Not many instruments dominated and divided opinions from central banks and financial institutions alike as bitcoin and blockchain did over the past year. While the bitcoin price-levels have hit record highs, blockchain isn't far behind — so much that it threatens to disrupt cross-border payments ecosystem which is dominated by the likes of Western Union and MoneyGram.

Bitcoin is the world's first cryptocurrency and blockchain the underlying software that empowers it. While bitcoin — a revolutionary idea — is still a topic of harsh criticism, people consider blockchain to be a more intriguing phenomenon, capable of reshaping banking and finance.

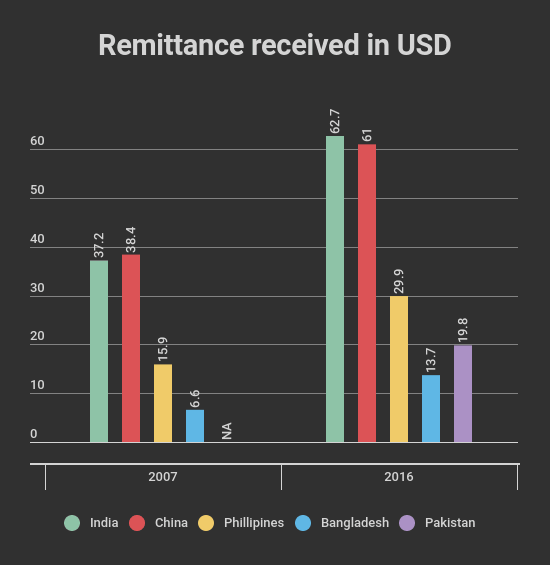

From 2007 to 2016 global remittances to developing countries increased by 51 percent, as per a recently released UN report. "By reducing average costs to below 3 percent globally, remittance families would save an additional USD 20 billion annually," the report says.

The average cost of sending remittances now stands at 7.45 percent, a decrease from 9.8 percent since 2008. However, transaction costs have remained essentially flat over the past few years and are unacceptably high in many low-volume corridors, according to the report.

India was the top remittance receiver in 2016, where Indians working abroad sent home USD 62.7 billion.

Going by the average of 7.45 percent for sending money home, around USD 4.6 billion was spent as costs by Indians in 2016.

"The basic elements of the current value transfer process have been in place for over 150 years," a World Economic Forum report said in 2015.

Given the present cumbersome money transfer model, the cost incurred is huge and this is where the blockchain comes as it can exponentially reduce this cost.

What is blockchain?

Blockchain technology, also known as a distributed ledger, is a software which enables data sharing across a network of computers. Being distributed in nature, each user shares the same 'ledger' which keeps the record of transactions happening over it. This brings more transparency and reduces the need for many middle men to process a transaction.

Conducting international money transfers through distributed ledger technology could provide real time settlement at negligible costs.

By removing intermediaries, lengthy documentation, and the need for verifications at various steps, the average time to complete a cross-border transaction can come down to a few seconds from current three to five business days.

The infographic below explains best how much cost one can save while sending USD 500 from the US to India.

Earlier this year the Reserve Bank of India’s research arm, IDRBT released a report which said that the time is ripe for blockchain technology adoption in India and it has tested the technology for core banking processes in the country.

Indian private banks like Yes Bank, Axis Bank and ICICI Bank have already implemented blockchain technology into their processes to test overseas transaction settlements.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.