March 08, 2023 / 16:13 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

The benchmark indices had a tumultuous trading session on Wednesday, with the Sensex up 123 points and the Nifty ending 43 points higher. In terms of industries, there was modest purchasing in the banking and Selective auto companies, although the realty and IT indices experienced higher levels of intraday profit booking.

Technically, after a weak opening, the index recovered sharply. From the lowest point of the day, the Nifty recovered over 150 points. It also formed a bullish candle which is broadly positive.

We are of the view that as long as the index is trading above 17,700 or 20-day SMA the uptrend formation is likely to continue. Above which, the market could move up to 17,850-17,875. On the flip side, below 17,700 the selling pressure is likely to accelerate. Below the same, the market could retest the level of 17,600-17,550.

March 08, 2023 / 16:02 IST

Jatin Gedia, Technical Research Analyst, Sharekhan by BNP Paribas

The Nifty opened gap down today however as the day progressed it witnessed buying interest at lower levels and closed with gains of 43 points for the day. On the daily charts we can observe that Nifty, after a sharp rally in the previous couple of trading sessions, witnessed a day of consolidation. The zone of 17,650 – 17,600 acted as a strong support zone and witnessed buying interest.

The hourly Bollinger bands are contracting and the hourly momentum indicator has a negative crossover, both of which indicate that a consolidation is likely before it begins a trending move. From a short-term perspective, the range of consolidation is likely to be 17,400-17,925.

March 08, 2023 / 15:50 IST

Vinod Nair, Head of Research at Geojit Financial Services:

The global market has fallen back into the grip of uncertainty as the Fed chief signalled the possibility of a prolonged and faster rate hike, contradicting a dovish comment made by another Fed official last week. The market now anticipates a 50 bps rate hike, which has pushed the dollar index to a three-month high. However, a strong recovery was seen in the domestic market towards the end of the day, which kept the bulls on the move.

March 08, 2023 / 15:32 IST

Rupee Close:

Indian rupee closed 13 paise lower at 82.05 per dollar against previous close of 81.92.

March 08, 2023 / 15:31 IST

Market Close:

Benchmark indices ended higher in the volatile session on March 8.

At close, the Sensex was up 123.63 points or 0.21% at 60,348.09, and the Nifty was up 42.90 points or 0.24% at 17,754.40. About 1894 shares have advanced, 1502 shares declined, and 119 shares are unchanged.

IndusInd Bank, Adani Ports, Adani Enterprises, Bajaj Auto and M&M were among the biggest gainers on the Nifty, while losers were Bajaj Finance, Hindalco Industries, Tech Mahindra, Apollo Hospitals and Infosys.

Mixed trend saw on the sectoral front with power index up nearly 2 percent, while capital goods and auto indices up 1 percent each, while selling was seen in the IT, metal, pharma, and realty names.

The BSE midcap index up 0.60 percent and smallcap index up 0.3 percent.

March 08, 2023 / 15:29 IST

Vaibhav Global further expands its presence in Germany

Vaibhav Global's German subsidiary, Shop LC GMBH, has further expanded its presence in Germany by partnering with Vodafone Germany on its nation-wide cable network. With this arrangement, Shop LC has added ~13 million additional households in Germany, the company said in an exchange filing.

Vaibhav Global was quoting at Rs 322.50, down Rs 2.55, or 0.78 percent.

March 08, 2023 / 15:25 IST

Jefferies View On Max Healthcare Institute

-Buy rating, target at Rs 530 per share

-Addition of 500 new beds by H1FY24 & 1,500 by FY25 well on track

-As most additions are brownfield, the breakeven timelines will be faster

-Company will not leverage balancesheet beyond net debt-to-EBITDA of 2-2.5x for potential acquisition

