History moves in rhythms. For centuries, the arc of empires has followed a familiar pattern: nations rise on the back of strong education, innovation, trade, and trust in their currency. Over time, excess debt, inequality, and political conflict erode that strength. Power shifts elsewhere, a new reserve currency emerges, and the cycle begins again.

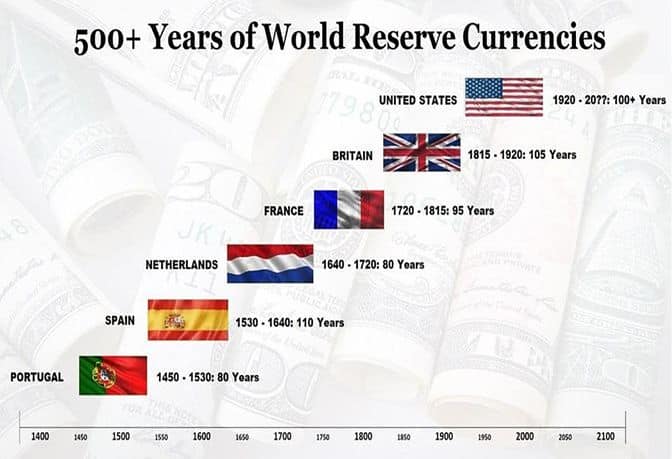

Ray Dalio’s research on the changing world order captures this story well. Over the last 500 years, we’ve seen Portugal dominate trade in the 1500s, followed by Spain, the Dutch Guilder, the French Livre, the British Pound, and eventually the US Dollar. Each held the mantle for roughly a century before the world moved on.

Today, the US Dollar’s supremacy is under its most serious scrutiny in decades.

Why the Dollar’s Grip Is Loosening

The signs are unmistakable:

Ballooning US Debt: America’s debt-to-GDP ratio has crossed 123 percent, levels previously seen only in wartime.

Political Polarization: Budget standoffs and partisan divides weaken confidence in US governance.

Protectionist Policies: Tariffs, H1-B restrictions, and industrial subsidies hint at a retreat from globalization.

Central Bank Behaviour: In 2024, global central banks bought over 1,100 tonnes of gold — the highest in 55 years — signalling hedging against dollar dominance.

When trust in paper wanes, history shows that gold — and eventually, new currencies — rise in relevance.

The Question: Who Benefits from the Next Shift?

This is where India enters the conversation. For the first time in a century, multiple structural advantages align in our favour:

Demographics: With a median age of 28, India has the youngest workforce among major economies.

Digital Infrastructure: Platforms like UPI and Aadhaar have built the backbone for mass-scale financial inclusion and innovation.

Capital Market Depth: Domestic mutual funds now channel over Rs 20 lakh crore into equities, reducing overreliance on foreign capital.Policy Tailwinds: Incentives for manufacturing, green energy, and digital transformation position India on global megatrends.

Yet, structural strengths alone don’t guarantee leadership. Execution matters.

What India Must Do Now

1. World-Class Education & Research: Build universities and R&D ecosystems that rival global leaders in original thought, science, and technology.

2. Entrepreneurship & Capital: Enable startups to scale globally without relocating abroad for funding or regulatory ease.

3. AI & Emerging Tech: Treat AI as a growth accelerator — channel talent into creating industries that don’t yet exist.

4. Global Currency Role: If BRICS or others develop an alternative reserve currency, India must shape its architecture as a hub of innovation, not a passive participant.

Why Investors Should Pay Attention

Epochal shifts create epochal opportunities. If India capitalizes on this moment, investors should watch:

• Financial Services: Domestic capital market deepening benefits banks, brokers, and asset managers.

• Digital Platforms & AI: From fintech to SaaS, India could lead the next wave of digital globalization.

• Manufacturing & Green Energy: Policy incentives and global supply chain diversification put India in a sweet spot.

The Next Verse of History

Reserve currencies don't change often, but when they do, they rewrite the world order for generations. The US Dollar’s reign isn’t over yet — but the foundations are shaking. For the first time in decades, India has the demographics, the digital rails, and the entrepreneurial energy to compete for a leadership role.

When the next global currency emerges, let it rise not from the ashes of the old order, but from the ideas, industries, and institutions India builds today.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.