SP Tulsian

The Nifty’s move to 10,000 in the last week of July, has boosted market sentiment. As with any big move, this one too was quite swift and unexpected, with the index gaining 500 points in one month alone.

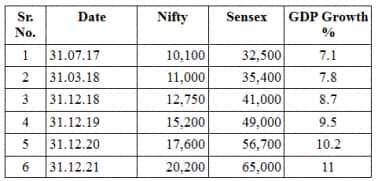

“Is this rally sustainable?” is the question uppermost in the minds of media, stock market experts, brokers and investors. I have been positive on the market since January (even when most experts were cautious or negative) and predicted the Nifty hitting within 10,000 sometime during the year. I remain positive, not just for remainder of 2017, but for the next four-and-a-half years, during which the Nifty can go all the way up to 20,000, and the Sensex to 65,000.

Here are the reasons for this bullishness:

> GST, the biggest economic reform post-independence, will be a major game changer and the transition from unorganised to organised is expected to happen sooner than later.

Now nobody is seen issuing kachha bill, second sale bill or non-GST bill, though in few cases, compliance has to improve. This is particularly true of Tier III and IV cities, where transactions are seen recorded at 50 percent to 75 percent of real value. But this may be temporary and those who have never paid any tax earlier will have no choice but become part of the GST network.

For instance, many udipi restaurants in Matunga in central Mumbai are likely to pay nearly thrice the tax under GST, against VAT and Excise paid by them earlier put together. This will boost income tax collections as well, maybe with a lag effect as tax authorities can now ascertain the income being earned through official businesses.

> Political stability has not been so predictable in the last four decades. The NDA government led by the BJP looks set retain power in 2019, due to the governance track record so far and also because of the lack of any credible alternative.

Apart from this, we may see state and general elections happening together in April-May 2019 across India. This will see more than 80 percent (in terms of population) states being ruled by the BJP or in coalition with an NDA partner.

The equations in the Upper House will also change in favour of this government from the end of 2018, when laws can get passed in a couple of days as well.

This will see better co-ordination between Centre and states, with faster implementation of reforms as well. Though few experts and the media may call it a risky move, a substantive opposition does not exist. The Opposition parties are to blame, as it has been unable to make itself relevant to the electorate.

> This government is also likely to present two Union Budgets (full -fledged and not one Vote on Account), before the next general elections to be held in middle of 2019. This is owing to the change in Financial Year, likely to happen in April 2018, from March-ending to to December-ending. The next financial year may be of nine months from 01.04.18 to 31.12.18, with calendar year as the financial year from year 2019.

Hence, the Union Budget may be presented on February 1, 2018 and November 1, 2018. This may see direct tax rate cut and re-alignment and reduction of GST slabs and rates as well, with higher allocation to be made on social projects, infrastructure and defence, with phasing out of wasteful subsidy, resulting in an elimination of corruption, partly due to shift to Digital India as well, which will be seen as highly positive for our economy.

> Owing to GST implementation and more businesses becoming part of the formal economy, India’s GDP is likely to rise to 7.8 percent in FY18, from 7.1 percent in FY17. However, it could rise to 8.7 percent in 2018, 9.5 percent in 2019 and 10.2 percent in 2020, owing to gradual gains seen accruing due to GST and normal growth.

> India’s economy is likely to grow to USD 5 trillion in 2021, from USD 2.67 trillion in FY18. Our current market capitalization is around USD 2.07 trillion and the market cap to GDP ratio is quite comforting at 78 percent of the GDP.

> The increase seen in GDP, better tax compliance, expected higher tax to GDP ratio, expected outlook upgrade by global ratings agencies, which may happen this fiscal, will result in huge foreign capital inflow by way of FDI and FII. India will be the fastest growing economy in the world and will visibly remain so for the next five years at least.

Domestic savings inflows into the capital market have surged, due to no comparable alternative for savings. Commodity, bullion, debt and real estate are no more seen as preferred investment avenues, as they are being purchased more on a need basis.

All these factors give an extremely positive outlook on India, which will positively reflect in to our capital market, and may see expected levels, given in the table, on Nifty and Sensex, over the next four-and-half years.

Hence remain prepared to welcome Nifty above 20K and Sensex above 65K in less than four-and-a-half years.

Long live Indian Investors.

The writer is CEO & Editor of www.sptulsian.com

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.