Over 1,200% returns in 2 years, but not over yet: MF still hold these multibagger smallcap stocks

Multibagger smallcap stocks held by mutual funds delivered huge returns over the last two years. Active fund managers still continue to hold these stocks in their portfolios even though they went up multi-fold. They feel that these stocks still have the potential to generate additional returns.

1/16

The last two years have seen domestic equity markets go on a roller-coaster ride. The volatility provided active fund managers opportunities to take positions in beaten-down stocks. Many of the stocks in their portfolios turned multi-baggers and have yielded handsome returns.

Here’s a look at the multibagger small-cap stocks that mutual funds continue to hold even after enjoying handsome returns over the last two years. Fund managers feel that these stocks still have the potential to generate additional returns.

Source: ACEMF. Portfolio data as on April 30, 2023.

Here’s a look at the multibagger small-cap stocks that mutual funds continue to hold even after enjoying handsome returns over the last two years. Fund managers feel that these stocks still have the potential to generate additional returns.

Source: ACEMF. Portfolio data as on April 30, 2023.

2/16

Rama Steel Tubes

Return over the last two years: (From May 31, 2021 to May 31, 2023): 1,200%

No. of schemes that hold the stock: 1

Sample of schemes that hold the stock long-term: Quant Value

Return over the last two years: (From May 31, 2021 to May 31, 2023): 1,200%

No. of schemes that hold the stock: 1

Sample of schemes that hold the stock long-term: Quant Value

3/16

Titagarh Rail Systems

Return over the last two years: 527%

No. of schemes that hold the stock: 5

Sample of schemes that hold the stock long-term: HDFC Balanced Advantage and HDFC Equity Savings Fund

Return over the last two years: 527%

No. of schemes that hold the stock: 5

Sample of schemes that hold the stock long-term: HDFC Balanced Advantage and HDFC Equity Savings Fund

4/16

TD Power Systems

Return over the last two years: 430%

No. of schemes that hold the stock: 16

Sample of schemes that hold the stock long-term: ICICI Pru Infrastructure and Nippon India Power & Infra Fund

Return over the last two years: 430%

No. of schemes that hold the stock: 16

Sample of schemes that hold the stock long-term: ICICI Pru Infrastructure and Nippon India Power & Infra Fund

5/16

Apar Industries

Return over the last two years: 420%

No. of schemes that hold the stock: 15

Sample of schemes that hold the stock long-term: Edelweiss Small Cap and HDFC Balanced Advantage Fund

Return over the last two years: 420%

No. of schemes that hold the stock: 15

Sample of schemes that hold the stock long-term: Edelweiss Small Cap and HDFC Balanced Advantage Fund

6/16

Power Mech Projects

Return over the last two years: 419%

No. of schemes that hold the stock: 4 Sample of schemes that hold the stock long-term: HDFC Small Cap Fund

Also see: 14 new midcap stocks picked up by PMS managers, lately

Return over the last two years: 419%

No. of schemes that hold the stock: 4 Sample of schemes that hold the stock long-term: HDFC Small Cap Fund

Also see: 14 new midcap stocks picked up by PMS managers, lately

7/16

Elecon Engineering Company

Return over the last two years: 349%

No. of schemes that hold the stock: 3

Sample of schemes that hold the stock long-term: HDFC Multi Cap Fund

Return over the last two years: 349%

No. of schemes that hold the stock: 3

Sample of schemes that hold the stock long-term: HDFC Multi Cap Fund

8/16

Safari Industries (India)

Return over the last two years: 344%

No. of schemes that hold the stock: 23

Sample of schemes that hold the stock long-term: Sundaram Small Cap and Union Small Cap Fund

Return over the last two years: 344%

No. of schemes that hold the stock: 23

Sample of schemes that hold the stock long-term: Sundaram Small Cap and Union Small Cap Fund

9/16

Raymond

Return over the last two years: 325%

No. of schemes that hold the stock: 2

Sample of schemes that hold the stock long-term: Nippon India Small Cap Fund

Return over the last two years: 325%

No. of schemes that hold the stock: 2

Sample of schemes that hold the stock long-term: Nippon India Small Cap Fund

10/16

Rail Vikas Nigam

Return over the last two years: 307%

No. of schemes that hold the stock: 4

Sample of schemes that hold the stock long-term: Kotak Infra & Eco Reform

Return over the last two years: 307%

No. of schemes that hold the stock: 4

Sample of schemes that hold the stock long-term: Kotak Infra & Eco Reform

11/16

Tejas Networks

Return over the last two years: 304%

No. of schemes that hold the stock: 3

Sample of schemes that hold the stock long-term: Edelweiss Small Cap and Nippon India Small Cap Fund

Also see: Long-term wealth creation | Here are the small-cap stocks that children-oriented mutual funds love to hold

Return over the last two years: 304%

No. of schemes that hold the stock: 3

Sample of schemes that hold the stock long-term: Edelweiss Small Cap and Nippon India Small Cap Fund

Also see: Long-term wealth creation | Here are the small-cap stocks that children-oriented mutual funds love to hold

