The bitcoin wave has taken over the world in its umpteenth comeback story, after pro-crypto Donald Trump won 2024 US presidential elections last week. Indian crypto exchanges too have been rejoicing in the victory, except one.

And no, it’s not WazirX which has been dealing with its own mess of a $230-million cyber theft.

Turns out, Bitbns -- one of the country's top crypto exchanges -- has been at the receiving end of many users’ wrath.

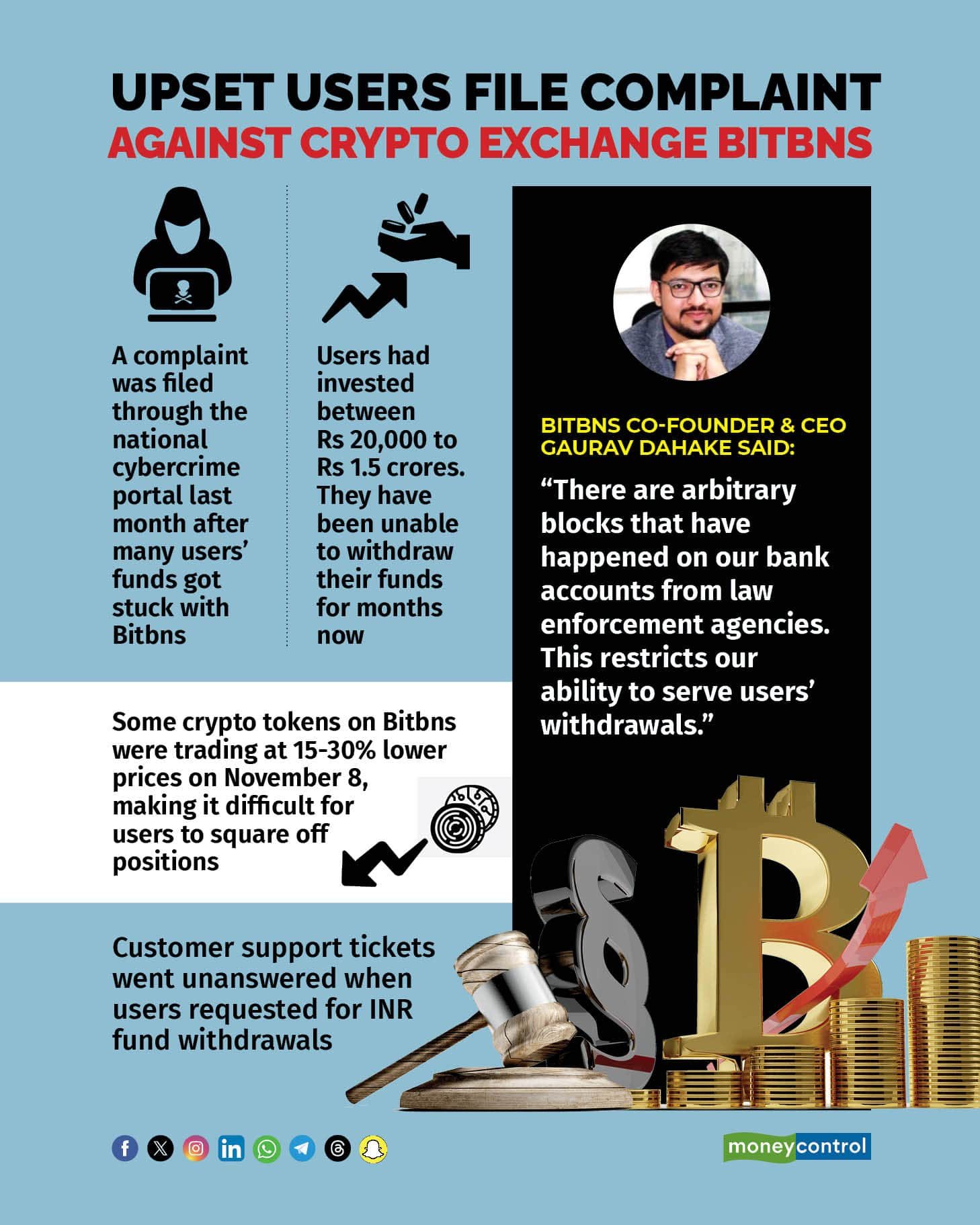

In October 2024, an anonymous Delhi-based user of Bitbns, lodged a complaint with the National Cybercrime portal through his advocate seeking a thorough investigation after he was unable to withdraw his funds from the platform for nearly 11 months. The investigation got assigned to the Delhi police.