March 08, 2023 / 15:20 IST

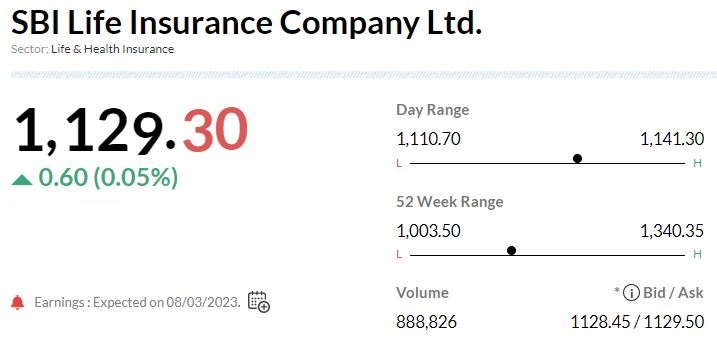

SBI Life Insurance declares an interim dividend

SBI Life Insurance declared an interim dividend on equity shares of the company of Rs 2.50 per equity share with a face value of Rs 10 each (i.e. 25%) for the Financial Year 2022-23.

March 08, 2023 / 15:18 IST

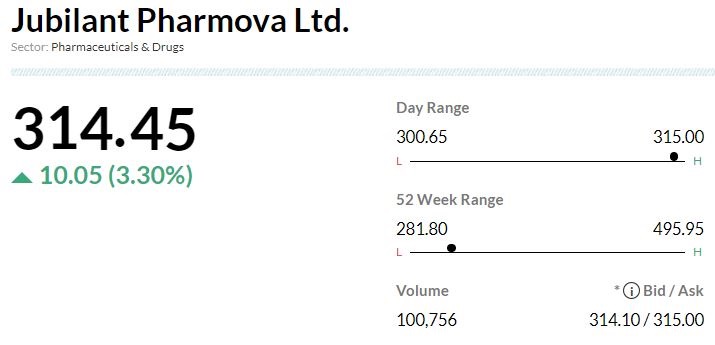

USFDA classifies inspection at Jubilant Pharmova as ‘Voluntary Action Indicated’

Jubilant Pharmova announced that, pursuant to the United States Food and Drug Administration (USFDA) inspection of its API manufacturing facility at Nanjangud during 05-13 December 2022, it received a communication from the USFDA through which the regulatory agency assigned the inspection classification of the API facility as “Voluntary Action Indicated (VAI)”.

Based on this inspection and the USFDA VAI classification, this facility is in compliance with regard to current good manufacturing practices (cGMP).

March 08, 2023 / 15:16 IST

Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas

Indian Rupee depreciated on Wednesday on weak domestic markets and overnight gains in the US Dollar as Fed Chair Powell’s testimony reignited worries of a 50-bps rate hike by Fed in its FOMC meeting to be held on March 21-22, 2023.

Powell said that the latest economic data released in the US are stronger than expected. He also added that the US central bank would be prepared to increase the pace of rate hikes if the totality of the data were to indicate that faster tightening is warranted. Odds of a 50-bps rate hike rose to 70% from 24% the previous day. Shorter duration US Treasury yields also surged, which led the US Dollar to a three-month high. Markets now expect terminal rates to be higher than previous estimates of 5.4%.

We expect Rupee to trade with a negative bias on rise aversion in global markets following Powell’s testimony. Surge in Dollar and weak risk assets may also put downside pressure on rupee. However, weak tone in crude oil prices and FII inflows may support Rupee at lower levels. Investors may await Powell’s second day of testimony. Traders may also look forward to JOLTS job openings, ADP non-farm payroll and trade balance data from US. USDINR spot price is expected to trade in a range of Rs 81.60 to Rs 82.50.

March 08, 2023 / 15:12 IST

BSE Midcap index up 0.5 percent led by Hindustan Aeronautics, Adani Power, Ajanta Pharma

Top Stock Gainers (Intra-day)

March 08, 2023 / 15:09 IST

Jefferies View On Cipla

-Hold call, target cut to Rs 900 from Rs 1,100 per share

-Lower FY24/25E EPS by 13%/15% as factor in delays in key approvals from Indore

-Target is Rs 740 per share in a bear-case scenario

-Bear-case scenario considers no big US launches for next two years, sharp erosion

-Stock is still away from bear-case value despite a sharp 15% fall in 1 month

Cipla was quoting at Rs 876.60, down Rs 4.45, or 0.51 percent on the BSE