In 2024, growth in advertising industry will be driven by two big events --the recently-ended general elections and the ongoing T20 Cricket World Cup.

In a normal year, the contribution from first six months (H1) is generally less than second half, however, general elections held from March to May followed by ICC T20 Cricket World Cup in June-July will boost H1 growth, equal to second half of the year, according to a report by global media investment and intelligence company Magna.

It is estimated that ad spend growth will be around 11.8 percent in H1 whereas the growth is expected to be 11.9 percent in the second half of 2024.

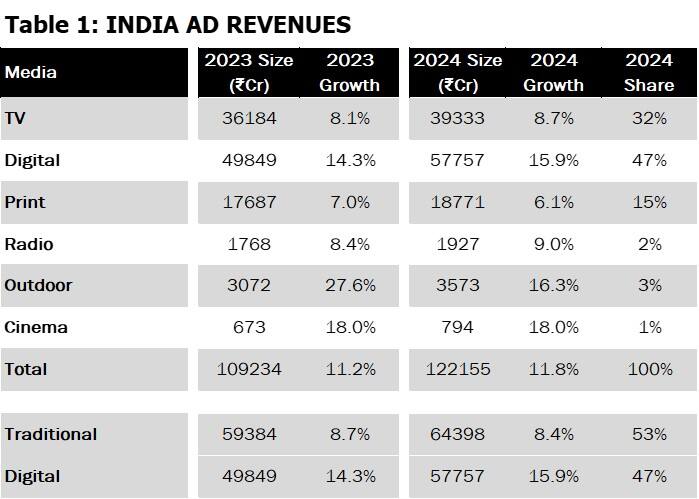

Both general elections and live sports will lead to a significant growth in advertising expenditure (adex) across both digital and linear media. For TV, ad revenues in 2024 will grow over 8.7 percent to reach an estimated Rs 39,300 crore ($4.7 billion) with elections driving advertising growth specifically for news and T20 World Cup will further boost revenues.

Ad spends on digital medium is estimated to grow more than 15.9 percent with digital formats or new media contributing to over 60 percent of the incremental revenue. Digital's share in overall adex (expenditure on advertisements) from its current 47 percent contribution is expected to reach 50 percent of total revenue by 2026.

Total advertising revenue will touch Rs 1.2 lakh crore this year ($14.6 billion) from Rs 1.1 lakh crore ($13.1 billion) in 2023, 50 percent higher than pre-pandemic period.

India's advertising revenues.

India's advertising revenues.

According to Magna's estimates, the advertising market is expected to reach Rs 1.7 lakh crore ($21.1 billion) by 2028 and India is projected to move into the top 10 markets in 2025.

"The Indian advertising market is set to expand by 11.8 percent in 2024, reaching Rs 1.2 trillion, driven by a robust 15.9 percent growth in digital media. Traditional media formats are also growing, enduring the relevance of print, OOH (out of home) and radio in addition to television. The government’s emphasis on digital public infrastructure is propelling digital ad spend to nearly half of total revenues by 2026. Our forecast highlights social media's significant rise, overtaking search as the second largest media format after television," said Venkatesh S, SVP, Director - Intelligence Practice, MAGNA India.

In digital's Rs 58,000 crore ($6.9 billion) ad spends, social and search with 34 percent and 33 percent share respectively will drive the digital pie followed by display and video at 19 percent and 14 percent, respectively. Social with over 21.9 percent growth and video with more than 19.1 percent growth are the fastest growing formats under digital.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.