In its 15th year now, the Indian Premier League (IPL) has seen its brand value soar 77 percent in 2022 at $8.4 billion on the back of new media rights auction and addition of two new teams - Gujarat Titans and Lucknow Super Giants.

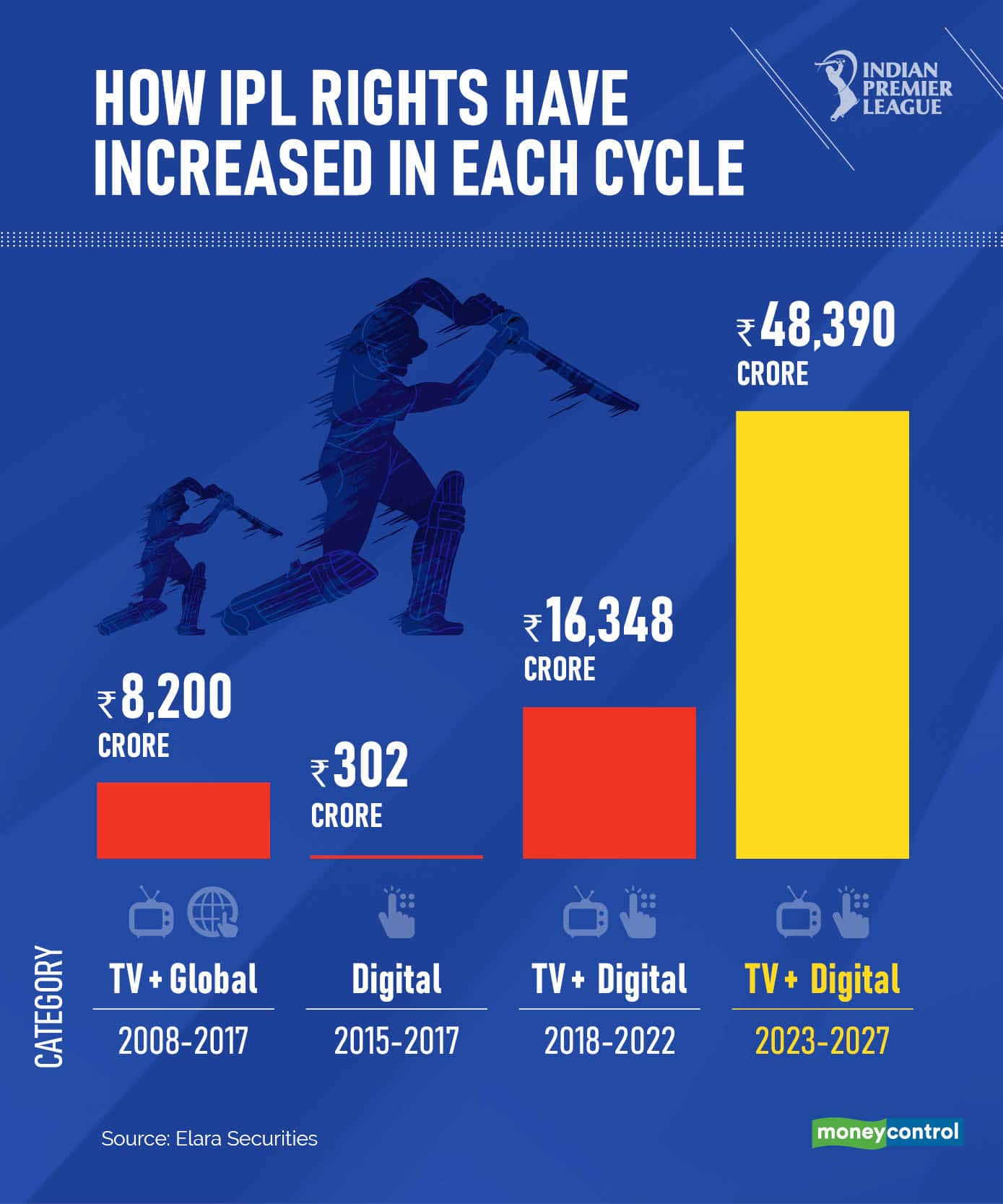

After the media rights auction held in June, IPL emerged as the world's second most valuable sports league. Its rights value surpassed Rs 48,000 crore for the 2023-2027 cycle, making the 15-year-old tournament the fastest-growing sports league globally.

