For Charan (name changed), the promise of crypto seemed like a path to a better life for his family, who had long worked as labourers in agriculture and construction. The 24-year old from Chittoor, Andhra Pradesh launched a successful infotainment YouTube channel, with over a million subscribers.

He ploughed most of his savings and earnings into buying meme token Shiba Inu on India's largest crypto exchange WazirX, following the crypto bull run of 2021.

Initially, he invested about Rs 15 lakh, and despite his portfolio’s valuation plunging by 70-80 percent, he continued to pump in more money. A few months ago, he pulled money from his mutual funds to add Rs 5 lakh more to buy crypto. And then came the shock.

On July 18, WazirX lost crypto assets worth over $230-million in a cyberattack, leaving nearly Rs 30 lakhs of Charan and his wife’s savings stuck. His family is still not aware.

“At this point, I am not even able to help my family with their health issues, and don’t have enough money to buy groceries…We wanted to provide better facilities to my family by using crypto money. We were planning to buy a house and a plot of land to start agriculture,” he told Moneycontrol.

Ausaf Pathan (40), who runs a café in Solan, Himachal Pradesh too started crypto trading in 2021, but eventually withdrew 90 percent of his funds amidst regulatory uncertainty in the sector. Pathan said that he still held about Rs 1 lakh worth of crypto assets on the exchange which got hacked.

“I wanted to keep some crypto investments in the portfolio because the next bull run is around the corner. I was expecting my remaining holdings to grow around 10X in the next eight to nine months,” Pathan said.

Mumbai-based Anuj Sharma (name changed), a 46-year-old software developer, had the worst blow. He had invested over Rs 60 lakhs through WazirX during the boom and his current portfolio had plunged to about Rs 35 lakhs.

“After 2021, I was waiting for the market to pick up to sell my portfolio at a higher prices. But in 2022, I ended up selling a lot tokens in my wallet at a loss. I only retained four tokens – XRP, XLM, Algorand and DOT. WazirX didn’t allow us to withdraw or sell Algorand and DOT tokens as they were a part of their rapid listing initiative,” he said.

Rapid listing initiative was started by WazirX in 2019, to allow users to get access to new listed tokens but they won’t be able to withdraw or trade the token from WazirX wallet. They can only sell it in USDT or BTC market.

“The exchange only allowed withdrawals of ERC-20 tokens on Etherum blockchain. This restructuring will make it very hard for us to withdraw our tokens, and that will also come with a lot of conditions,” a worried Sharma told Moneycontrol.

Since WazirX’s dispute with Binance, Sharma had also started to invest through other exchanges including CoinDCX to diversify.

Broken dreams

Charan, Pathan and Sharma are among 4.4 million impacted crypto users or creditors who had jumped into the crypto bandwagon during 2021’s bull run. Right now, they are staring at the possibility of losing over 43 percent of their crypto funds in WazirX’s ongoing restructuring plan.

Prior to the hack, WazirX held over $570 million in crypto assets, and lost nearly 45 percent of its assets in the theft. On July 18, one of WazirX’s multisig wallets was attacked which held nearly $234 million or 45 percent of its crypto assets. Multisig wallets are crypto wallets which require more than two private keys to unlock for transactions.

Overall, WazirX has around 16 million registered users. To be sure, WazirX is the largest crypto exchange in the country with at least 33 percent of Indian crypto users either holding balances or having an account with the exchange. According to WazirX’s affidavit with a Singapore court, more than 94 percent of its active users both individuals and corporate users, are from India.

A lot of this user trust and volumes for WazirX in India also came from its now disputed acquisition by global exchange Binance back in 2019. Binance is the world’s largest crypto exchange, despite regulatory uncertainty in the country, users felt trading through Binance would be the safer way out.

Angry users seek INR recovery

Not just crypto assets, for other users their INR funds too remain partially locked as WazirX is allowing access to only 66 percent of their funds. The exchange claimed that the INR funds are safe but will be released only partially for now citing ongoing investigations by various law enforcement agencies (LEAs).

