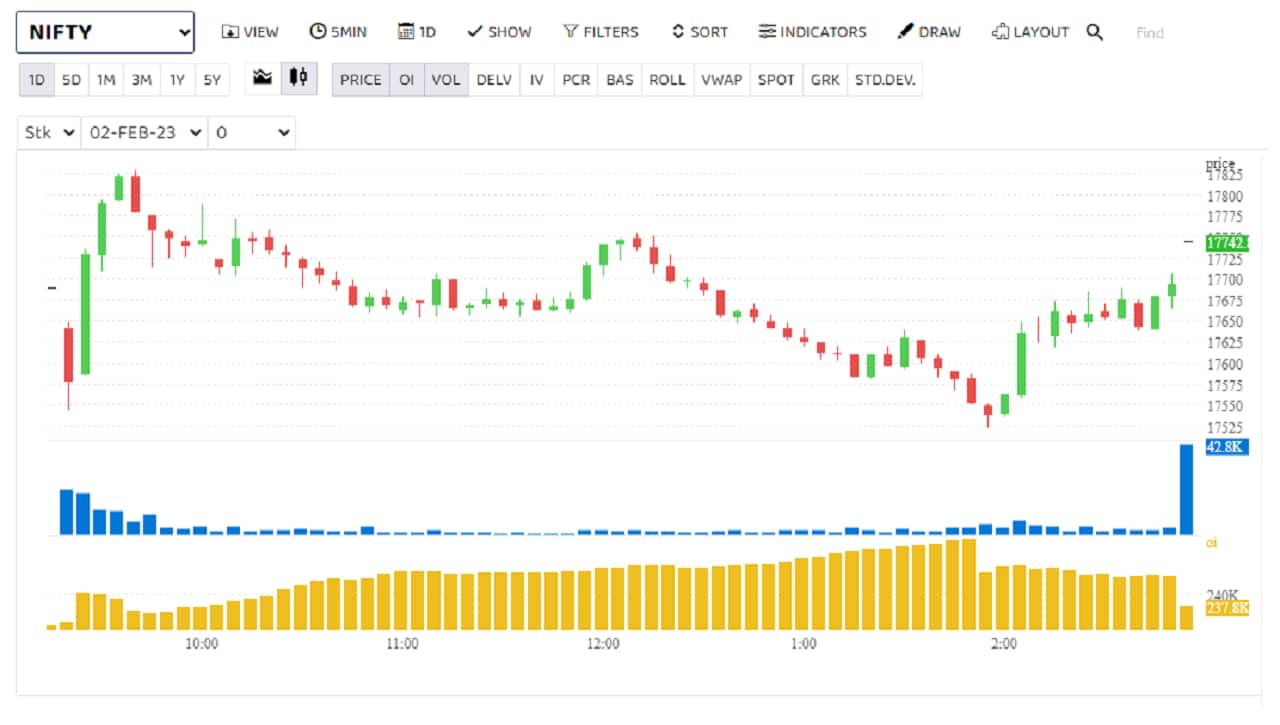

F&O Manual | Summit 17,600 emerges as Nifty battle zone as setup remains weak

Traders and analysts have been advising to stay on the sidelines rather than take intraday trades in individual stocks as there is high volatility.

BUSINESS

F&O Manual: Volatility remains high, analysts suggest keeping positions hedged

On the option front, 17,800 remains the biggest hurdle for the index. During the day, 17,500 was in the battle zone as the strike saw both put and call writing.

BUSINESS

F&O Manual: Traders selling every rise; Adani stocks see long build-up

Manish Shah, a Sebi registered investment adviser and a trader, advises staying away from intraday trades in individual stocks because of huge volatility

BUSINESS

Budget 2023-24: This veteran trader has 4 tips to offer for February 1

Budget 2023: Limit orders and strict stop-loss can be lifesavers on the Budget Day, says Rajesh Sriwastava

BUSINESS

F&O Manual: Market in free fall, bearish traders mount pressure

Barring auto, which is seeing a long buildup, all other sectors are witnessing a short buildup, especially capital goods, infrastructure, telecom and cement

MARKETS

Be ready for a roller-coaster ride if you’re trading on Budget Day, says Ankush Bajaj

Traders face major challenges while the Union Budget speech is in progress; they can expect a swift, upward movement or a dizzying fall, says Bajaj

BUSINESS

F&O Manual | Weakness far from over, traders continue with their short position

The February 2 contracts saw heightened activity at 18,000 and 18,100 levels with heavy call writings.

BUSINESS

F&O Manual: Muted trade likely, deploy short strangle on Nifty

Tata Motors saw massive long buildup as OI rose 14 percent to its highest in the year.

BUSINESS

Budget 2023: Govt expected to up the ante on domestic defence manufacturing

Budget 2023: Not just local manufacturing, defence exports too have surged. Besides increased allocation, the centre is also expected to announce a PLI for defence and space research.

BUSINESS

F&O Manual | 18,200 is the battlezone, traders opting for neutral strategies

Given lack of direction on an intraday basis, some traders are preferring to take a neutral strategy for now. Rajesh Sriwastava,a derivatives trader, said he has taken positions according to Straddle strategy.