His complaint soon found support from 24 other users across the country, and some of them have been trying to withdraw their funds for at least a year and a half.

A copy of the complaint report seen by Moneycontrol, showed that the unnamed user had invested a large sum through Bitbns to buy 1.02 Bitcoin (BTC), 2.5 Ethereum (ETH) and 4000 Tether (USDT). That would cumulatively be over Rs 80 lakhs worth of funds remaining stuck going by token prices as of 10 AM on November 11.

The users said in the complaint that while the exchange platform still remains open for trading and investing through various offerings, withdrawing money by Bitbns’ “recommended USDT P2P payment method” has been a major challenge. Users weren’t even able to withdraw in INR after selling their crypto assets. Bitbns like most of its peers in India, doesn’t let users withdraw in crypto directly or hold it in private wallets.

“In order to withdraw the invested amount, the victims initiated multiple withdrawal requests. However, rather than receiving the refund for the withdrawal requests, the withdrawal transaction would automatically get cancelled, and the amount would be credited back to the victims wallet after a few days. Unfortunately, after multiple failed attempts, the transactions and funds disappeared entirely, and to date, the victims have not received their withdrawn funds/refunds,” the complaint copy mentioned.

It added, “The victims have raised several issues and complaints regarding the disappearance of funds from the account by raising support tickets for each failed withdrawal attempt. However, each time the victims raised support tickets, they received an automated response stating that the issue would be addressed within 24-48 hours. Unfortunately, no resolution has been provided to the victims to date…”

According to Dinesh Jotwani, Co-managing partner at Jotwani Associates, whose firm is pursuing the Delhi-based user’s case, the number of “victims” or impacted users is much bigger. Users are trying to withdraw their funds from their exchange wallets but they have been unable to encash.

“The investments of these users have been between Rs 20,000 to Rs 1.5 crores. These users have reached out to us to take legal action against Bitbns. A complaint was filed with the National Cybercrime portal and it got assigned to the Delhi police. Police said that the founders have not been traceable. Looks like they are not in India and have started something else in Dubai,” he told Moneycontrol.

Jotwani added that some of the users with his firm had also visited Bitbns’ office in Bengaluru.

“Though they had an office, the founder and directors were nowhere to be found. We are in the process of adding more affected users as parties to the complaint. Then we plan to file a PIL (public interest litigation) directing the police to expedite the investigation. We are exploring other legal options too,” Jotwani said.

Some of the users also tried to contact Bitbns founders but said they were unable to reach them.

Most of these users had started trading and investing through Bitbns in 2021, when the crypto industry was witnessing a bull run. Seeing an opportunity to diversify his investments, Sandeep (name changed), 34, a Kolkata-based IT professional too had opted for a monthly SIP investment plan through Bitbns’ subsidiary Bitdroplet. He started investing in 2021 and continued with his SIPs till early 2024.

“I had invested a total of Rs 11 lakhs -- about Rs 6.5 lakhs in BTC and rest in ETH. When I decided to withdraw partially in October, I started getting these standard responses on the website that either INR withdrawal is not available at the moment or that they are integrating with some payment providers,” said Sandeep, one of the users supporting the complaint.

He is also a part of a WhatsApp group that Jotwani’s team has started to bring more affected users together. Sandeep shared that while he has opted for an INR withdrawal option on the exchange that claims to settle funds within 60 days, there are other users in the group who had opted for the same, but hadn’t received their withdrawals six months on.

Responding to these allegations, Gaurav Dahake, co-founder and CEO, Bitbns told Moneycontrol over a telephonic interaction that he is very much in Bengaluru and has not shifted his base to Dubai.

Dahake said, “We had tried to reach Jotwani Associates and solve this issue. It looks like a publicity stunt. These are genuine user concerns and we had asked them to share the user IDs of the users to prioritise their withdrawals, but we haven’t received those from the firm yet.”

Dahake shared that apart from USDT P2P payment method, Bitbns is at present offering two INR withdrawal modes – regular INR withdrawals that would allow withdrawals of upto Rs 1 lakh and take up to 60 days to clear; and INR Express, that lets users get Rs 5,000 withdrawal each day.

