Nitin Agrawal

Moneycontrol Research

Interglobe Aviation (IndiGo), the market leader in domestic skies, posted a strong all round performance in the June quarter with significant growth in revenue and record profit after tax. We continue to like the business on the back of operational efficiencies and multiple growth drivers.

Quarter in a Snapshot:

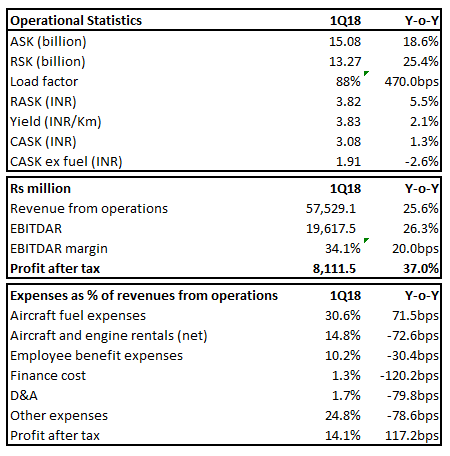

Revenue from operations clocked a growth of 25.6 percent (y-o-y) led by increase in volume (24.4 percent) supported by a rise in yield (2 percent). Additionally, the load factor witnessed growth of 470bps over the same quarter last year.

On the back of operational efficiencies, Indigo was able to post EBITDAR margin of 34.1 percent, up from 33.9 percent for the same period last year. This was led by reduction of 2.5 percent (y-o-y) in cost per unit (CASK) - ex fuel. However, CASK witnessed a growth of 1.3 percent (y-o-y) primarily because of rising fuel cost.

With India witnessing double-digit domestic passenger growth for last 35 months and domestic load factor above 85 percent, Indian carriers look set to fly high. The industry is navigating smooth on the back of benign fuel prices and increase in middle-class affluence. In this environment, IndiGo is placed well to capture all opportunities unfolding in the sector.

Cost Optimization – the best in the industry

Despite all odds in the Aviation Industry in the past, IndiGo was able to generate profit consistently, thanks to its cost optimization strategy. The carrier was focused on reducing cost to the hilt and had the lowest cost per unit in the industry. Even when oil prices were ruling very high and competitors were struggling, the company was able to generate profit. In fact during 1Q18, fuel prices had gone up by 16 percent but IndiGo’s fuel cost per ASK had gone up by only 8 percent, thanks to its fuel efficient neo aircrafts.

Owning aircrafts – well timed

IndiGo has a strong balance sheet, thanks to its asset-light model. Most of its aircraft (87 percent) were on operating lease, which helped in reducing capital requirements. On the back of low capex, the company was able to post healthy free cash flow for years.

However, IndiGo now plans to use the cash flow to own aircrafts and believes that this would bring in additional operational cost savings. The management indicated that the primary reason for owning aircrafts is because the new technology has just come into the market and there is lesser chance of its obsolescence soon. This new technology will bring in additional cost savings if the aircraft are kept for longer duration. However, they are yet to evaluate this option thoroughly.

Efficient sweating of assets

IndiGo has a young fleet (average age of five years), which gives it a better fuel efficiency. Use of single aircraft and class configuration also help it to reduce training costs. Additionally, the company has been able to utilise its assets much better than its peers - its aircraft utilisation stands at 12.7 hours per day (SpiceJet: 10 hours per day).

Growth DriversForay into international market

IndiGo's management has indicated its interest in stepping up presence in the long-haul international market. With that objective, the management has expressed interest in acquiring debt-laden Air India's international operations, which would give IndiGo immediate access to the various restricted and closed foreign markets. It would strengthen its reach and give it access to highly coveted slots at foreign airports. The management is confident of tackling challenges that come with ailing Air India.

Even if the deal does not fructify, the management is intends to start a low-cost airline for the long-haul market.

Significant capacity addition to capture increasing demand

The company has placed a huge order for aircrafts. It has an order book of around 411 aircrafts and delivery of these aircrafts will help IndiGo retain its leadership position in the Indian market. In fact, the management indicated that IndiGo’s capacity is expected to register a CAGR (compounded annual growth) of about 20 percent over FY18-20.

The government’s regional air connectivity scheme, UDAN, is another avenue for IndiGo to capture growth coming from non-trunk routes. IndiGo has started connecting non-trunk routes aggressively and has chalked out plans for regional connectivity and has placed orders for ATR planes.

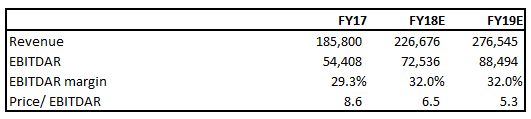

We believe IndiGo has all the right ingredients that is required to retain its leadership position in the Indian aviation sector. It has a well chalked out growth plan. At the current price, it is quoting at 6.5 and 5.3 times FY18 and FY19 projected EBITDAR, which we believe is attractive for the long term investors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.