BUSINESS

Radico Khaitan: Will investors get a dizzy hangover in 2023?

The liquor maker registered a moderate top-line growth, but earnings contracted

BUSINESS

Concor: Stable Q3, but sentiment has turned sour

The outlook is cautious for this container freight operator and its stock valuation is rich

BUSINESS

V-Guard: Outlook for 2023 softens as demand remains lacklustre

Sunflame’s acquisition will strengthen its kitchen appliances portfolio where V-Guard has very limited market presence

BUSINESS

Dixon Technologies Q3: External risks come to the fore

Due to the prevailing macroeconomic conditions, the company's growth trajectory remains ambiguous

BUSINESS

Borosil Renewables: Turning cautious on rising competitive risks

After the removal of Anti dumping duty, the selling rates in the domestic market have dropped by 10-15 percent

BUSINESS

Delhivery: Valuation is on a slippery slope

Competitive intensity in the logistics sector is rising while we're seeing demand slacken across the board.

BUSINESS

Amber Enterprises Q3: Multiple catalysts stacking up

Components, electronics and mobility division report strong revenue growth, but profitability was dented by competitive intensity and cost challenges

BUSINESS

Nazara Technologies: Niche businesses with exciting growth prospects

Investments in new growth initiatives took a toll on Nodwin’s operating margins

BUSINESS

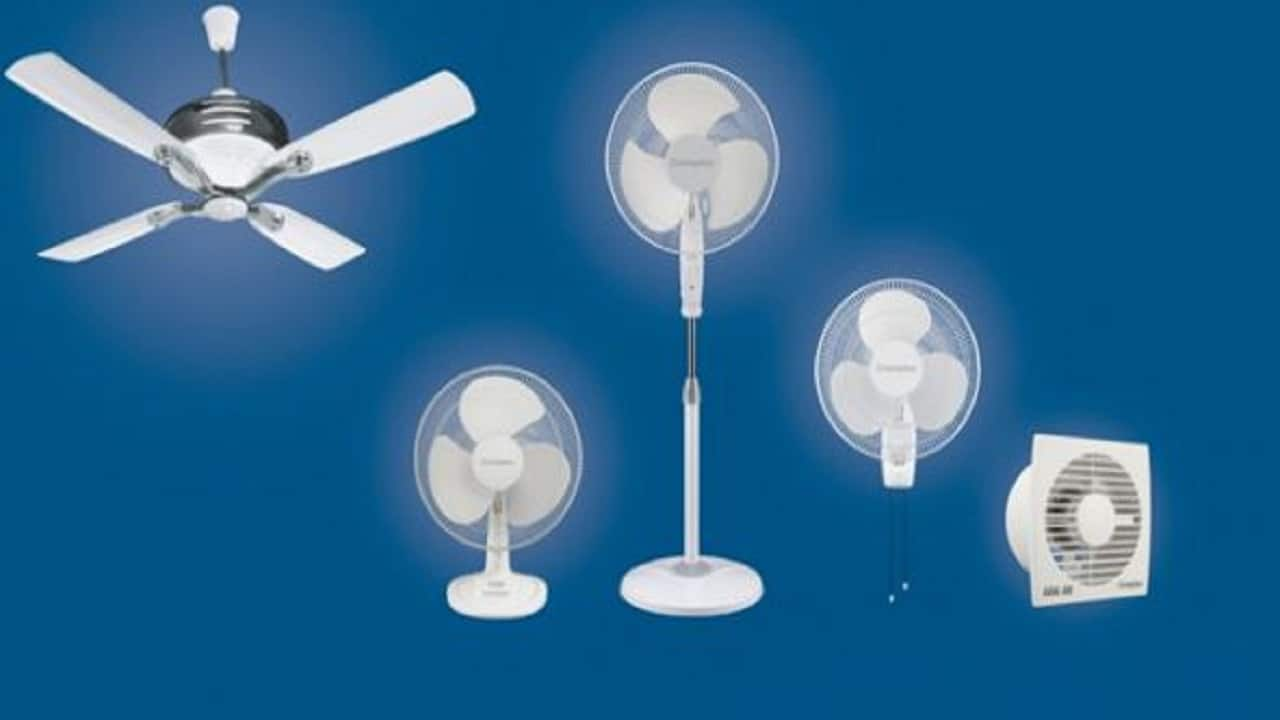

Crompton Consumer: Weak Q3 not a dampener for long run

The company’s leadership position and its effort to drive sales will help to improve business margins

BUSINESS

Cement sector: Supply glut, global macros could hurt ongoing business momentum

It is better to be selective on this sector and keep away from companies based in central and eastern regions

BUSINESS

Dalmia Bharat Q3: Well positioned for structural growth

Capacity expansion and acquisition to drive volume growth as demand outlook remains encouraging

BUSINESS

UltraTech – Successfully executing the growth playbook

The cement maker will have to hold onto the performance to justify the valuation as competition in the industry will intensify, going forward

BUSINESS

Polycab India: Going from strength to strength

Polycab India is currently focusing on expanding its distribution reach and changing its revenue mix to propel its earnings trajectory.

BUSINESS

Renewable energy likely to get a deeper thrust in Budget 2023

The Budget 2023 will continue to focus on policy incentives to encourage investments in re-newable energy as India steps up its efforts to decarbonise the domestic power sector

BUSINESS

Havells India: Q3 internals point to a mixed outlook

While the B2B business of Havells is on a strong footing, consumer demand has slackened

BUSINESS

Asian Paints: Underwhelming quarter throws up downside risks

Volume growth will be under stress going forward, as people cut down on their stay at home and competition increases

BUSINESS

GM Breweries Q3: Record revenue, robust margins

The country liquor manufacturer has a recession-resistant business model, excellent management, and a solid financial track record

BUSINESS

SastaSundar Ventures: Massive capacity step-up is in full swing

SastaSundar’s business is at an inflection point although SastaSundar ongoing investments will probably start yielding results in the next couple of years

BUSINESS

Kajaria Ceramics has the right levers working for it

The earnings quality, market leadership, and a robust business model make the Kajaria stock an ideal holding for long-term investors

BUSINESS

Sagar Cements – Going full steam ahead on growth

The company is rapidly expanding its reach but high debt remains a concern

BUSINESS

Dalmia Bharat – Takeover of Jaypee's cement assets marks a new chapter on growth

Besides gaining market share, the deal should help Dalmia achieve economies of scale and operating efficiencies through its existing distribution network

BUSINESS

Sula Vineyards IPO: The business wine could be tastier than stock valuation

Though the wine-maker has decent fundamentals and healthy growth prospects, its valuation has a lot of froth

BUSINESS

Sirca Paints: Great progress on all fronts

Shareholders have reaped the benefits as the stock has already delivered more than 70 percent returns since we covered this lesser-known smallcap as part of our discovery series.

BUSINESS

Borosil Renewables: Long-term thesis intact, rising competition a challenge

Though cost pressures have eased a bit, increased supply from Chinese manufacturers can put strain on the company’s performance