Nitin Agrawal

Moneycontrol Research

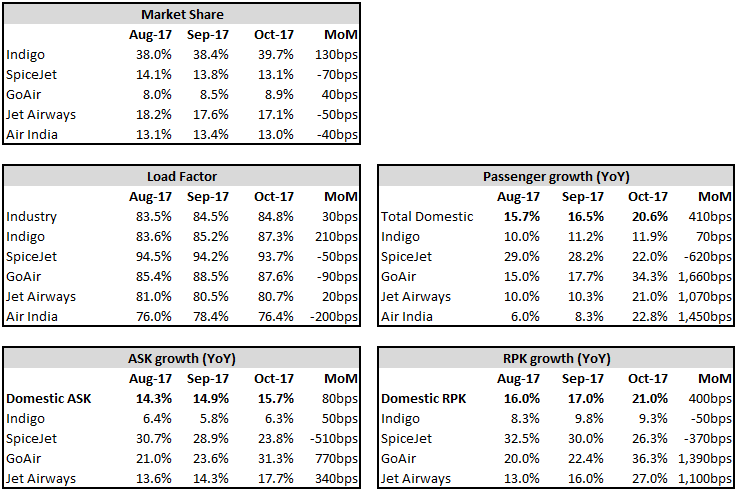

India's domestic aviation industry is navigating well on the skies. The industry has been clocking double-digit growth for the last 39 months and the trend continued with the industry witnessing 20.6 percent (YoY) growth in October 2017, higher than 16.5 percent it clocked in September 2017. The incremental show was on account of fixing of IndiGo's and GoAir's engine issues.

Operating Statistics for August 2017

IndiGo – coming out of the engine trouble

With the engine problem of A320neo aircraft coming to an end, IndiGo witnessed an expansion of 130bps (MoM) in its market share in October 2017. The company had grounded 13 aircraft due to the engine issues earlier, most of which are now in the sky. This resulted in a better sequential performance on all parameters in October 2017.

IndiGo continued to manage double-digit growth in passenger traffic for the last three months and its load factor also witnessed an expansion of 210bps.

SpiceJet – came to its normalcy

After riding high at the expense of IndiGo (engine issue), things have come to normalcy for SpiceJet in October 2017. Though it witnessed a meagre fall of 70bps (MoM) in the market share, it witnessed a significant fall in passenger growth (620bps), ASK (510bps) and RPK (370bps).

Jet – at a standstill

Jet Airways continues to struggle to gain market share. It lost 50bps (MoM) market share in October 2017, and is far from the high of over 20 percent market share that it achieved in July 2014. Jet managed to witness double-digit passenger growth (21 percent YoY) in October 2017. Its RPK witnessed a gain of 1,100bps (MoM); ASK rose by 340bps (MoM), and the load factor by 20bps.

The management of Jet in the recent analyst meet indicated that they are working towards cost optimization which is highly inefficient when compared to its peers due to higher employee, maintenance and selling cost. In addition, the management indicated that B737-max aircraft which are about to join Jet's fleet are 15 percent more fuel-efficient than the current aircraft and the company has also improved its aircraft utilization. These initiatives will help Jet in catching up with its peers but we doubt if it would impart any competitive advantage.

GoAir, a small player in Indian skies in terms of its market share, is showing signs of coming out of the engine issue just like IndiGo. Though its market share witnessed only 40bps gain (MoM), its passenger traffic grew significantly (1,070bps MoM) leading to a rise of 1,390bps in RPK and 770bps in ASK. We believe GoAir would continue to perform business as usual.

Continue to like IndiGo and SpiceJetWhile taking note of these developments, we continue to reiterate our preference for IndiGo and SpiceJet.

As highlighted in earlier notes engine problem faced by IndiGo was temporary and it is almost fixed now. We witnessed improvement in the performance in this month as the company has started getting spare engines from P&W. Additionally, the company got compensation from P&W for not providing spare engines, which partially offset the losses arising out of this issue and this was evident in the 2QFY18 numbers.

SpiceJet also posted a very good set of 2QFY18 numbers driven by year-on-year improvement on all operating parameters: yield (up 5 percent), load factor (continue to be above 92 percent), ASKM (available seat kilometers) (up 25.6 percent), RPKM (revenue passenger kilometer) (up 24 percent).

IndiGo and SpiceJet in our opinion have got all the right ingredients that are required to navigate at a higher altitude in the Indian aviation sector.

We retain our accumulate recommendation on IndiGo and a buy recommendation on SpiceJet as mentioned in our earlier notes.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.