INR funds are when users may have sold or liquidated their crypto tokens but continued to held their funds in INR on WazirX for further trades or other use cases.

Vivek Mishra (name changed), 24, a freelance digital marketer from Indore is one such example. He has been using WazirX for the last three years, not as a trader but to receive his payments from his customers abroad. He would get his payment in crypto and convert it into INR, often holding the balance for some time with the exchange.

When the hack happened, Mishra’s payment of three months got stuck, which would have amounted to around Rs 10.35 lakhs. “This money was in INR and I had already paid the TDS (tax deducted at source) over it. I was saving the money as my family was planning to buy a house with it,” he told Moneycontrol.

Things are only getting more worrisome for users in the absence of any crypto regulations in the country that could have safeguarded them, although they are paying taxes at present for earnings from crypto.

Mishra shared that there has been widespread anger and confusion around WazirX’s ownership among the crypto communities he is a part of.

“Nischal Shetty (WazirX founder and CEO) is not even in India, what if he runs away with our money. They are only letting 66% INR withdrawals. This is wrong for us… Our INR funds are with Zanmai Labs in India, why are they taking it to Singapore?” he questioned.

“I have paid TDS yet my 34 percent funds will now remain stuck. You don’t have any right on that money to block it. We don’t know when the investigation will get done and I will get my money. It takes years for investigations to conclude in India,” he added.

In a media townhall last week, Shetty and WazirX’s legal advisors from Kroll, a global restructuring advisory firm, shared that the India entity Zanmai Labs which held the INR funds continues to remain safe. And Zettai, the parent company of Zanmai, registered in Singapore will be undergoing restructuring as the crypto business comes under it.

Under the restructuring plan, WazirX will be looking for new partners who could support them with capital infusion and come up with newer strategies to restart the platform’s operations. This will ultimately also bail out the users whose funds were lost.

However, the legal advisors also clarified that the exchange will be able to return only 55-57 percent of the user funds lost initially through the restructuring plan.

Speaking on the possible timeline of accessing complete INR funds, Jason Kardachi, managing director, restructuring at Kroll said, “As a part of the restructuring, the investigation being conducted by various LEAs needs to conclude. There are several of them going on. The INR funds doesn’t have anything to do with the restructuring.”

Ownership dispute and profit booking

In its affidavit to a Singapore court seeking a six-month moratorium to safeguard itself from any other legal action as it looks to implement its restructuring plan, WazirX said that it is in talks with 11 global crypto exchanges for a capital infusion and support. The exchange has already signed non-disclosure agreements (NDAs) with at least three exchanges, but didn’t disclose the names yet.

WazirX said that it will be looking for various kinds of partnerships including collaboration on various revenue-generating products and profit-sharing mechanisms, airdrops, assistance for the recovery of stolen assets through forensic analysis and litigation support, and the deployment of token assets to generate yield.

However, the caveat here is until there is a resolution to WazirX’s disputed ownership with Binance, it is unlikely to be able to give out equity against funds to the partners, Kroll’s legal advisors had also mentioned.

The spat between Binance and WazirX started back in August 2022, when the Enforcement Directorate (ED) had frozen bank assets of WazirX worth Rs 64.67 crore in relation to allegedly assisting a bunch of accused loan apps in money laundering and fraud through the transfer of virtual crypto assets.

Following this, Binance’s CEO Changpeng Zhao (CZ) took to X (then Twitter) to clarify that his firm didn’t own any equity in WazirX and nor did it control its operations. Earlier, in 2019, the global exchange had announced in a blogpost that it had acquired WazirX.

According to George Gwee, director at Kroll, majority of the revenues, cash flows or profits of WazirX parent Zettai goes to Binance’s books.

