Bulls continued to gain ground and the market scaled higher for another day with the Nifty trading up 25 points at 18,143. Traders and analysts have noted that all data has turned positive and hence the index may rise further. However, a few also expected increased volatility leading up to expiry this week and the Budget.

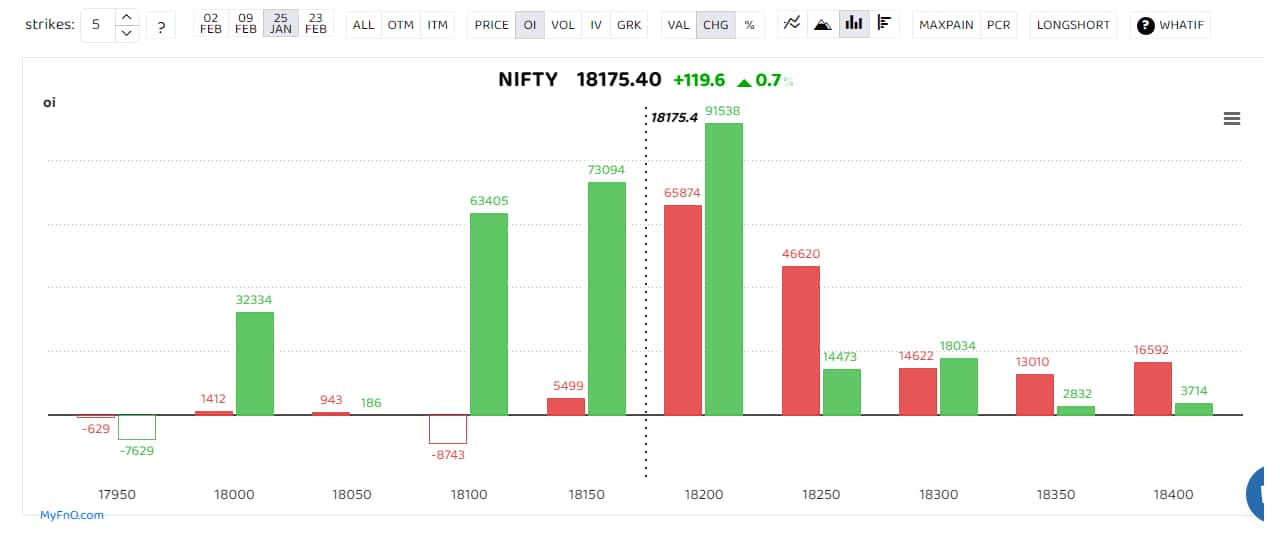

On the options front, 18,200 strikes turned into fresh battle zone. Most Put and Call writings were at this level. The 18,250 level, which is the upper limit of the last four week’s trading zone, also saw good activity.

Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.

Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.Given a lack of direction on an intraday basis, some traders are preferring to take a neutral strategy for now. Rajesh Sriwastava, a derivatives trader, said he has taken positions according to the straddle strategy.

A straddle is a neutral options strategy that involves buying or selling both a Put option and a Call option for the underlying security with the same strike price and the same expiration date. Sriwastava said he is selling strikes that give him Rs 200 premium on the Nifty.

Sector wise, cement continued to see a short build-up. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume.

Technology and auto were among those that saw long build-up. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price.

IT stocks such as Coforge and Persistent Systems were under spotlight for another day as they saw long build-up. Can Fin Homes, Birlasoft, and LTI Mindtree were others that saw long build-up.

Short covering was seen in L&T Tech Services, Intellect Design and Torrent Power.

Seema Jain, a trader and Sebi registered research analyst, said TCS looks good for buying above Rs 3,440 and Tata Elxsi above Rs 6,820.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.