BUSINESS

15 smallcap gems with major MF stakeholding

As per the latest shareholding pattern data, mutual funds hold a significant portion in the total shares of these smallcap companies. This indicates fund managers’ optimism over the future growth prospects of these companies.

BUSINESS

Buy high, sell higher: Does momentum strategy work for Indian investors?

Momentum strategy follows a ‘buy high and sell higher’ approach of investing and exhibits high volatility in the short term. Investors with a high risk profile and long-term view can allocate 10-15 percent of their portfolio to momentum strategy. About 12 mutual fund schemes offer this play

BUSINESS

Why systematic withdrawal plans in MF work best for retirees

Systematic withdrawal plan allows unitholders to withdraw money at regular intervals. A Moneycontrol analysis of MC30 debt and equity funds show that 6-8% can be ideally withdrawn every month without depleting the corpus, if you stay invested for 10 years

BUSINESS

Nifty 200 Momentum 30 Index rebalancing: 11 new mid-cap stocks that entered the index

These midcap stocks scored relatively high momentum score as they have outperformed the peers in Nifty 200 basket over the last one year. To reduce the risk levels that come with momentum strategy, some fund houses have launched momentum index funds

BUSINESS

Smallcaps today, multibaggers tomorrow: Unique stocks that make it to MF hotlists

Due to a wide range of small-cap stocks in the market, fund houses go bottom-fishing to pick multibaggers of tomorrow. In this pursuit, many schemes end up having unique or exclusive stocks

BUSINESS

13 midcap stocks that are most shunned by active mutual fund managers

These midcap stocks are either totally ignored or least favoured by active mutual fund managers

BUSINESS

AMFI reclassification: Smallcap stocks that got upgraded to midcaps. Do you own them?

Mutual funds schemes rejig their portfolios based on this classification aligning with the regulator’s mandate. Especially, midcap schemes are likely to add exposure in these stocks to maintain the stipulated limit

BUSINESS

How has Nippon India Small Cap fund compensated risks with handsome returns?

Nippon India Small Cap fund, one of the top performing smallcap funds, has compensated risk with handsome returns over the long term. It is suitable only if you have the stomach for high risk and a time horizon of 10 years and more

BUSINESS

How HDFC and HDFC bank multiplied the wealth of MF investors

Believing in the long-term growth story of HDFC and HDFC bank, many fund managers held these stocks in their portfolios for long term, irrespective of the market gyrations

BUSINESS

Want to build an emergency corpus? These debt funds come with a good track record

Low risk short term debt fund categories that can help your emergency corpus to grow and generate return over and above the banks’ savings and fixed deposits