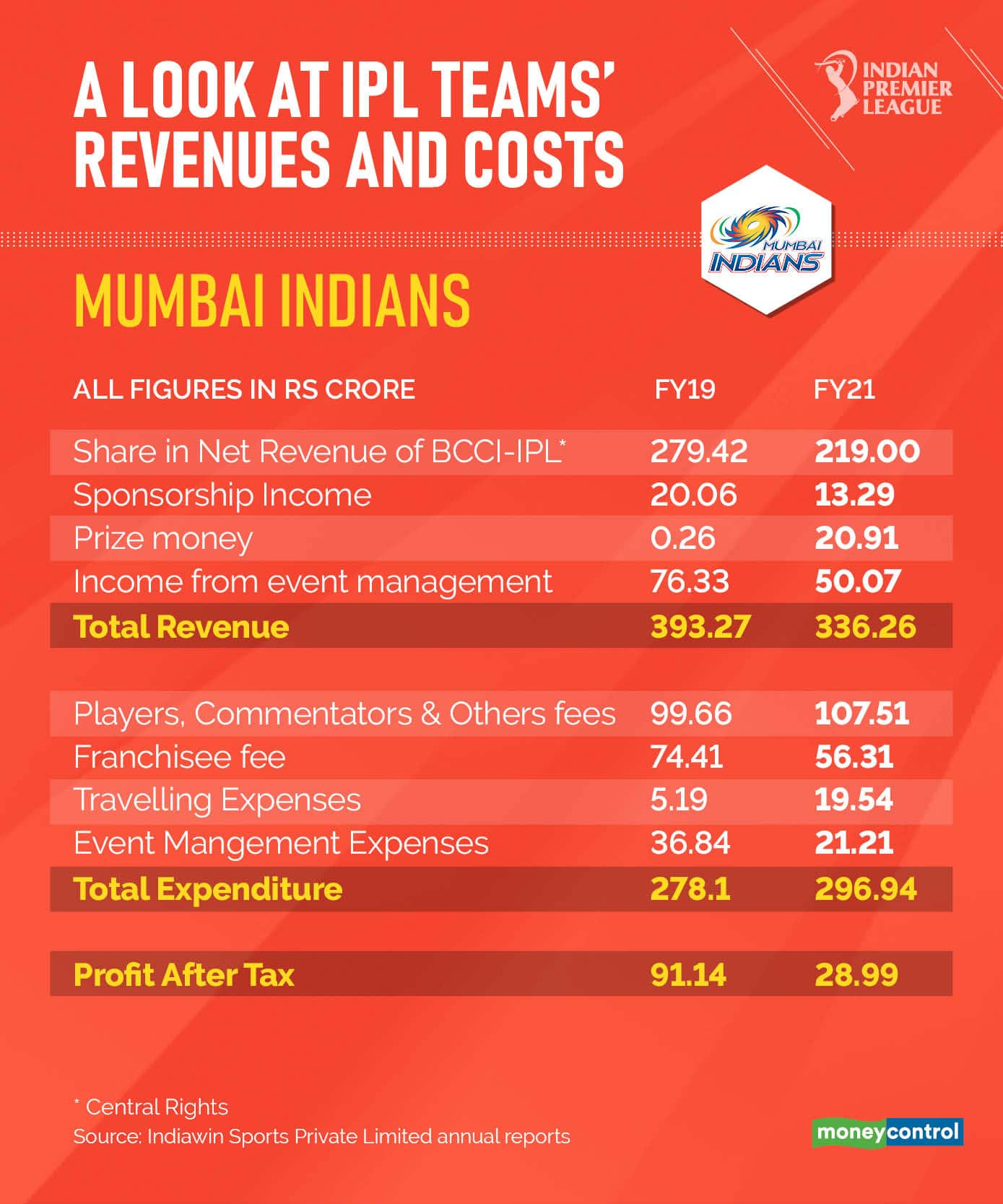

The additional revenue coming from the central pool from 2023 onwards has boosted the brand value of franchises. Mumbai Indians recorded a 4 percent increase in brand value this year as against that of 2021 and continues to be the most valuable brand at $83 million, followed by Kolkata Knight Riders and then Chennai Super Kings with valuations of $76.8 million and $73.6 million.