MARKETS

F&O Manual: All signals positive, buy 18,300 on next week's contracts

On the options front, for the January 25 contract, 18,100 saw the maximum put being written as the level emerged as the strong support zone for bulls, while 18,300 strike saw the most calls being written, as it is the new resistance level

BUSINESS

F&O Manual: Traders start buying on dips as Budget 2023 draws near

The weekly expiry is on Wednesday, January 25, instead of the usual Thursday when the markets will be closed on account of Republic Day. Throw earning season and the Budget 2023 in the mix and the market is staring at more volatility, says analysts and traders

BUSINESS

Trader’s Edge | Back-to-basics strategy of this Delhi duo turns a wealth creator

The high risk, high rewards strategy requires you to do just one thing: read as many exchange filing you can. This, followed by some market research, can help you strike gold

BUSINESS

Saurabh Mukherjea’s Marcellus ends love affair with Relaxo Footwears after calling its chappals wealth creators

Some market experts call the reversal a courageous call that saves investors from underperformance

MARKETS

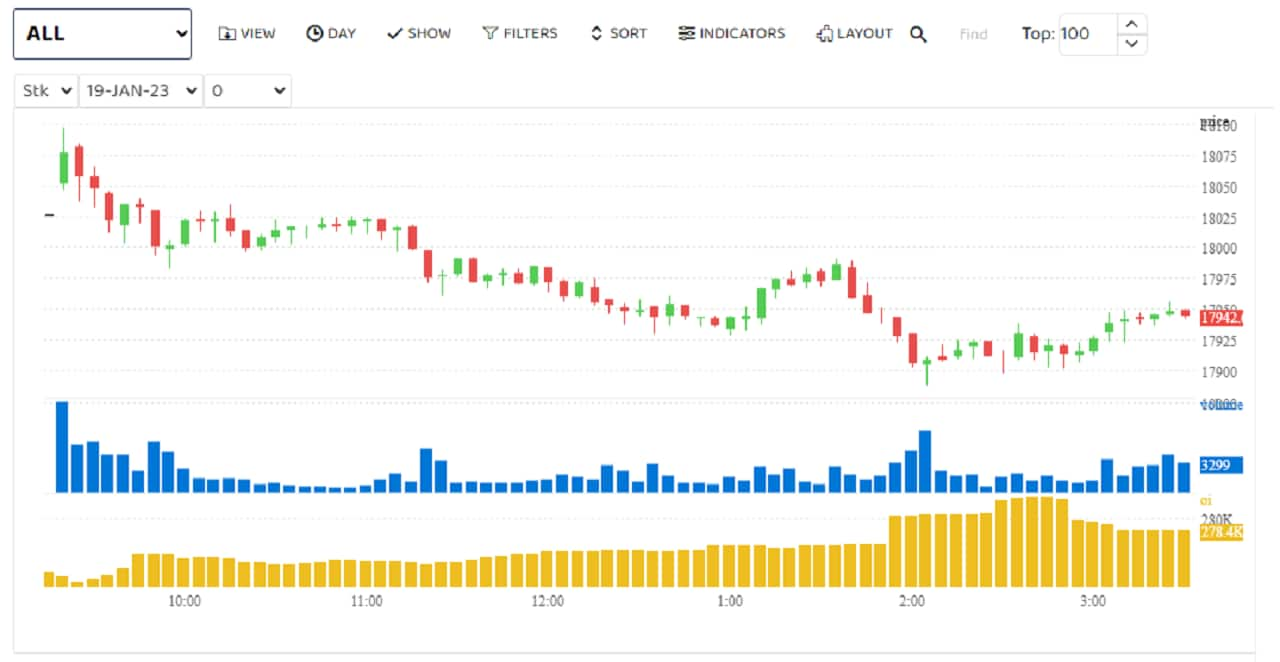

F&O Manual: 18,100 is the battle zone as Nifty consolidates

Traders are worried that this weekly expiry is short as the next Thursday, January 26, is a holiday and those who are taking slightly longer-term positions may not have much time to manage them

BUSINESS

F&O Manual: Buy 18,100 calls if Nifty opens higher

Bank Nifty closed with a cut of about 0.3 percent at 42,328.85. Maximum call writing was seen at the 42,500 level which will act as the hurdle for the index now.

BUSINESS

HUL’s 80 bps royalty hike to Unilever will hurt, says Jefferies

The FMCG major increased royalty and central services fees payable to the parent Unilever Plc from 2.65% of turnover in FY22 to 3.45%

BUSINESS

F&O Manual: Short buildup seen across sectors led by infra, power names

Torrent Power, Indiabulls Housing Finance, Adani Enterprises, Titan, Voltas and Tata Communication were among those seeing a short buildup as analysts warn of market volatility in the runup to the Budget 2023

BUSINESS

F&O Manual: Employ bull call spread to capture further upsides in Nifty

Some analysts believe the recovery to extend further but also caution that the upside seems capped, given restricted participation and hurdles around the 18,250-mark.

BUSINESS

F&O Manual | Despite market rallying, a breakout is unlikely, say traders

Among sectors, traders continue to be bearish on telecom stocks as they saw short buildup for another day.

BUSINESS

Sebi floats consultation paper for ASBA-like process for trading

Sebi said the proposed process by design safeguards clients’ assets from misuse or brokers’ default and consequent risk to their capital

BUSINESS

F&O Manual | Traders position themselves with rangebound expectations; Siemens, Delta Corps in focus

Short buildup – a bearish phenomenon that happens when price go down and open interest (OI) rise – was seen in telecom, media and finance

BUSINESS

F&O Manual: Buy Nifty 18,900 calls on dips, say analysts

Stock market today: Bank Nifty settled with a cut of about 0.5 percent at 42,167.55. All out-of-the-money strikes saw activity with the highest call activity at 42,500 and call activity at 42,000.

BUSINESS

F&O Manual: Traders stick to sell-on-rise stance; BoB, Muthoot Finance in focus

Metals, oil and gas and telecom were seeing a short buildup, a bearish phenomenon when prices fall and open interest rises, while a long buildup, when prices rise along with OI, was seen in capital goods and finance