Nitin Agrawal

Moneycontrol Research

SpiceJet, from the brink of bankruptcy, has navigated well in the skies over the last few quarters. The company has posted a decent set of numbers for the quarter ended June 2017 with significant growth in the operating revenues and an improvement in the load factor. However, the EBITDAR (earnings before interest, tax, depreciation, amortization and lease rental) margins was marred by higher fuel prices and maintenance charges. We like the company on the back of its turnaround and multiple growth drivers. Additionally, the relatively undemanding valuation is an additional draw.

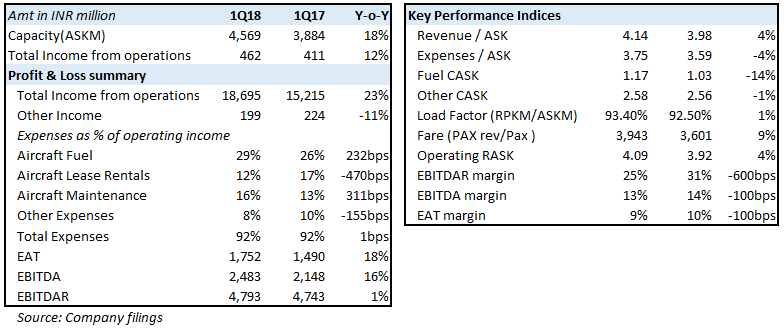

Quarter in a snapshot

Revenue from operations witnessed a growth of 23 percent (YoY) led by an increase in volume (12.2 percent) and supported well by an increase in yield (4 percent). Additionally, the load factor witnessed a growth of 90bps over the same quarter last year.

The company, however, witnessed a decline of 600bps (YoY) in EBITDAR margin. The decline was attributed to the rise in fuel prices, and aircraft maintenance cost that were partially offset by the reduction in the other expenses.

EBITDA margin was down by a more respectable 100bps, supported by the reduction in the aircraft lease rentals.

Why should you board this flight?

Favourable macros

India is witnessing double-digit domestic passenger growth for the last 35 months. With domestic load factor above 85 percent, Indian carriers look set to fly high. The industry is navigating smoothly on the back of benign fuel prices and increase in middle-class affluence. In this environment, SpiceJet is well placed to capture the opportunities unfolding in the sector.

Huge capacity expansion plans

SpiceJet currently has a fleet of 55 aircraft and its capacity as measured by ASK (Available Seat Kilometres) has increased by 18 percent (YoY) in this quarter. The company has indicated that it plans to increase its fleet size to 61 aircraft by the end of this fiscal. Additionally, it plans to add 9 Boeing 737s and 6 Q400s in the year 2018. The company has placed a huge order of 205 Boeing planes and placed an additional order for 20 (737 MAX 10) planes.

UDAN – an important catalyst

The government’s regional air connectivity scheme, UDAN, would enable SpiceJet to capture growth coming from the non-trunk routes. The company has started connecting non-trunk routes aggressively and has already launched operations in two routes.

Foray into ancillary services

SpiceJet has started focusing on new avenues to generate additional income -- the result of which is evident in the increase in ancillary revenues from 6 percent to 17 percent in the last two years.

The company has launched its new retail venture SpiceStyle, which has a portfolio of more than 12 fashion and lifestyle brands. This should act as a fresh catalyst for the ancillary revenues of the company.

Maintaining load factor – above 90 percent

During the quarter ended June 2017, SpiceJet had the best load factor (93.4 percent) in the industry. The company has recorded more than 90 percent load factor for 27 consecutive months now.

Focus on cost optimization

The carrier is now focusing on reducing costs. While fuel cost is beyond control, they are trying to optimize other expenses. The company’s efforts have started showing results: aircraft lease rental cost as a percentage of operating revenues dropped to 12.4 percent from 17.1 percent, and other expenses fell to 8.4 percent from 10 percent. These reductions in the costs helped the company to maintain its EBITDA.

Comforting valuationsAt the current price, the stock is quoting at 3.6 and 3.2 times FY18 and FY19 projected EBITDAR, which is at a steep discount to competitors. Given the growth outlook it is currently witnessing, we believe that valuations are comforting and will provide enough margin of safety to the investors.

We believe SpiceJet has now got all the right ingredients that are required to navigate at a higher altitude in the Indian aviation sector. With the right management at the helm and comfortable valuations, we advise investors to board the flight for a safe journey.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.