12/16

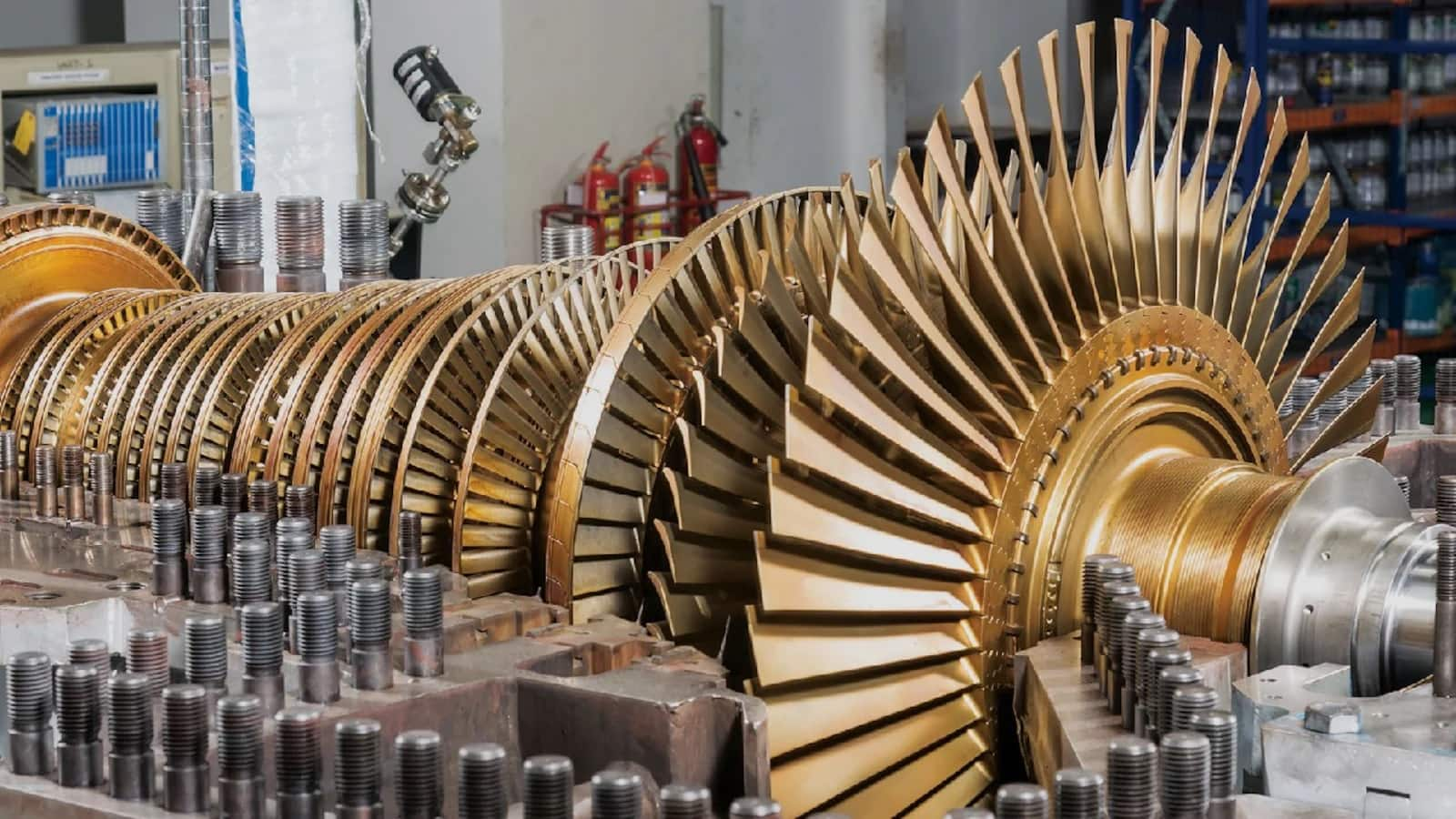

Triveni Turbine

Return over the last two years: 294%

No. of schemes that hold the stock: 22

Sample of schemes that hold the stock long-term: SBI Small Cap and Nippon India Multi Cap Fund

Return over the last two years: 294%

No. of schemes that hold the stock: 22

Sample of schemes that hold the stock long-term: SBI Small Cap and Nippon India Multi Cap Fund

13/16

Mazagon Dock Shipbuilders

Return over the last two years: 285%

No. of schemes that hold the stock: 3

Sample of schemes that hold the stock long-term: SBI PSU and HSBC Infrastructure Fund

Return over the last two years: 285%

No. of schemes that hold the stock: 3

Sample of schemes that hold the stock long-term: SBI PSU and HSBC Infrastructure Fund

14/16

Rajratan Global Wire

Return over the last two years: 278%

No. of schemes that hold the stock: 2

Sample of schemes that hold the stock long-term: SBI Small Cap Fund

Return over the last two years: 278%

No. of schemes that hold the stock: 2

Sample of schemes that hold the stock long-term: SBI Small Cap Fund

15/16

Voltamp Transformers

Return over the last two years: 250%

No. of schemes that hold the stock: 14

Sample of schemes that hold the stock long-term: DSP Small Cap and Edelweiss Small Cap Fund

Return over the last two years: 250%

No. of schemes that hold the stock: 14

Sample of schemes that hold the stock long-term: DSP Small Cap and Edelweiss Small Cap Fund

16/16

Gokaldas Exports

Return over the last two years: 241%

No. of schemes that hold the stock: 20

Sample of schemes that hold the stock long-term: HSBC Small Cap and Quant Active Fund

Also read: Market CAP below Rs 200 crore, but these nanocap multibaggers remain PMS darlings

Return over the last two years: 241%

No. of schemes that hold the stock: 20

Sample of schemes that hold the stock long-term: HSBC Small Cap and Quant Active Fund

Also read: Market CAP below Rs 200 crore, but these nanocap multibaggers remain PMS darlings

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!