Since its launch in 2009, the brand IPL has recorded 318 percent growth in brand value, from around $2 billion to over $8 billion this year, according to a Brand Finance report.

The addition of two new franchise teams has raised IPL's value by close to Rs 12,500 crore ($1.5 billion).

From its staggering growth in media rights valuation to the windfall for IPL teams, Moneycontrol takes a look at the business of IPL in 12 charts.

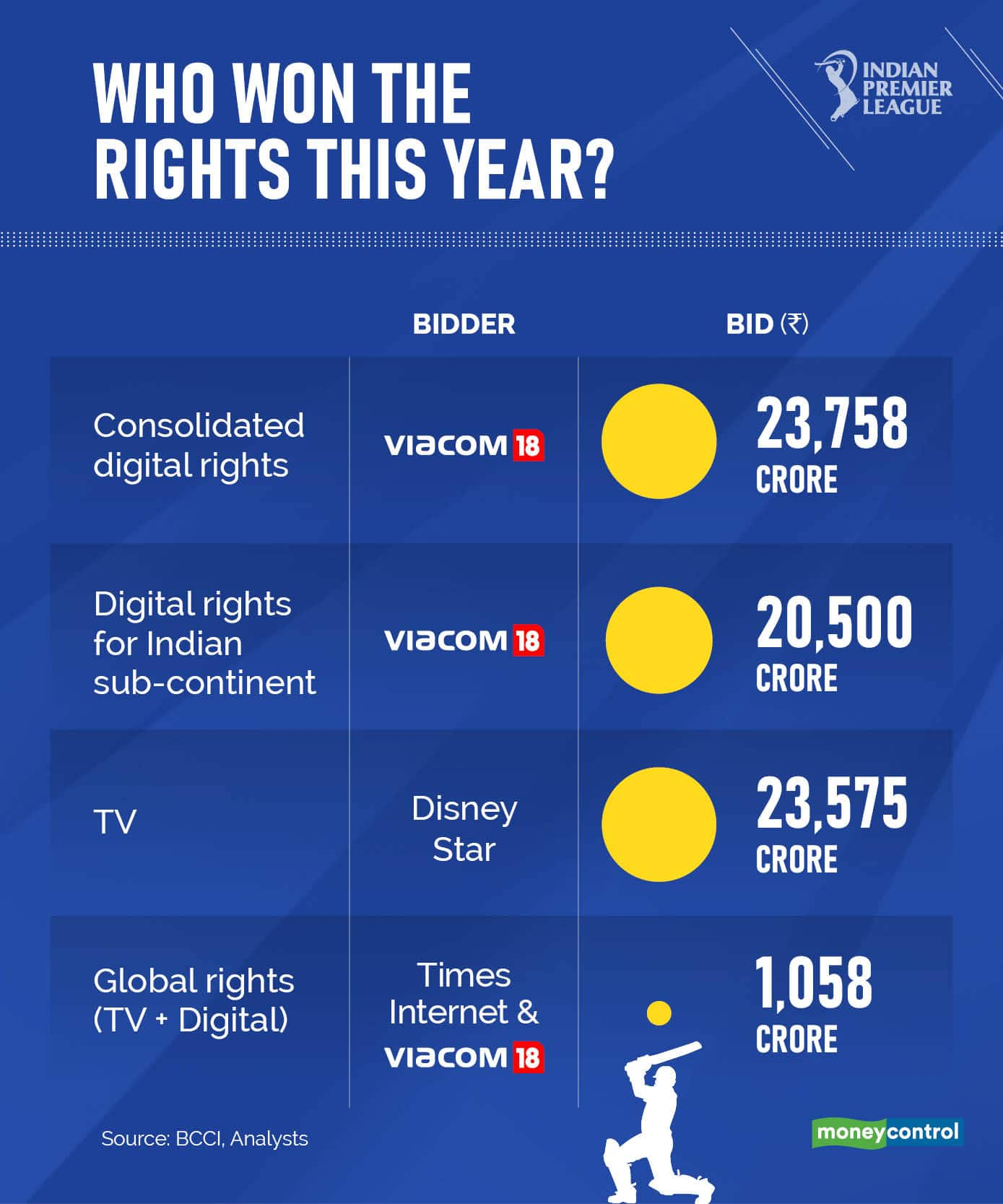

The media rights valuation for the 2023-2027 cycle grew more than two-and-a-half times compared to the previous cycle. Digital saw the highest growth.

