The market stayed weak on January 25 - the monthly expiry date - and analysts and traders expect the downward trend to continue as the index respects resistance placed at 18,250. The Nifty was down 0.95 percent at 17,946.25 in morning trade.

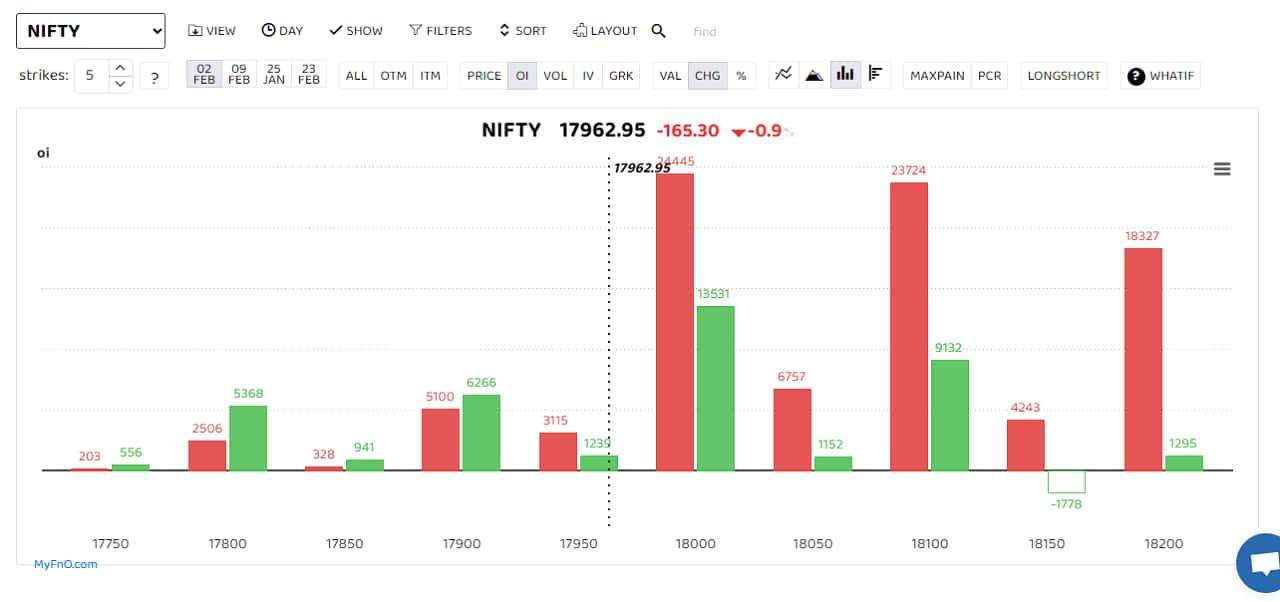

The February 2 contracts saw heightened activity at 18,000 and 18,100 with heavy Call writings. Thus, they may emerge as local resistances for the index. Put writers were relatively less active.

Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.

Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.

Ankush Bajaj, a Chhattisgarh-based trader, said he has a negative outlook on the index. He has been holding a short position since yesterday and plans to continue with this position even in the next expiry.

Market participants had expected a fair bit of volatility, given it was the monthly expiry date. India VIX jumped over 6 percent to 14.52.

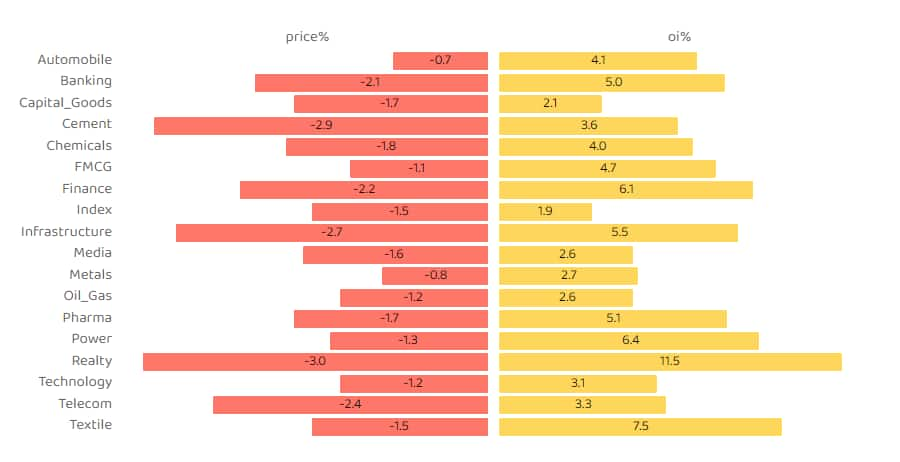

All sectors saw short buildup led by realty, cement and infrastructure. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume.

Short buildup was also seen in the majority of stocks trading in the F&O segment, including Granules India, Ambuja Cement, Delta Corp, Adani Enterprises, ACC and Biocon.

Auto brands such as TVS Motor, Maruti Suzuki and Bajaj Auto saw long buildup. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!