BUSINESS

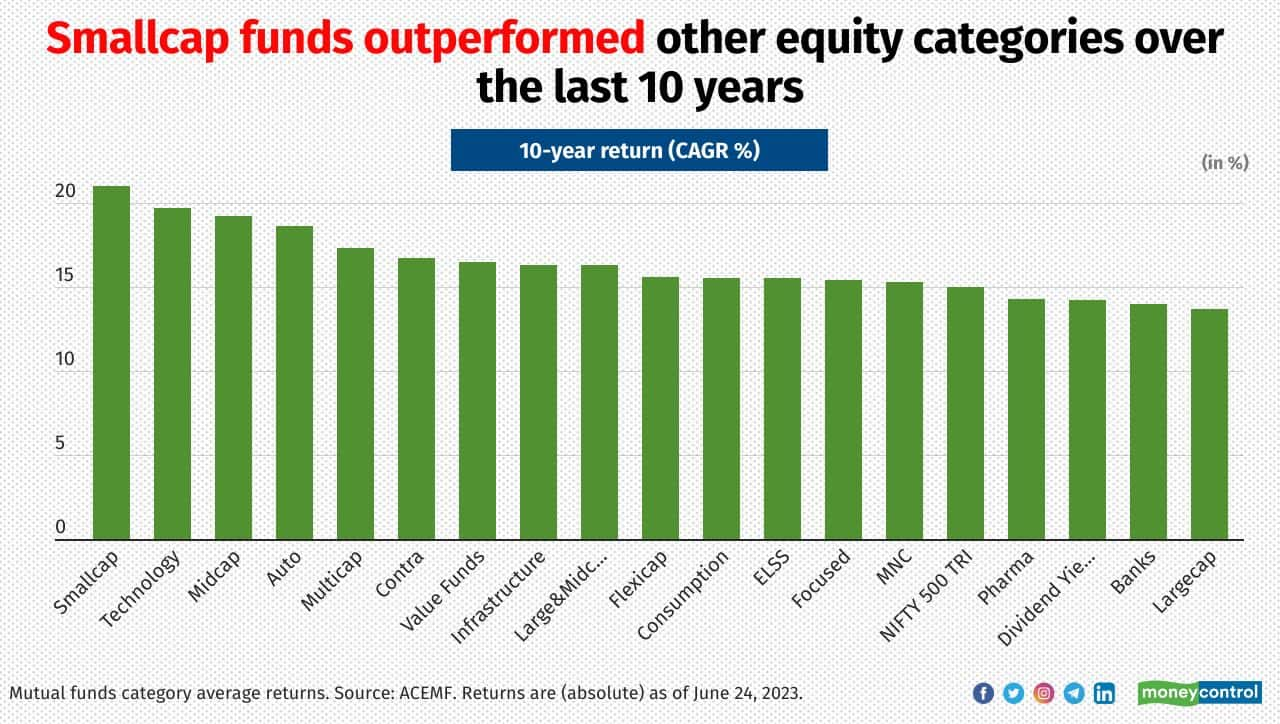

Smallcap MFs outshine: Top schemes surge up to 12 times in 10 years

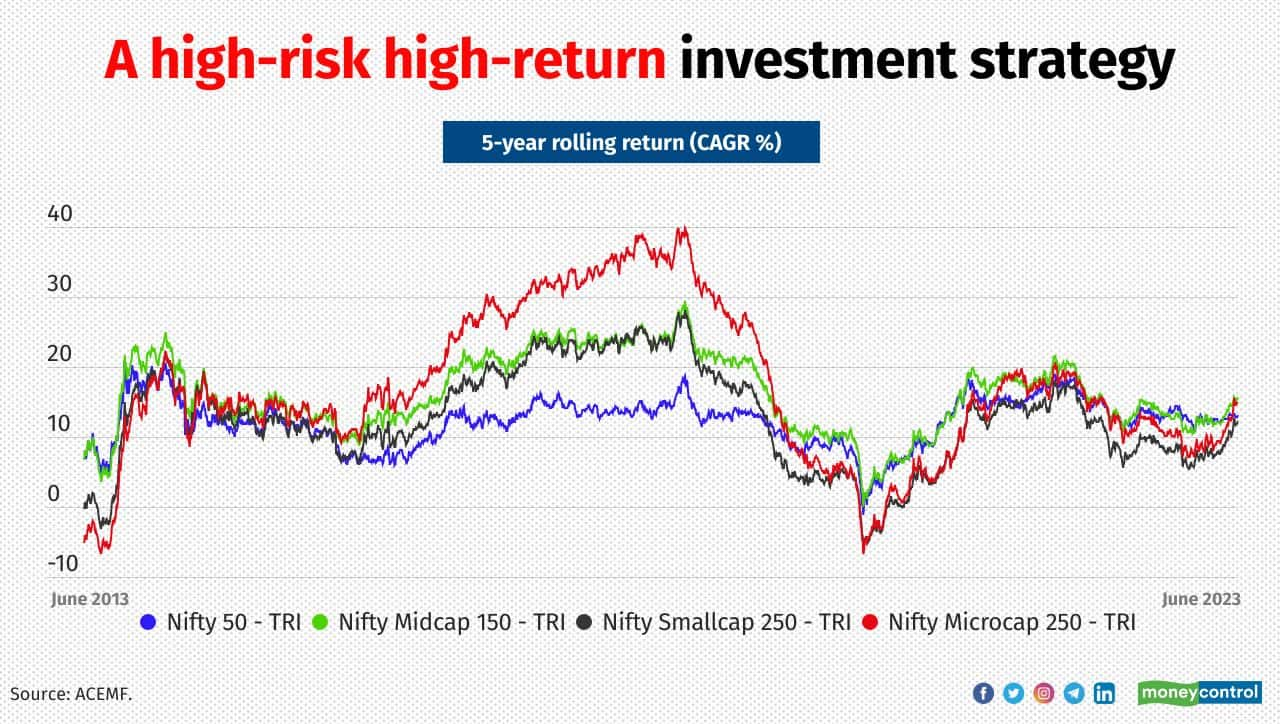

Smallcap mutualfunds outperformed largecap and midcap funds with huge margin in the last 10 years. They have a potential to generate relatively higher return if they are held for long term. But they are more volatile than other equity funds