With $16 million per match value, IPL has vaulted past many global leagues.

Analysts expect revenues of IPL franchises to double in FY24 after the media rights auction and also due to the addition of more matches which will be 40 percent higher than the previous cycle.

Experts estimate that the net profit of IPL franchises is likely to increase from Rs 100-125 crore to Rs 270-300 crore, thanks to an increased media rights valuation.

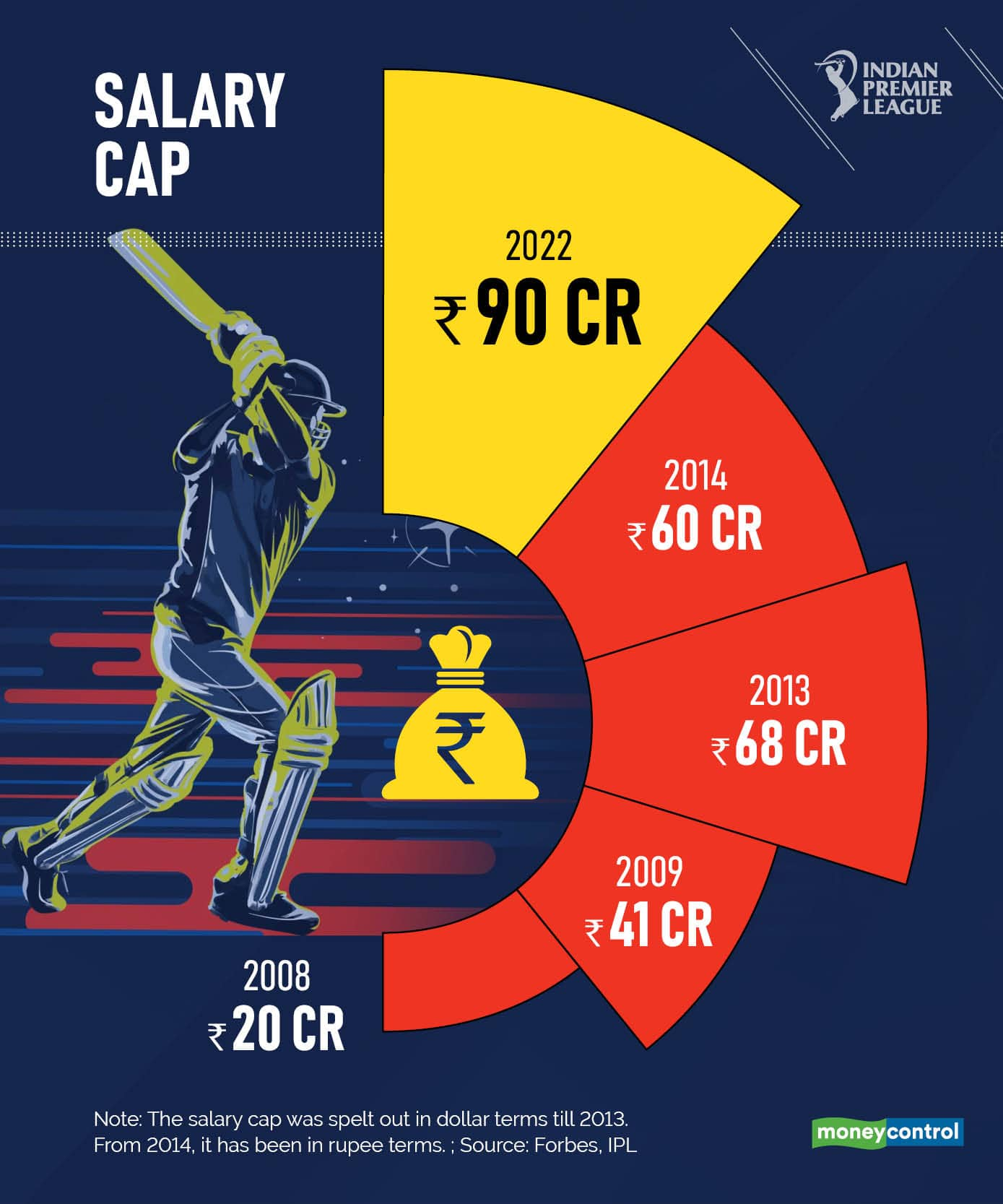

Players' salaries are also expected to increase. The total salary purse is estimated to double from the current Rs 90 crore to Rs 180 crore.

