The market traded positive throughout the day as data for the January series turned positive, lifting hopes that the Nifty will break out of the 17,775-18,250 range. The Nifty added 91 points, or 0.5 percent, to close at 18,119 on January 23. Analysts see more upside in the index as we move closer to the Union Budget. (The blue bars show volume and the golden open interest (OI).)

The market traded positive throughout the day as data for the January series turned positive, lifting hopes that the Nifty will break out of the 17,775-18,250 range. The Nifty added 91 points, or 0.5 percent, to close at 18,119 on January 23. Analysts see more upside in the index as we move closer to the Union Budget. (The blue bars show volume and the golden open interest (OI).)

On the options front, for the January 25 contract, 18,100 saw the maximum put being written as the level emerged as a strong support zone for bulls. Maximum calls were being written at 18,300 strike, as it is the resistance level now. “All data show positivity now, especially after foreign traders have covered their shorts. Traders can buy 18,300 calls in Feb 2 series,” said Ruchit Jain, derivatives analyst at 5Paisa Securities. (The bars reflect changes in OI during the day. The red bars show call option OI and green put option OI.)

On the options front, for the January 25 contract, 18,100 saw the maximum put being written as the level emerged as a strong support zone for bulls. Maximum calls were being written at 18,300 strike, as it is the resistance level now. “All data show positivity now, especially after foreign traders have covered their shorts. Traders can buy 18,300 calls in Feb 2 series,” said Ruchit Jain, derivatives analyst at 5Paisa Securities. (The bars reflect changes in OI during the day. The red bars show call option OI and green put option OI.)

The Bank Nifty closed with a gain of about 0.74 percent at 42,821.25. Call writing was seen at 42,300, as it emerges as the key hurdle. “The index remains in buy-on-dip mode with immediate support at 42,400 levels, which should act as a cushion for the bulls. The immediate upside hurdle is visible at 43000, where call writing is observed, and once cleared, we will see a sharp short covering on the upside," said Kunal Shah, Senior Technical Analyst at LKP Securities. (The bars reflect changes in OI during the day. The red bars show call option OI and the green put option OI.)

The Bank Nifty closed with a gain of about 0.74 percent at 42,821.25. Call writing was seen at 42,300, as it emerges as the key hurdle. “The index remains in buy-on-dip mode with immediate support at 42,400 levels, which should act as a cushion for the bulls. The immediate upside hurdle is visible at 43000, where call writing is observed, and once cleared, we will see a sharp short covering on the upside," said Kunal Shah, Senior Technical Analyst at LKP Securities. (The bars reflect changes in OI during the day. The red bars show call option OI and the green put option OI.)

