Ruchi Agrawal

Moneycontrol Research

Rosneft’s deal to acquire Essar Oil is important not only because a highly-leveraged corporate is selling family silver to put its house in order; it has far-reaching implications for India’s downstream oil business, especially fuel retailing. The de-regulation of the downstream sector had triggered a re-rating of most state-run oil marketing companies. Is the best behind for them?

The deal

Rosneft (Russia’s state-owned energy giant), along with Trafigura (Swiss commodity trading firm) and United Capital Partners UCP (Russian Bank) recently completed the acquisition of 98 percent stake in Essar Oil for USD 12.9-billion. The deal asserts that the Indian Oil retail market is an attractive investment option for foreign investors.

The deal provides Rosneft with a 49 percent stake in Essar Oil and the rest 49 percent will be equally divided between UCP and Trafigura. The deal marks Rosneft’s entry in growing Indian markets and facilitates its access to Essar’s Vadinar refinery in Gujrat, having a capacity of 405,000 barrels per day, along with Essar’s vast network of 3500 fuel stations across the country. The Russian firm has disclosed plans for an aggressive expansion in the Indian retail segment and it aims to nearly double Essar’s retail fuel pumps in India to 6000 in the near term.

The deal comes as a breather for the debt-laden Essar group. As a part of the deal, Rosneft plans to take up USD 5 billion debt outstanding on Essar’s balance sheet. Having a better credit rating than Essar, Rosneft has superior negotiating powers to refinance the debt at better terms, which would be beneficial for Essar Oil.

Indian downstream market

The retail fuel market is largely dominated by state-owned companies like IOC, HPCL and BPCL who have witnessed little competition over the past decades. They account for more than 90 percent of the 59,595 pumps spread across the country.

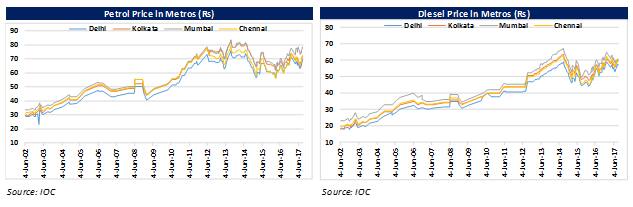

Historically, fuel was sold at subsidized rates in India and the government used to compensate the companies for losses incurred. This was one of the main reasons why private firms, who entered the market around 2002, were not able to survive after 2005 when crude prices spiked. Petrol and diesel prices have been deregulated since June 2010 and May 2014, respectively. Since May 2017 they are adjusted on a daily basis.

Pricing and Margins

Although prices have been deregulated and are adjusted on a daily basis now, the entire benefit of soft global crude prices is not being transferred to the consumer currently. Since deregulation, the government has sharply increased the excise duty on oil which is keeping the prices high in the retail market.

However, despite higher taxes, the overall decline in prices had a positive impact on volumes. The retail selling price of petrol is determined by oil marketing companies. It is usually made up of price paid to refinery plus marketing costs & margins, excise duty, dealer commission, and VAT. Margins in the retail business vary between Rs 2-3 per litre.

Changing dynamicsPricing freedom coupled with growth in fuel demand and auto sales together with globally low crude prices has made Indian retail fuel segment attractive and profitable. With retail markets getting saturated in Europe and US, most private players are eyeing expansion in Asia, especially India.

Private vehicle penetration in India is still very low at approximately 18 vehicles per 1000 compared to around 500 per 1000 in developed markets. This provides immense scope and incentive for foreign and private players to foray into Indian markets. While penetration of electric vehicles would pose a medium term challenge to growth in fuel demand, we do not see a mass adoption of the same at least for the next ten years.

Expansion of global and private sector players would intensify competition for the Indian state-owned players. Apart from the Essar-Rosneft deal, Reliance has started reviving its fuel stations and has announced plans for expanding its retail fuel network in partnership with BP. The joint venture plans to invest around USD 6 billion in Indian markets in the near term.

New entrants to play the pricing card

Retail fuel demand in India is extremely price sensitive. Small changes in prices have toppled governments in the past. Recently, Reliance Industries introduced a Re1 discount on diesel refueling across its stations. This move enabled it to gain market share rapidly in the past 6 months.

Foreign players entering Indian markets have deeper pockets and better fuel sourcing capabilities. Rosneft plans to source crude from its Venezuela subsidiaries to facilitate better margins.

Moreover, unlike the state-run companies, private players have the freedom to strategically plan fuel stations near high sales areas like highways and do not face the compulsion to open stations in rural areas.

Investment plans by these private players indicate their hunger for aggressive expansion in retail business.

In order to quickly establish their position and capture markets, we believe private players would resort to pricing discounts (Reliance has already started it) and invest heavily in marketing. This could lead to intense price competition in the retail oil markets. With increased competition, state-run players will have to invest in marketing initiatives as well. Increased marketing costs would, in turn, impact margins.

Though state-run retailers would still have the dominant position in the short run, we see pressure building up on margins in the medium-term and changing landscape in the long term. The incumbents will have to up their game significantly in order to sustain positions.

(Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.