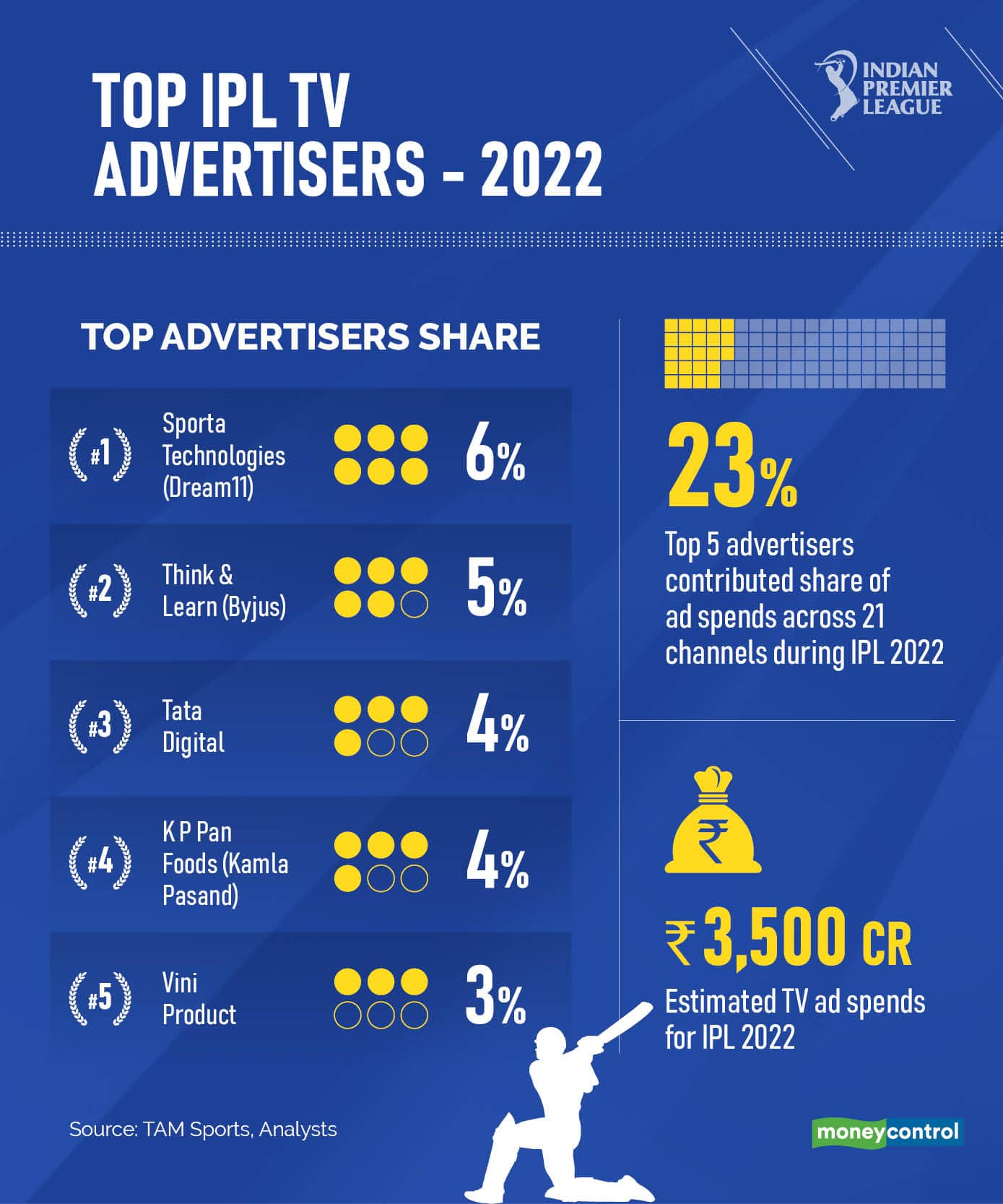

From online gaming to edtech, new-age brands have come on board to partner with IPL franchises over the years. Analysts expect teams to see 15-20 percent growth in earnings from sponsorships this year.