BUSINESS

Low-risk, high-return: 10 high-rated listed bonds that give returns up to 10%

Corporate non-convertible debentures or NCDs offer a good option for those seeking regular income. If you have a medium-risk profile, these can be a good alternative to bank and corporate fixed deposits or FDs. Watch out for the credit rating though

BUSINESS

Nifty Midcap index at record high: 10 stocks that rewarded the MF investors

The Nifty midcap 150 index and Nifty Midcap 100 index hit fresh highs, driven by sustained buying momentum. The mid-cap space is likely to continue moving higher as the fundamentals of the domestic market are healthy, say experts

BUSINESS

Motilal Oswal Nifty Microcap 250 Index Fund NFO: Check out these favorite microcap stocks of active MFs, PMSes & AIFs

Motilal Oswal Nifty Microcap 250 Index Fund NFO has opened up for subscriptions. However, active funds in the small and microcap space have been chasing micro-cap stocks as well. But such stocks are illiquid and volatile. Here are the most popular microcap stocks among active MFs, PMSes & AIFs

BUSINESS

Cautious of market highs, these large-caps exit MF portfolio

In light of the current market condition, taking a cautious approach, mutual funds trimmed their equity holdings

BUSINESS

Why NPS Tier-II tax saver scheme has failed to gain traction with central government employees

The NPS-TTS provides tax benefit to the central government subscribers for investment up to Rs 1.5 lakh under section 80C but is unpopular due to a heavy fixed-income component.

BUSINESS

12 new midcap stocks that PMS fund managers picked in May. Do you own any?

Volatility in the market provided PMS managers an opportunity to take fresh position in the beaten down midcap stocks

BUSINESS

70% of NPS annuity subscribers choose single life policy to pass on principal to nominee: PFRDA

According to the Handbook of NPS 2023, over 1,09,344 subscribers opted for annuity plans at the time of superannuation/exit since the launch of the National Pension System. Of them, 70 percent chose the Annuity for Life with Return of Purchase Price plan.

BUSINESS

Franklin Templeton equity funds go up when things are down. Here's why

Franklin Templeton equity funds' philosophy is not to aim for the stars, but to consistently deliver 50 to 100 basis points alpha over the index. Janakiraman R's small- and mid- cap funds' performance reflect a similar trend. In terms of consistency in strategy and philosophy, the fund does the job quite well.

BUSINESS

Over 1,200% returns in 2 years, but not over yet: MF still hold these multibagger smallcap stocks

Multibagger smallcap stocks held by mutual funds delivered huge returns over the last two years. Active fund managers still continue to hold these stocks in their portfolios even though they went up multi-fold. They feel that these stocks still have the potential to generate additional returns.

BUSINESS

NPS sees remarkable 650% growth in voluntary subscribers' AUM, outpacing other segments

Ever since the ‘all citizen model’ was introduced in 2009, the NPS attracted more number of voluntary subscribers to 30 lakh. Their asset base in NPS grew by 650% in the last five-years

BUSINESS

NPS Equity funds shine, but struggles to beat broader indices

A Moneycontrol rolling return analysis on the NPS data available from the Handbook of NPS Statistics (2023) shows that all the Tier – 1 equity schemes struggle to beat the Nifty 100 – TRI while the Tier – 1 Corporate bond schemes and Government securities schemes comfortably beat the relevant categories of mutual fund counterparts

BUSINESS

ULIP debt funds back in focus after debt mutual funds taxation. Here’s the top performing funds

Moneycontrol's analysis of 5-year rolling returns from ULIPs reveals impressive performance by these funds. Despite the recent attention on debt-oriented ULIPs following the removal of capital gains tax for debt mutual funds, it is still ideal to separate insurance and investment. Here are the top performing ULIP debt funds

MCMINIS

B30 AUM in mutual funds grew higher than T30’s