On the weekly chart, Nifty50 Index has broken out of a downtrend line resistance formed by joining previous peaks triggering a bull trend reversal. Further, a sustained trade beyond 8,950 level may extend the Bull Run to levels of 9,225-9,575 in the coming trading sessions.

However, failure to hold support levels of 8,950 can trigger corrections dragging the Index lower to levels of 8,720-8,570, said the Yes Securities report.

On the daily chart, Nifty50 is facing resistance at the upper end of a rising channel placed at 9160; close beyond the channel upper end can extend the rise.

Failure to takeout channel resistance of 9,160 in the coming week may drag it to the lower end of the channel placed at 8,950. Moreover, a close below 8,950 may terminate the ongoing bullishness dragging it to levels of 8,720-8,570.

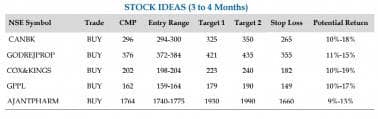

Yes Securities lists out top five stocks which investors can watch out for with a holding period of 3-4 months:

Canara Bank: BUY | Target Rs 325-350 | Stop Loss Rs 265

On the weekly chart, Canara Bank is on the verge of a breakout from a Symmetrical Triangle pattern suggesting bullishness building up in the stock (as indicated on chart). The neckline of the pattern is placed at 303; breakout from the neckline on higher volumes can trigger bull trend reversal.

On the daily chart, stock is on the verge of a breakout from a falling wedge pattern. The neckline of the pattern is at 298, a breakout would affirm the bullishness in the stock.

The RSI is on the verge of a breakout from the upper end of the Bollinger Bands portending to a bull trend reversal. The stock can be bought in the range of Rs 294-300 for targets of Rs 325-350, keeping a stop loss at Rs 265.

Godrej Properties: BUY | Target Rs 421-435 | Stop Loss Rs 355

On the weekly chart, Godrej Properties Ltd. has broken out from the neckline of an Ascending Triangle pattern triggering an extension of the bull trend. The neckline of the pattern is at Rs 380 and a sustained trade above the neckline can extend the gains.

On the daily chart, stock has broken out from a Triangle pattern affirming the bullishness dominant in the stock. The RSI has turned upwards after trading sideways affirming bullishness building up in the stock.

The stock can be bought in the range of Rs 372-384 for a target of Rs 421-435, keeping a stop loss placed at Rs 355.

Cox & Kings Ltd: BUY | Target Rs 223-240 | Stop Loss Rs 182

On the weekly chart, Cox & Kings Ltd. is on the verge of a breakout from a downtrend line resistance formed joining previous peaks. The trend line resistance is placed at Rs 205, and a sustained trade beyond the trend line on volumes can trigger a bull trend reversal.

On the daily chart, it is has broken out from a downward sloping channel neckline on high volumes suggesting bullishness building up in the stock. The RSI and MACD are favoring an extension of the uptrend.

The stock can be bought in the range of Rs 198-204 for targets of Rs 223-240, keeping a stop loss placed at Rs 182.

Gujarat Pipavav Port Ltd: BUY | Target Rs 179-190| Stop Loss Rs 149

On the weekly chart, Gujarat Pipavav Port Ltd. (GPPL) is on the verge of a breakout from a falling wedge pattern suggesting bullishness building up in the stock. The neckline of the pattern is placed at Rs 173, and a breakout on good volumes can trigger bull trend reversal.

On the daily chart, it has broken out of a consolidation pattern affirming the strength, portending to higher levels in the coming sessions.

The relative strength index (RSI) is making higher highs and higher lows suggesting a strong upward moment in the stock. The stock could be bought in the range of Rs 159-164 for targets of Rs 179-190, keeping a stop loss placed at Rs 149.

Ajanta Pharma: BUY| Target Rs 1930-1990| Stop Loss Rs 1,660

On the weekly chart, Ajanta Pharma Ltd. is on the verge of a breakout from a downward sloping channel pattern, portending to a resumption of bull trend.

The neckline of the pattern is at 1770; breakout on higher volumes can resume the uptrend. On the daily chart, has broken out of a consolidation pattern affirming the bullishness in the stock.

The RSI and MACD are also favoring the bulls portending to higher levels in the coming trading sessions. The stock could be bought in the range of Rs 1,740-1,775 for targets of Rs 1,930-1,990, keeping a stop loss placed at Rs 1,660.

(Views and recommendations given in this section are the analysts' own and do not represent those of Moneycontrol. Please consult your financial adviser before taking any position in the stock/s mentioned.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.