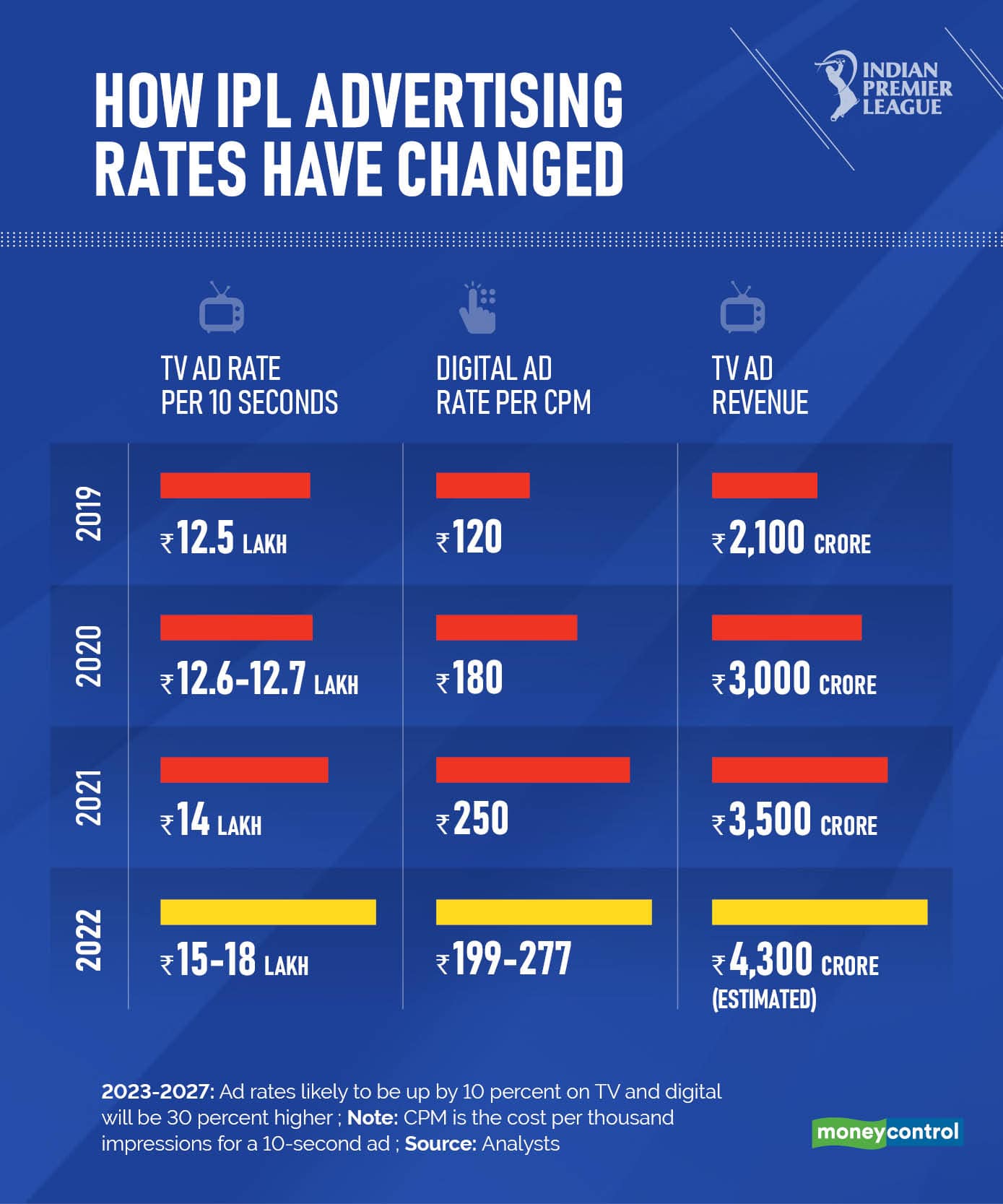

Advertisers pay high premiums to feature during the league matches. The league's ad revenue has grown three-fold in the last five years.

Online gaming emerged as the top category during IPL 2022, up from its second place in IPL 2021. Fantasy sports company Dream11 was the top advertised brand during both IPL 2022 and 2021.