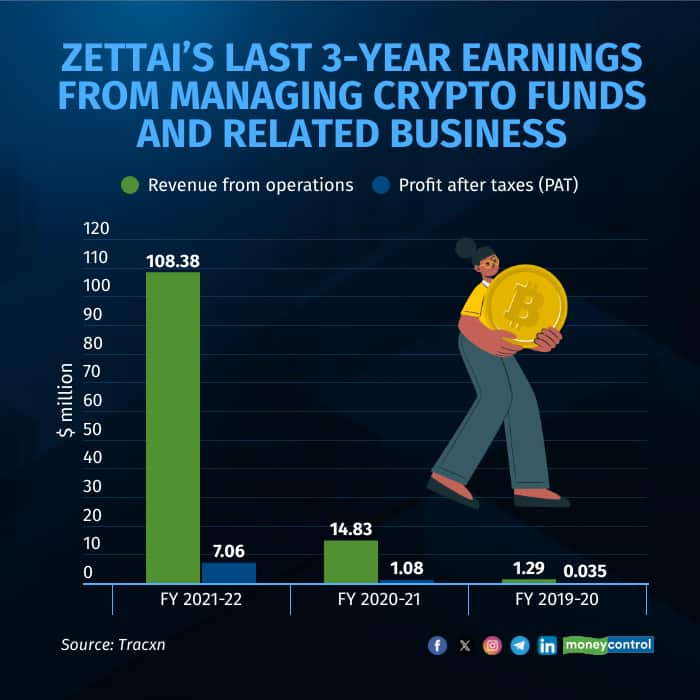

Gwee didn’t disclose the latest financials of Zettai either. The last reported numbers sourced from Tracxn said Zettai’s revenue in FY22 stood at $108.38 million while profit after taxes came in at $7.06 million.

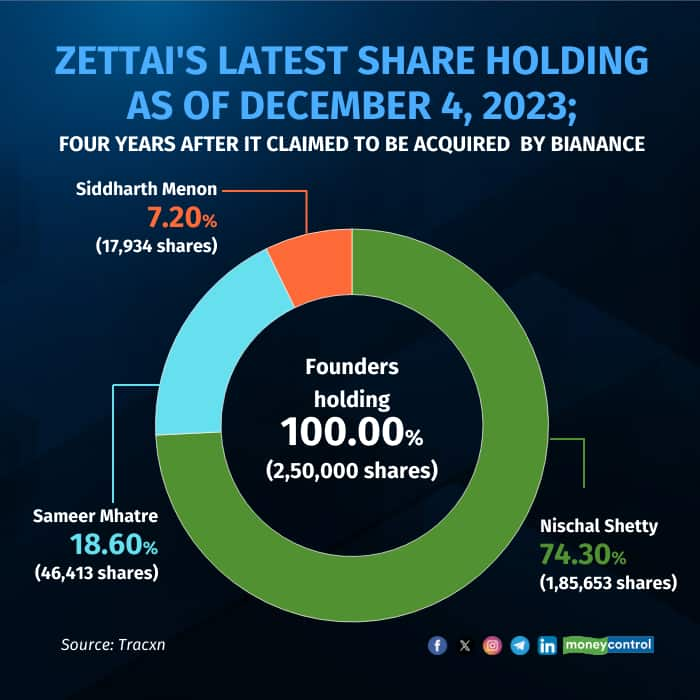

Even as Binance had acquired WazirX from Zettai in November 2019, in terms of shareholding as of December 2023, Shetty continued to hold 74.30 percent stake in the company, and his co-founders Sameer Mhatre held 18.6 percent and Siddharth Menon held 7.20 percent respectively, according to data sourced from Tracxn.

Zanmai Labs was incorporated in December 2017 and Zettai was started in January 2019. In 2019, Zettai was used to sell the WazirX platform to Binance.

As ordinary tax paying citizens continue to suffer, the WazirX episode has emerged as a cautionary tale in the Indian crypto ecosystem.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.