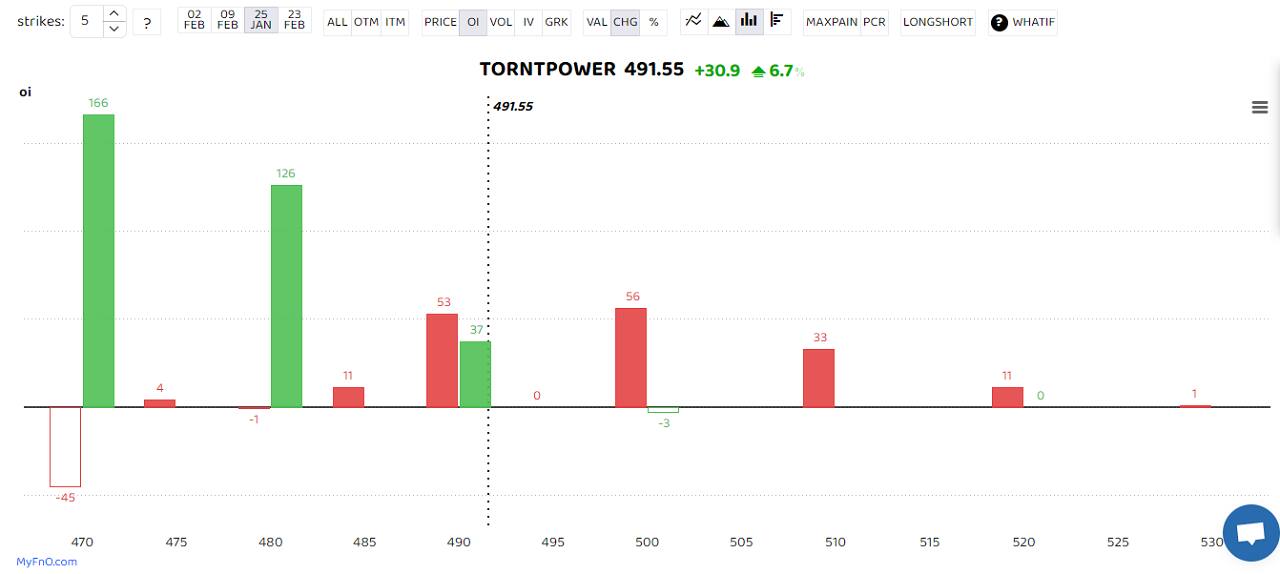

Torrent Power saw a massive long buildup as OI rose 9 percent to its highest in the quarter. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. Can Fin Homes, Coforge, Persistent Systems and Intellect Design were others that saw a long buildup. (The bars reflect changes in OI during the day. The red bars show call option OI and the green put option OI.)

Torrent Power saw a massive long buildup as OI rose 9 percent to its highest in the quarter. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. Can Fin Homes, Coforge, Persistent Systems and Intellect Design were others that saw a long buildup. (The bars reflect changes in OI during the day. The red bars show call option OI and the green put option OI.)

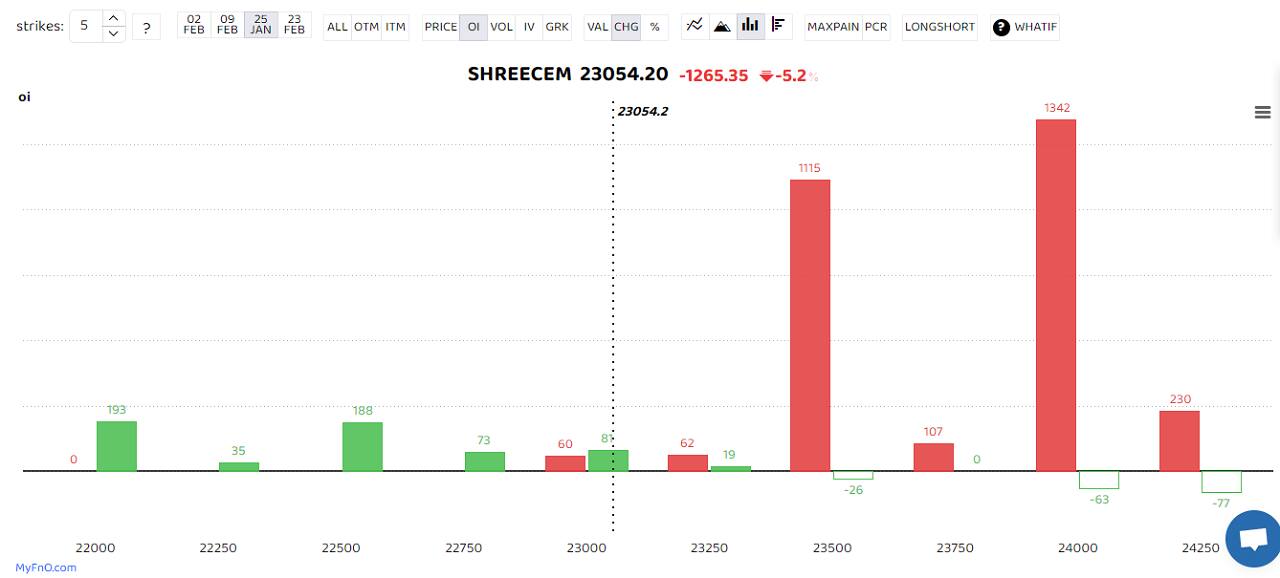

Shree Cement saw a massive short buildup as open interest in the counter surged 52 percent to its highest in the quarter as well. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. (The bars reflect changes in OI during the day. The red bars show call option OI and the green put option OI.)

Shree Cement saw a massive short buildup as open interest in the counter surged 52 percent to its highest in the quarter as well. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. (The bars reflect changes in OI during the day. The red bars show call option OI and the green put option OI.)

UltraTech Cement, Dalmia Bharat and India Cement were others that saw a short buildup. (Numbers reflect changes in futures prices.)Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

UltraTech Cement, Dalmia Bharat and India Cement were others that saw a short buildup. (Numbers reflect changes in futures prices.)Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.