The S&P BSE Sensex took five years to climb 10,000 points, but the next 10,000 points which could take the index towards 40K could well come in the next three years, say experts.

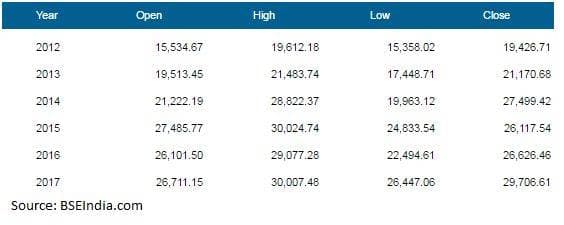

The S&P BSE Sensex which was trading around 19,426 at the close of 2012 rose to 29,706 in the year 2016. It took nearly five years for the index to rally about 10,000 points, BSEIndia.com data showed.

The domestic liquidity has added the much need optimism in the market which could support the market even at times when foreign institutional investors (FIIs) decide to cash out.

“Since the time Narendra Modi came to power, investor inflows into Indian equity markets have been over Rs 2 lakh crore. In the last 3- year’s flows have doubled to the flows seen in last one decade before May 2014,” Sunil Subramaniam, CEO, Sundaram Mutual Fund told in an interview with CNBC-TV18.

The fund has a hefty target for Sensex in the next three years at 40,000. Subramaniam said the first leg of the market cycle will be driven by consumption, and then 12-18 months from now, the infrastructure segment will come to support.

“Sharp surge in DII flows into equity market shows the confidence of an Indian investor towards the economic growth of the ruling government. For the next 3-5 years, we are in a bullish trend for growths,” he said.

Subramaniam is not alone in his view towards Sensex. The liquidity driven rally which took the benchmark indices to record highs earlier this month certainly has further room.

A poll conducted by Moneycontrol.com last month highlighted that most analysts on D-Street are hoping for a sharp rally towards 30-35 K by the end of December 2017.

Almost 14 of 18 fund managers and analysts polled by Moneycontrol News are of the view that the Sensex is likely to hover in a range of 30,000-35,000 by the end of December 2017 while 2 analysts think that it could make an attempt to touch 40,000 in the same period.

DSP BlackRock MF, which is one of the world’s largest investment management firm sees Nifty climbing above 9,500 by December 2017 and sees Sensex to hover in 30,000-35,000 range in the same period.

FIIs Overweight on India

The optimism about India has grown louder in the recent past not just domestically but globally as well. India is back in the game to command overweight status among top foreign institutional investors (FIIs).

Global investors cheered BJP strong show in the just-concluded state elections where the ruling government managed to attain a majority in most states, especially in Uttar Pradesh.

The demonetisation impact on the economy was also minimal compared what analyst’s factored into their base calculation. FIIs which remained net sellers in the October-December quarter poured in Rs 30,906 crore in March to set a record for the highest monthly inflows in the history of India’s capital markets, according to data provided by Central Depository Services (India) Ltd.

HDFC mutual fund said in a report that FIIs bought Indian equities worth $4.7 billion in March and $8.7 billion in FY17 despite record outflows of $4.7 billion between October 2016 and January 2017.

Global investment bank, Credit Suisse held its 20th Credit Suisse Asian Investment Conference in the month of March where more than 330 companies from 15 countries in the region participated in the event.

“China-H and India were again the markets that attendees were most overweight on, followed by China-A (which was, in fact, one of the biggest underweights last year). Pakistan, Malaysia, and Australia were by far the markets that investors were most underweight on,” it said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.