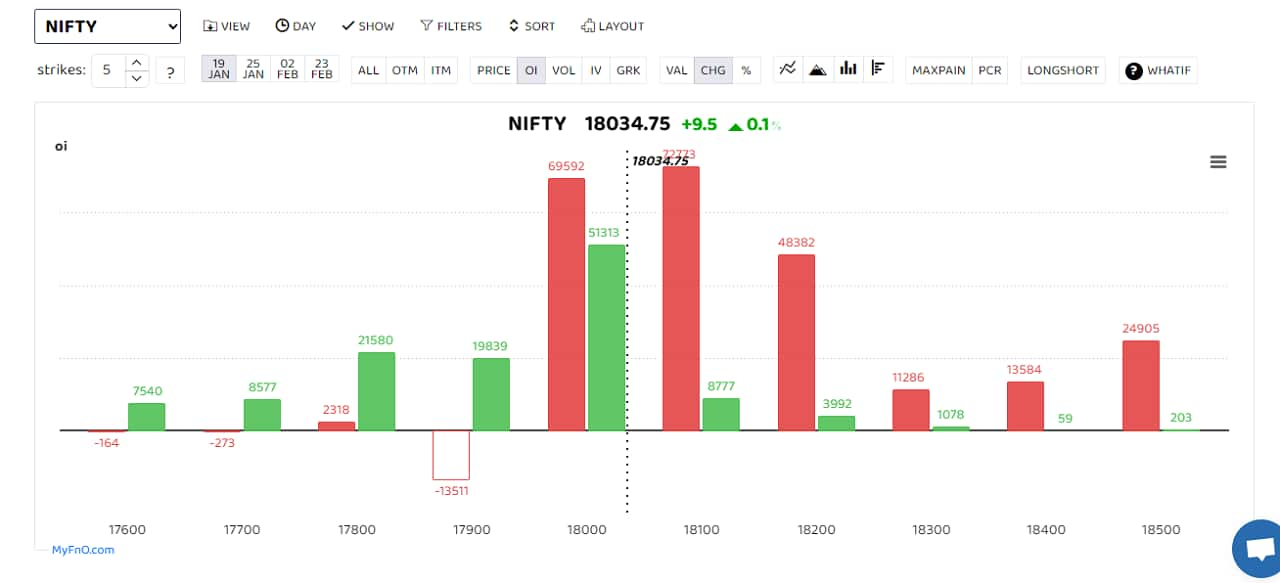

Indian equity benchmark failed to hold on to morning gains and slipped under selling pressure on January 16. At 10.35 am the Nifty was trading flat at 17,969, while its near-month futures struggled at around 18,034.75. Traders and analysts expect the index to be range-bound.

As every rise was being sold, the index couldn't gain momentum, said traders. Several of them were armed with the same strategies.

(Blue bars show volume and golden bars open interest (OI)

(Blue bars show volume and golden bars open interest (OI)

“The market continues to be a sell-on-rise one,” said Santosh Pasi, a Sebi registered investment adviser and a derivatives trader. The index was finding stiff resistance at the upper end of the recent trading range, he said.

In the last few weeks, the Nifty has moved between 17,850 and 18,200. On January 19 expiry contracts, most new call writings were concentrated around 18,000 and 18,100 as they emerged as resistance zones. Put writers were moving lower as they unwinded their position at 17,900 strikes.

The Bank Nifty was trading with some gains. The index was up 0.5 percent at 42,601.75 but not all traders were hopeful about the index holding on to the gains.

Shijumon Antony, an equity derivatives trader, who usually trades Bank Nifty and Fin Nifty contracts, said he has initially bought calls but booked profits and now has bought puts as he sees a drawdown in both indices.

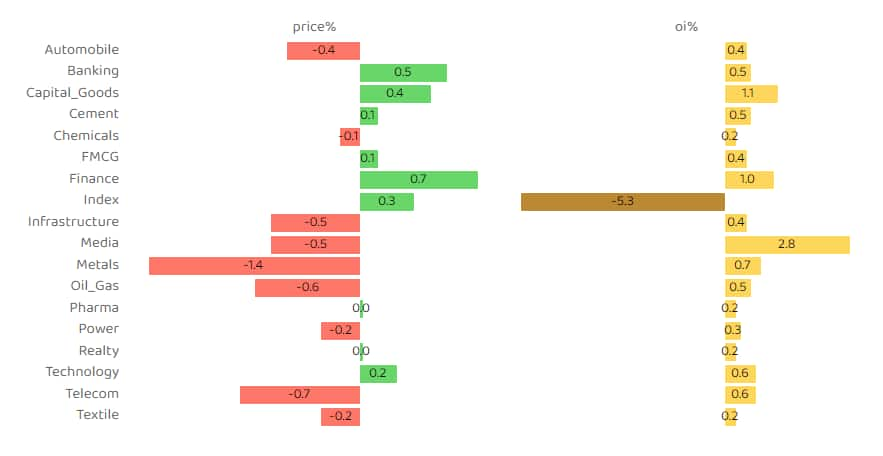

Short buildup – a bearish phenomenon when prices fall and open interest rises (OI) – was seen in metals, oil and gas and telecom among others. Finance and capital goods saw a long buildup – a bullish phenomenon when price rise along with OI.

L&T Financial Holdings and Whirlpool of India were among those that saw a long buildup as well. They saw the biggest rise in OI during the day. PVR, meanwhile, saw a short buildup.

Manish Shah, a trader and technical analyst, said the market will be flat but he sees some short-term trading opportunities in individual stocks.

He said Muthoot Finance is a buy at around Rs 1086 with an intraday target of Rs 1,115. He also has a buy call on Bank of Baroda with the target at Rs 191.

Disclaimer: Trading in futures and options markets is extremely risky. Traders and experts mentioned above may not be SEBI registered. Hence, trades they have taken should not be construed as investment or trading advice. Please consult a financial adviser before taking any trades.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.