Note to readers: Healing Space is a weekly series that helps you dive into your mental health and take charge of your wellbeing through practical DIY self-care methods.

Elon Musk tossed the world a puzzle this week. To the people who pointed out to him that $6 billion of his net worth had the potential to solve world hunger, he asked them to show him how exactly, and offered to liquidate his stock and do it. But it raises the larger question, one that occurs to so many of us when we look to multiply our wealth: is money the answer to all our problems?

Money, as we know, grows by compounding. The problem is, so do our problems. So the richest man in India may not be worried about how to repay his credit card debt, but that’s because his debts are in hundreds of thousand of crores now, and the credit card is the least of his worries.

Money, as we know, grows by compounding. The problem is, so do our problems. So the richest man in India may not be worried about how to repay his credit card debt, but that’s because his debts are in hundreds of thousand of crores now, and the credit card is the least of his worries.

‘A’ rarely resolves ‘B’ in a straight line of cause and effect. As Morgan Housel points out in The Psychology of Money, “the world is too complex to allow 100% of your actions to dictate 100% of your outcomes”. We are each in a complex weave of circumstances and people, decisions, luck, sectors, world events, even the weather, that influences our decisions. So how does money guarantee us any end?

It doesn’t. What money does is buy us some bouncebackability. It rarely offers a solution. People are often not in debt because of a lack of money, they are in debt due to a lack of thoughtful spending, financial education, medical emergencies, family circumstances and inherited debt legacies or other handicaps that can range from social oppression to just bad luck.

We see this play out when workers who get those coveted jobs in tax-free havens like Dubai, return bankrupt and unable to pay their rent. Also with lottery winners who somehow never go on to found the next great company with their winnings. The world’s largest companies have emerged from a startup in a garage.

Logically, the evidence shows us that while we do need some capital, it isn’t what dictates how we end up. What does, is our ability to know what to invest in that will push growth. Our capacity for growth depends on how well we understand abundance.

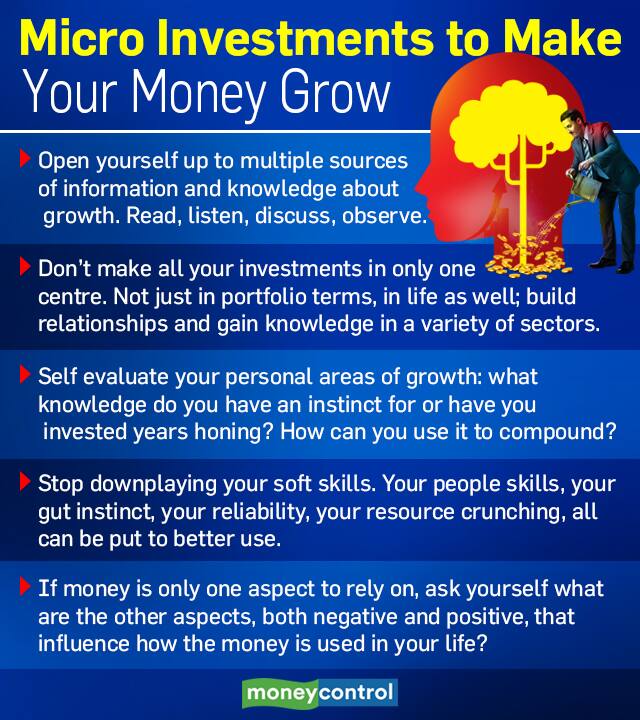

If growth came from one decision, one investment, one stock, all of us would have to rely only on dumb luck. But we stabilise ourselves by growing laterally. This is the principle governing the diversified portfolio. It is unlikely that we gain abundance in only one area of our lives. It is equally unlikely that all areas grow simultaneously. You’ll notice that a great investment decision is made on the back of a variety of interactions; reading, consulting, discussing, sifting information, experience, and observation of markets, risks, and patterns. One decision is in fact a series of micro decisions.

In the same way, abundance in life results from a series of micro investments in various areas – relationships with family, friends, peers, bosses, prospective employers, collaborators, investors, charitable works – long before they actually become activated. When we participate constantly in nurturing those relationships, through small investments of our times and energy, we invest not just in a future potential, but to growth in many unexpected areas. We become open to all opportunity.

Abundance is typically active in each one of us differently. Some people are abundant in ideas, others in execution, some in consulting, wisdom, some hosts who are sprung with unexpected house guests always seem to know how to stretch what’s at hand to make the most of it, which is a valuable ability to manage meagre resources, others come with deep subject matter expertise. We are not all growth-oriented in the exact same way and when we discover and tap into our individual areas of abundance, we begin to compound our returns.

Instead of looking at where we can grow and how, we look at people with a larger house or a better car, i.e., as a common metric of growth, and imagine they are more abundant than we (when they may just be in more debt than we are). Musk is right. Comparison with a generic sum of money doesn’t solve our problems. It’s how growth is applied to it.

However, we tend to overlook micro investments for money.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.