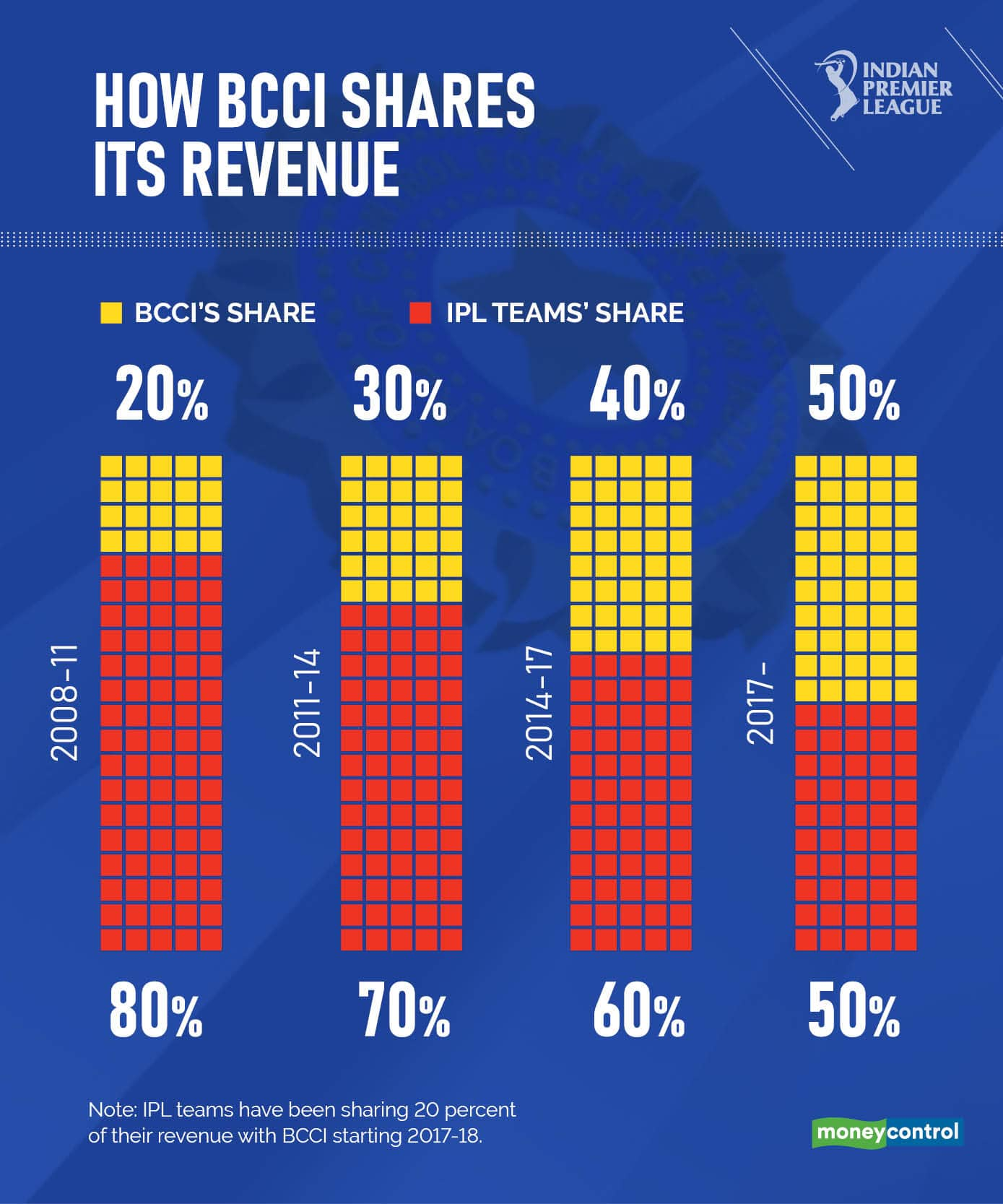

Franchises are expected to get a bigger cut in profits from the board as the central revenue pool will increase.

Just like media rights, the cost of owning an IPL franchise has also seen significant growth.

In its 15-year journey, IPL has seen the highest ad spending changing from traditional categories like FMCG to digital-first brands like Dream11 and Swiggy.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.