Earlier, back in 2021-2022, Bitbns offered INR withdrawals of upto Rs 20 lakhs at once through the 60-day clearance option. The limit was later reduced to Rs 1 lakh, ever since the exchange had been a part of many legal cases across various state jurisdictions which has led to several bank account freezes, hampering the exchange’s ability of allowing timely INR withdrawals, according to Dahake.

“There are arbitrary blocks that have happened on our bank accounts from law enforcement agencies (LEAs). This restricts our ability to serve users withdrawals,” he said.

At present there are at least 200 ongoing judicial proceedings that the exchange is facing. Many of these are third-party issues wherein a suspicious transaction by a user would have led to investigation into Bitbns’ bank accounts and eventual freezes while the case hearings were on.

For instance, Bitbns is fighting two cases on the same bank account which holds Rs 27 crores – one being heard at the Appellate Tribunal and another at the Andhra Pradesh High Court.

A document seen by Moneycontrol showed that while the “amount involved in the crime was less than Rs.1 crore, the amount frozen in the account of the petitioner is more than Rs.27 crores.”

Dahake said that the Andhra Pradesh HC has ruled in favour of the exchange a few weeks back unfreezing the account and holding the required Rs 1 crore, but the exchange is still in the midst of judicial proceedings with the Appellate Tribunal.

In another such case, Bitbns had got clearance for a bank account holding Rs 1.25 crores but the bank involved has been delaying unblocking the same for over three and a half months now despite the court order, Dahake shared.

“Banking support is very weak for crypto entities in India. On top of that, the cases we were expecting to get resolved in three-four months got extended for over 2 years now,” Dahake said.

He added, “In 2021, we were expecting to clear withdrawals by distributing the profits we earned during the bull run. But in 2022 we were hit by crypto taxes implemented by the Indian government that led to trading volumes plummet by over 90 percent. And by that time we had lost our credibility with the users who would have moved to other global exchanges.”

In 2022, Indian government had implemented 30 percent tax on income from virtual digital assets (VDA) and about 1 percent Tax Deducted at Source (TDS) on every VDA transaction of Rs 10,000 and above.

When asked what would be the expected timeline for clearing pending INR withdrawal requests, Dahake said, it would be hard to comment on as the judicial proceedings are still on.

In March 2023, the exchange had shared that about $7.5 million of its funds were also compromised in a hack back in 2022.

Bengaluru-headquartered Bitbns was founded in 2017 by Dahake and Prashant Kumar Singh. Currently, the exchange has two entities registered with the Financial Intelligence Unit—India (FIU-IND), under the Prevention of Money Laundering Act, 2002, which are used for its user transactions and operations – Buyhatke Internet Private Ltd. and Bitbns Internet Private ltd.

Deep discounts on token pricesAngry users also alleged that the crypto exchange has been “rigging” token prices too. As seen by Moneycontrol as well on November 8, top crypto tokens including Bitcoin, Ethereum, Ripple, Solana to name a few, on Bitbns’ exchange were priced at least 15-30 percent discounted rates as compared to peers like CoinDCX and Binance.

“This too has made it difficult for us to square off our positions once we have already invested through Bitbns. They are rigging token prices especially alternate tokens. Usually there would be difference of 1-2 percent in token prices of different exchanges. This is a huge difference on Bitbns,” said another user, Dilip Singh (name changed), a 40-year-old banking professional from Kolkata, who is not a part of the complaint filed.

Singh has about Rs 42 lakhs of crypto assets stuck with the exchange despite raising several tickets to sell off the tokens and withdraw funds for the last couple of months. His portfolio included Dogecoin, Ethereum, Cardano and other smaller tokens.

Commenting on the pricing discrepancy, Dahake said, “Usually users won’t find more than 8-9 percent price difference on tokens. We have no control on that. Pricing is controlled by buyers and sellers. The drop in prices on our exchange is due to the bottlenecks with withdrawals.”

On November 11, as of 1:12 pm, Bitcoin was trading on Bitbns at 19.45 percent lower price as compared to India prices of tokens, Ethereum was trading at 13.86 percent lower price and Ripple’s price was down by 9.51 percent.

(This article was updated to include latest crypto token price changes on Bitbns on November 11.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.